Synthetic long stock (also just synthetic stock) is a bullish synthetic option strategy with two legs. It replicates long stock position, using a long call option combined with a short put option. Like long stock, it has unlimited potential profit and limited loss (although the loss can also be very big if underlying price falls a lot).

Setup

Synthetic long stock is a combination of long call and short put.

To create a synthetic long stock position:

- Buy a call option.

- Sell a put option with the same strike and same expiration.

Example

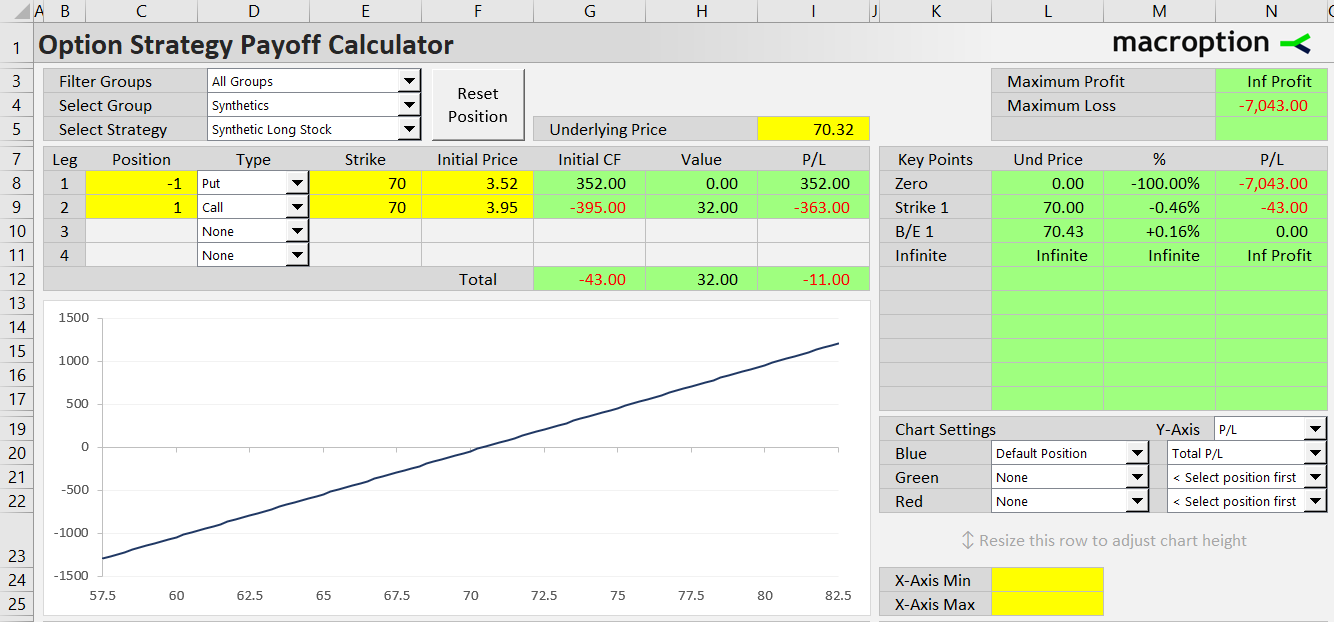

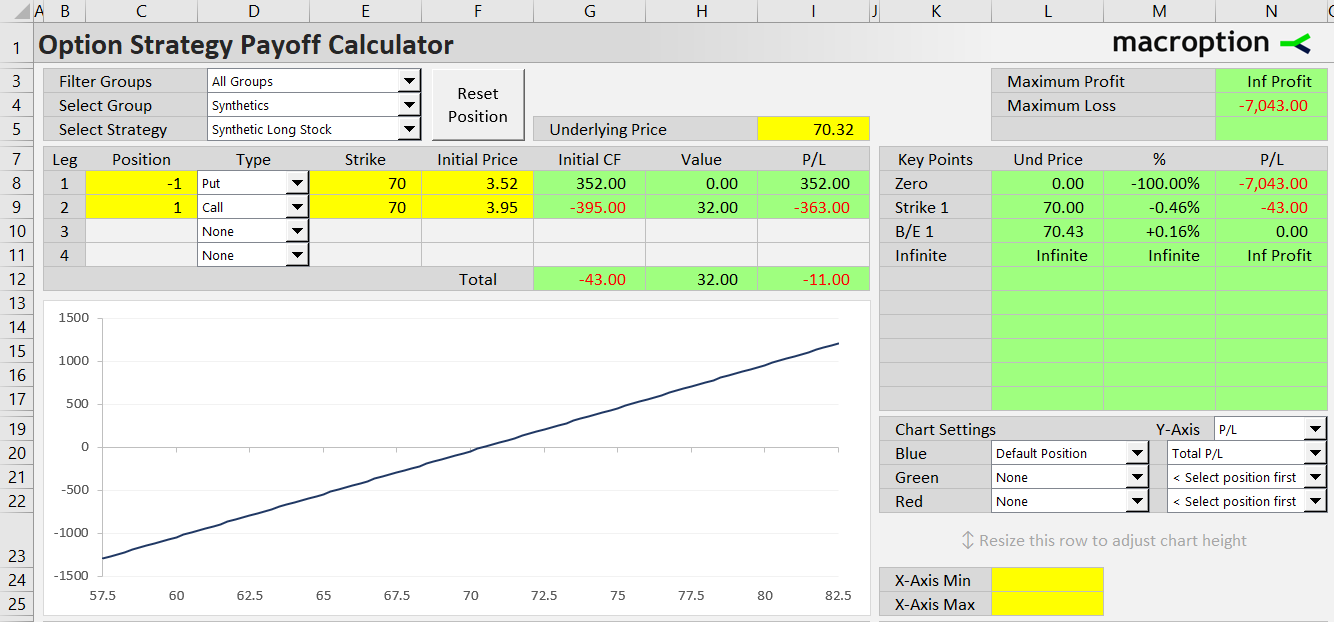

- Buy a call option with strike $70 for $3.95 per share ($395 for one option contract).

- Sell a put option with strike $70 for $3.52 per share ($352 for one contract).

Payoff

As long as the call and put strikes are equal, the payoff diagram is exactly the same as a long stock position - an upward sloping straight line.

If the strikes were not identical, there would be an area of constant profit or loss between the strikes - such strategy is called long combo.

Strike Selection

Typically, a synthetic stock position is entered using at the money options (the strike closest to underlying price at time of opening the position). However, this is not a universal rule.

Strike selection does not change the payoff, but it does affect cash flow.

Cash Flow

Cash flow is the greatest difference between long stock and synthetic long stock. With a traditional long stock position, all of the stock price must be paid in the beginning:

Long stock initial cash flow = underlying price

On the contrary, a synthetic long stock typically requires only a very small cash amount to set up (and sometimes the position can be entered for credit). Initial cash flow equals cash gained from selling the put option minus cash paid for buying the call option:

Synthetic long stock initial cash flow = put premium - call premium

When the position is entered using at the money strike, initial cash flow is very close to zero. It can be slightly positive (if the put option price is greater than the call option price) or negative (if the call option is more expensive, as in the example above), but it is a very small amount.

In our example, initial cash flow is:

3.52 - 3.95 = -0.43 per share = net debit $43 per contract

Choosing a strike far above the current underlying price (put option is in the money, while call option is out of the money) makes initial cash flow more positive. Conversely, choosing a lower strike makes it a debit strategy with negative initial cash flow.

Dividends

Although payoff is the same as long stock position, there is significant difference in dividend treatment. While a stock holder gets dividends normally, a trader with a synthetic stock position does not (because options generally don't entitle their holders to dividends).

As a result, if the underlying stock pays dividends, actual payoff from a synthetic long stock is worse than plain long stock, exactly by the amount of dividends paid.

Related Strategies

- Synthetic short stock - the inverse position (short call + long put with same strike)

- Long combo - call strike is higher than put strike

- Synthetic call - long stock and long put option creates a payoff similar to long call