Short combo (or short combination) is a bearish option strategy with two legs. It is similar to synthetic short stock, only with a gap between strikes. It has unlimited loss and limited profit (although the profit can also be very large if underlying price falls a lot).

Setup

Short combo is the inverse position to long combo. It includes:

- Long put option.

- Short call option with higher strike and same expiration date.

The strategy is similar to synthetic short stock, with the only difference being the gap between strikes (synthetic stock uses the same strike for the short call and long put).

Strike Selection

Like with long combo, the typical way to create short combo is with the higher (call) strike above the current underlying price and the lower (put) strike below it. In other words, both options are out of the money when the position is initiated.

Alternatively, both strikes can be above underlying price (the long put is in the money) or both can be below (the short call is in the money). In any case, the call strike must be higher than the put strike.

Note: Some sources use the name short combo for any combination of long put and short call, with any combination of strikes (so synthetic short stock, where both strikes are the same, would also be a case of short combo). Other sources require the call strike being higher than the put strike for the position to be named short combo.

Example

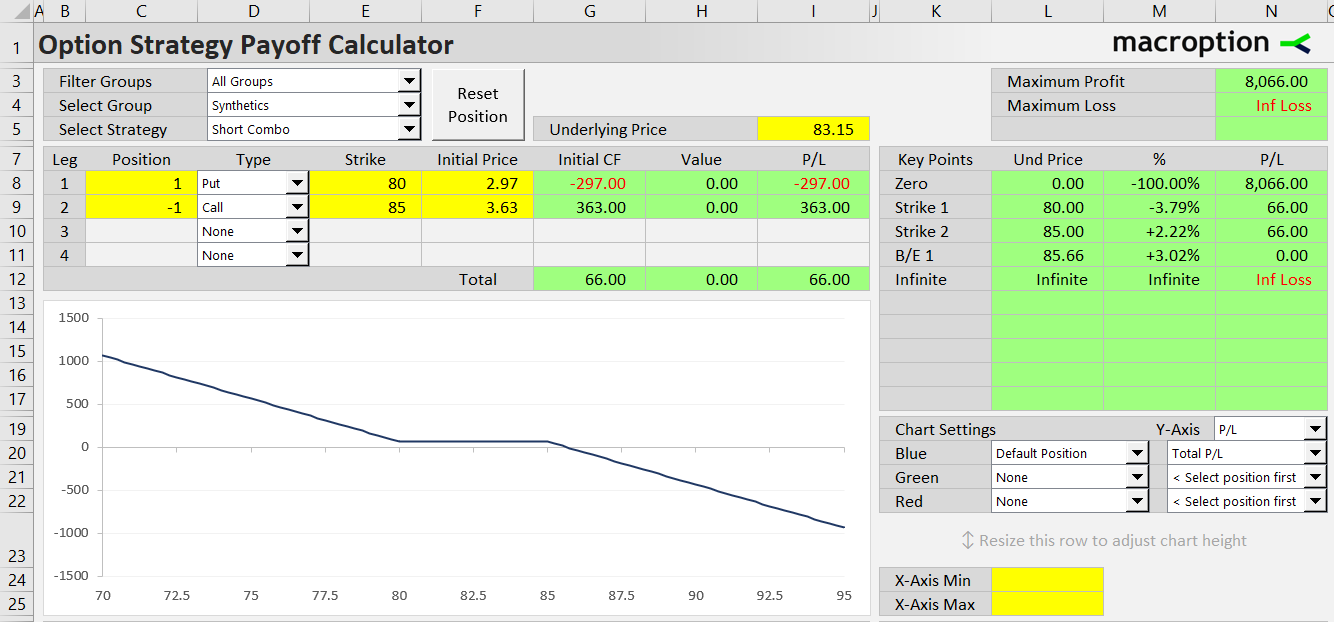

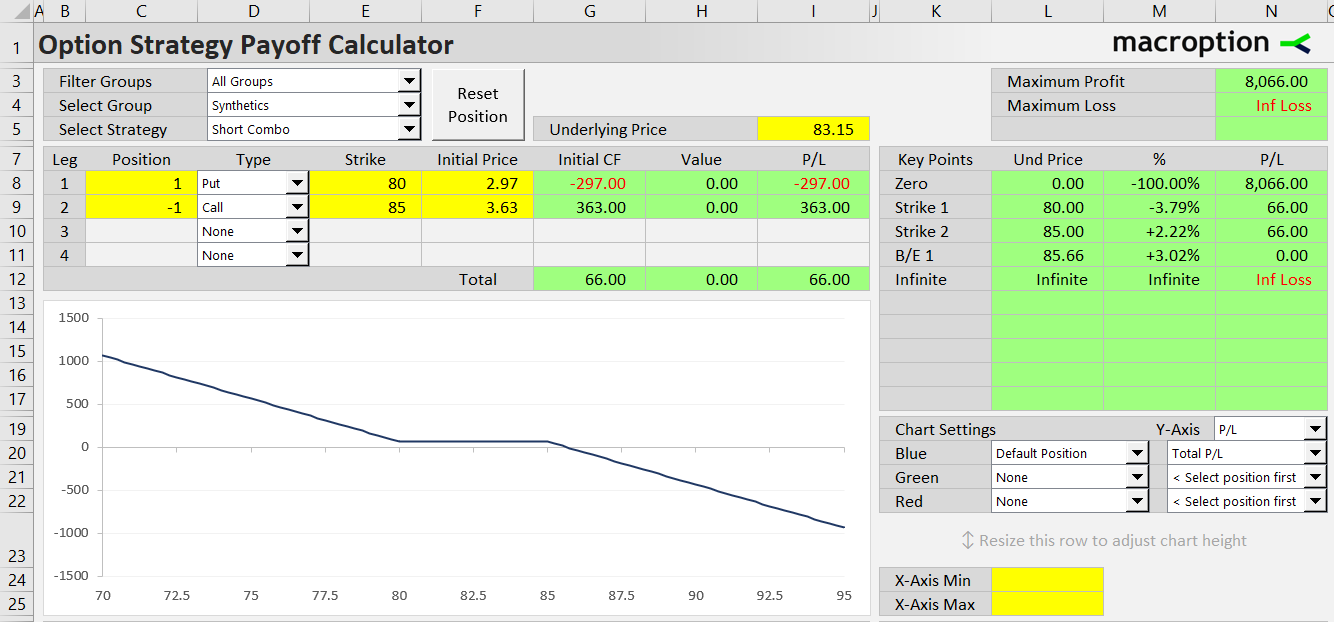

Let's say a stock is currently trading at $83.15 per share (this is the underlying price). We can set up a short combo position using strikes 80 and 85:

- Buy the 80 strike put option for $2.97 per share.

- Sell the 85 strike call option with same expiration for $3.63 per share.

Cash Flow

Because short combo is the inverse position (the other side of the trade) to long combo, its initial cash flow is exactly opposite. It can be positive or negative, depending on the relative prices of the call and put option.

If the strikes are selected with underlying price approximately halfway between them, both options have similar value and initial cash flow is close to zero (because we are paying the put premium and receiving the call premium).

Short combo initial cash flow = call premium received – put premium paid

In the above example, we receive $3.63 per share ($363 for one contract) for the call option sold and pay $2.97 ($297 per contract) for the put option bought. Net initial cash flow is therefore positive $0.66 per share, or $66 for one contract (if one option contract represents 100 shares as for US traded stock options).

Payoff at Expiration

The payoff diagram is also inverse to long combo. It is similar to short stock (or synthetic short stock), only with a gap between the two strikes.

Total profit grows when the underlying goes down. When underlying price increases, the strategy loses money.

Between the two strikes, profit or loss is constant and equals initial cash flow (because both options are out of the money and there is no more cash flow at expiration).

Maximum Loss

Maximum loss from short combo is theoretically unlimited. Above the call strike, losses grow dollar-for-dollar with underlying price.

Maximum Profit

Maximum profit is reached when underlying price falls to zero. The long put option is in the money by the amount equal to its strike price. The short call expires worthless. Therefore, maximum profit formula is:

Short combo max profit = put strike + initial cash flow

= put strike + call premium received – put premium paid

In our example, maximum profit is 80 + 3.63 – 2.97 = $80.66 per share or $8,066 per contract.

Break-Even Point

Like with long combo, location of short combo break-even price depends on initial cash flow.

If it is positive (as in our example), the break-even point is above the call strike. Its distance from the call strike equals initial cash flow:

Short combo B/E = call strike + initial cash flow

In our example, the break-even point is:

85 + 0.66 = 85.66

If initial cash flow is negative, underlying price must fall below the put strike for the position to turn profitable, after P/L has started to increase with rising value of the put option. The distance of break-even price from the put strike is again equal to initial cash flow:

Short combo B/E = put strike – net initial cost

Related Strategies

- Long combo – the inverse position (short put + long call with higher strike)

- Synthetic short stock – like short combo, but call and put have same strike