Synthetic covered strangle is a synthetic strategy that replicates the covered short strangle position using two short put options with different strikes. It is a bullish option strategy with limited loss and limited profit (although the loss can be very large if underlying falls a lot).

Setup

Covered short strangle applies partial hedge to short strangle using an extra long position in the underlying asset.

Synthetic covered strangle replicates that position by replacing the long underlying and short call (from the strangle) with a short put option, because:

Long underlying + short call = synthetic short put

Because there are two different strikes involved in any strangle, the two short put options in synthetic covered strangle must also have different strikes (and same expiration date).

Example

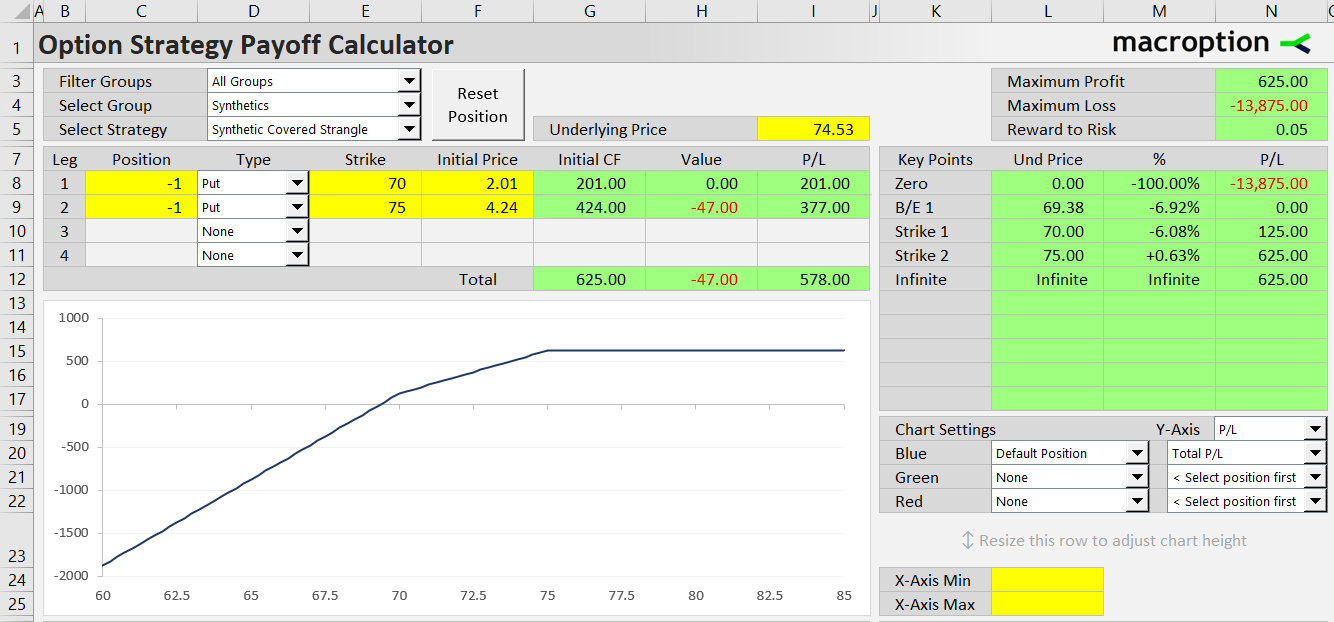

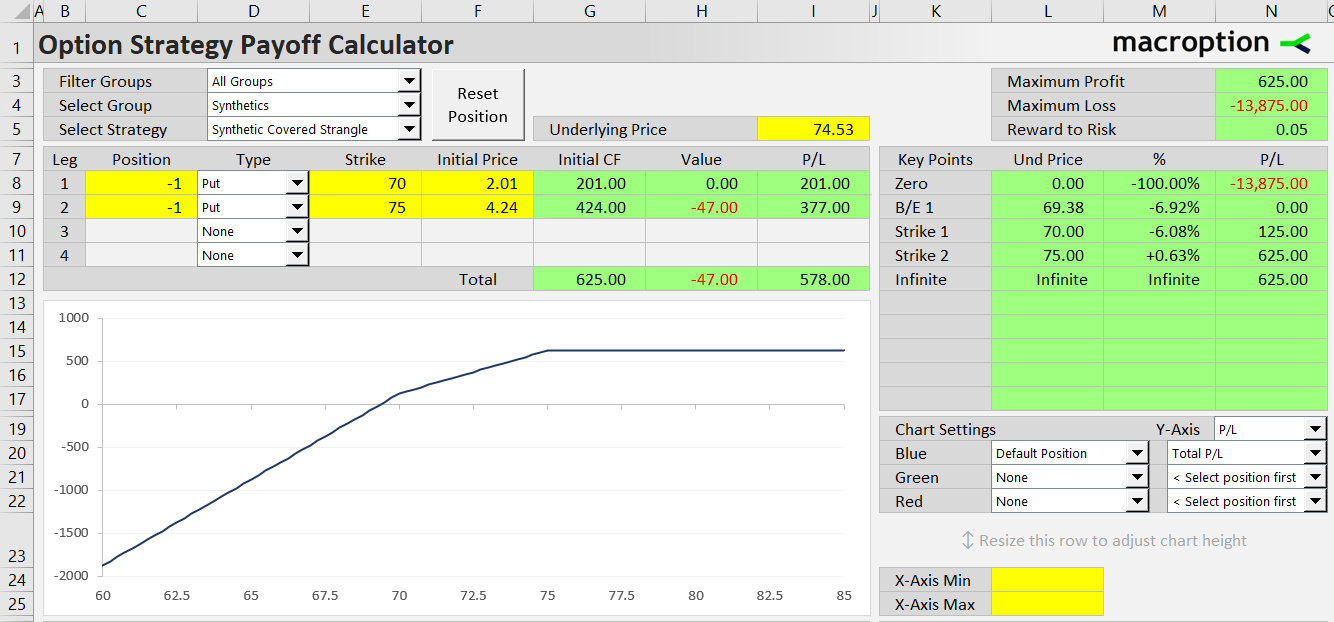

Let's say a stock is currently trading at $74.53 per share. We can set up a synthetic short strangle position with the following option trades:

- Sell the 70 strike put option for $2.01 per share.

- Sell the 75 strike put option with same expiration for $4.24 per share.

Cash Flow

One advantage of synthetic covered strangle over plain covered strangle is positive initial cash flow, as we don't need to buy the underlying asset and only sell options instead.

Synthetic covered strangle initial cash flow = premium received

In our example, initial cash flow is 2.01 + 4.24 = $6.25 per share, or $625 for one option contract.

Payoff at Expiration

Payoff at expiration is the same as covered short strangle.

The strategy makes constant profit above the higher strike.

Between the strikes, profit declines (or losses grow) with decreasing underlying price.

Below the lower strike, losses increase at double the pace, as both short put options are in the money.

Maximum Profit

Maximum profit is reached above the higher strike and equals initial premium received. There is no more cash flow at expiration, as both short puts expire out of the money.

Synthetic covered strangle max profit = premium received

Maximum Loss

Loss is limited only by the lower limit on underlying price. For most underlying assets that is zero (price can't be negative). Total loss at zero underlying price is the sum of both strikes (the amount by which the two short puts are in the money) minus option premium received:

Synthetic covered strangle max loss = lower strike + higher strike – premium received

In our example, maximum loss is:

70 + 75 – 6.25 = $138.75 per share

Although maximum loss is technically limited, it can be very large. Below the lower strike, losses increase at double rate (from both short put options combined).

Related Strategies

- Covered short strangle – the non-synthetic equivalent

- Short strangle – plain short strangle without the partial hedge

- Synthetic covered call – replicates covered call using short put options

- Synthetic covered put – replicates covered put using short call options