Synthetic short stock is a bearish synthetic option strategy with two legs. It replicates short position in the underlying stock, using a long put option combined with a short call option. Like short stock, it has unlimited loss and limited profit (although the profit can also be very large if underlying falls a lot).

Setup

Synthetic short stock is the strategy inverse to synthetic long stock, with payoff similar to short underlying position. It is a combination of short call and long put.

To enter a synthetic short stock position:

- Sell a call option.

- Buy a put option with the same strike and same expiration.

Example

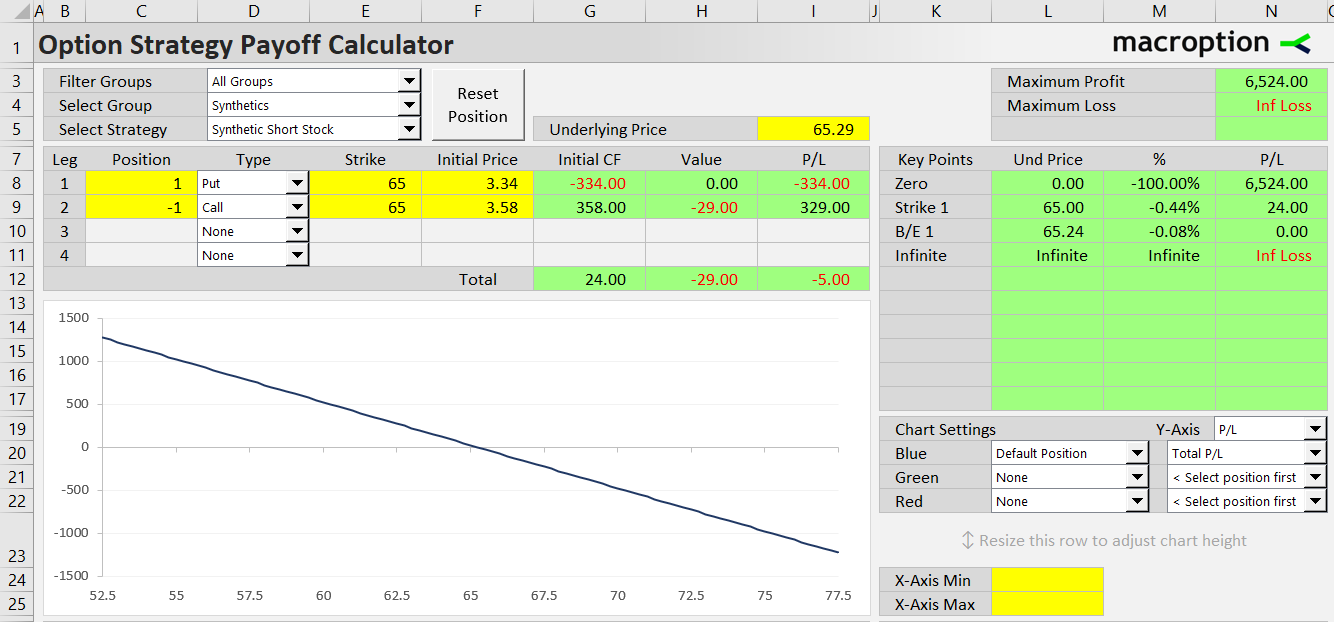

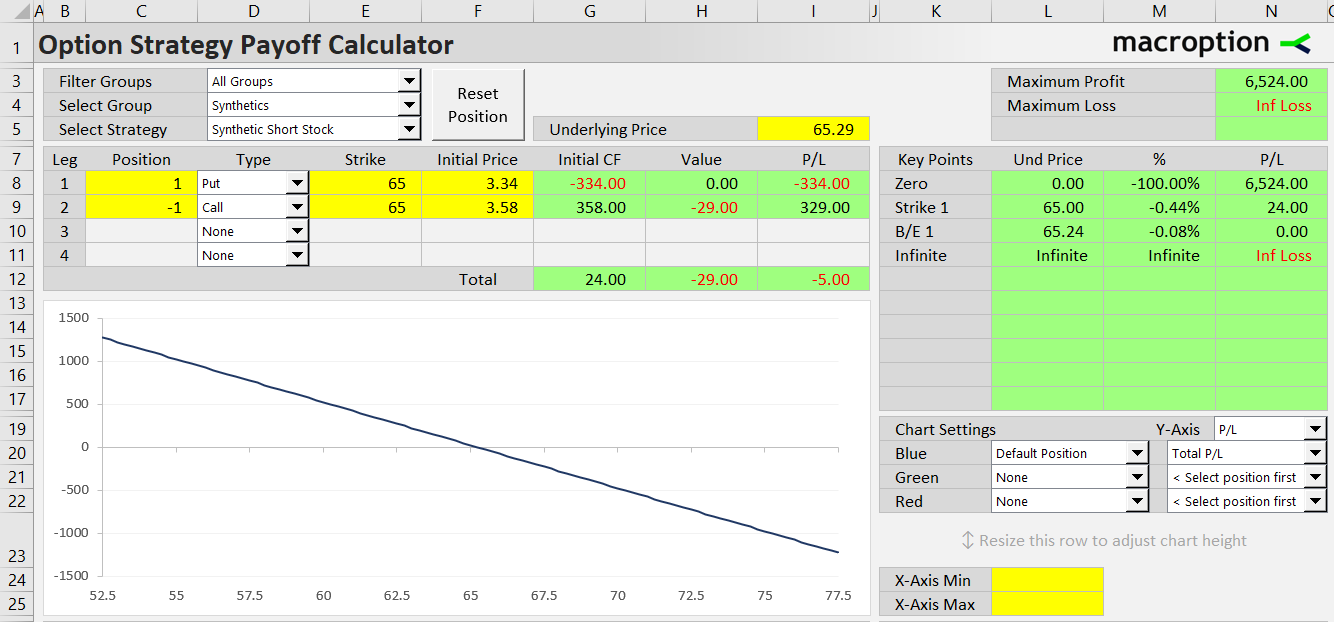

- Sell the 65-strike call option for $3.58 per share ($358 for one option contract).

- Buy the 65-strike put option for $3.34 per share ($334 per contract).

Payoff

Payoff from a synthetic short stock is identical to a short position in the underlying stock – the payoff diagram is linear and declines with increasing underlying price to a potentially unlimited loss.

Maximum profit is reached when underlying price falls to zero.

Strike Selection

Basic requirement for a synthetic short stock is that the call and put strikes must be equal (if they are not, it is a short combo strategy).

The most common way to set up a synthetic stock (long or short) is using at the money strike (the strike closest to underlying price at time of position entry). Choosing a higher or lower strike does not change the payoff, but it does affect cash flow.

Cash Flow

When using at the money strike, initial cash flow is very close to zero, as both the options have similar premium.

Synthetic short stock initial cash flow = call premium – put premium

This is different from plain short underlying position, where the cash amount initially gained from the short sale equals the entire stock price.

When choosing strikes other than at the money, initial cash flow shifts away from zero, as one of the options is in the money (and has higher premium) while the other is out of the money (with lower premium).

Related Strategies

- Synthetic long stock – the inverse position (long call and short put with same strike)

- Short combo – call strike is higher than put strike

- Synthetic put – short stock and long call