Contents

- Calculating Call and Put Option Payoff in Excel

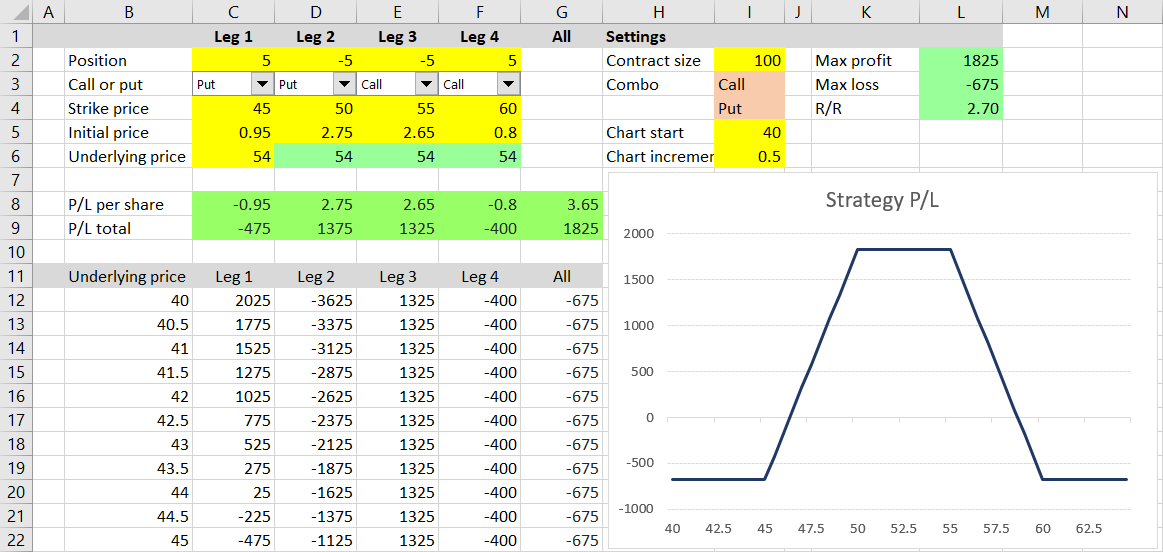

- Merging Call and Put Payoff Calculations

- Short Option Payoff and Position Size

- Option Strategy Payoff and Multiple Legs

- Drawing Option Payoff Diagrams in Excel

- Calculating Option Strategy Maximum Profit and Loss

- Calculating Option Strategy Risk-Reward Ratio

- Calculating Option Strategy Break-Even Points

- Further Improvements

About This Tutorial

In this Option Payoff Excel Tutorial you will learn how to calculate profit or loss at expiration for single option, as well as strategies involving multiple options, such as spreads, straddles, condors or butterflies, draw option payoff diagrams in Excel, and calculate useful statistics for evaluating option trades, such as risk-reward ratios and break-even points.

During the nine parts of the tutorial, we will create a spreadsheet from scratch, starting from simple calculations and adding one feature at a time.

Required Knowledge of Options

The tutorial assumes at least basic understanding of how options work – you should be familiar with basic terms and concepts such as strike price, underlying price, expiration, the difference between calls and puts, and the mechanics of long and short option trades.

You don't need a detailed knowledge of particular option strategies – it is enough to know that various option strategies can be built by combining different options together.

Required Excel Skills

To be able to go through the tutorial and successfully replicate the calculations, you only need basic Excel skills, such as entering formulas, basic arithmetics, copying, inserting and deleting cells, rows and columns, or creating simple line charts. We will also touch a few more advanced concepts, such as combo boxes, but these will be explained as we go (more advanced Excel users will be informed where it's safe to skip such parts). This tutorial will not use or teach any macros or VBA.

We will use Excel functions including IF, AND, OR, MAX, MIN, SUM, ABS, SIGN, RANK.EQ, COUNTIF, INDEX, MATCH. Most readers will be already familiar with most of these, but each will be briefly introduced before we use it – at least what inputs it takes, what it returns, and how it relates to the thing we are trying to do at the moment. The more advanced ones will get a bit more detailed explanation.

We will also pay attention to the issues of design, performance, and making our spreadsheets clean and user-friendly. Sometimes more than one solution to the same problem will be introduced and we will discuss why one formula or structure may be better than another, even when both lead to the same result. Many readers will find they have learned as much about Excel itself as about the option strategy calculations.

Questions & Feedback

If you have any questions or suggestions, please feel free to contact me.

Let's Go to Part 1

Continue to part 1: Calculating Call and Put Option Payoff in Excel