Long put synthetic straddle is a long volatility synthetic option strategy with two legs. It replicates the long straddle strategy with a combination of long underlying position and put options. Like long straddle, it has limited loss and unlimited potential profit.

Setup

Long put synthetic straddle is one of two variants of the synthetic long straddle strategy. The other is long call synthetic straddle.

Unlike the call variant, long put synthetic straddle replaces the call option part of classic long straddle with synthetic call, which is the combination of long underlying position and long put option.

Long straddle = long call + long put

Synthetic long call = long underlying + long put

Long put synthetic straddle = long underlying + 2x long put

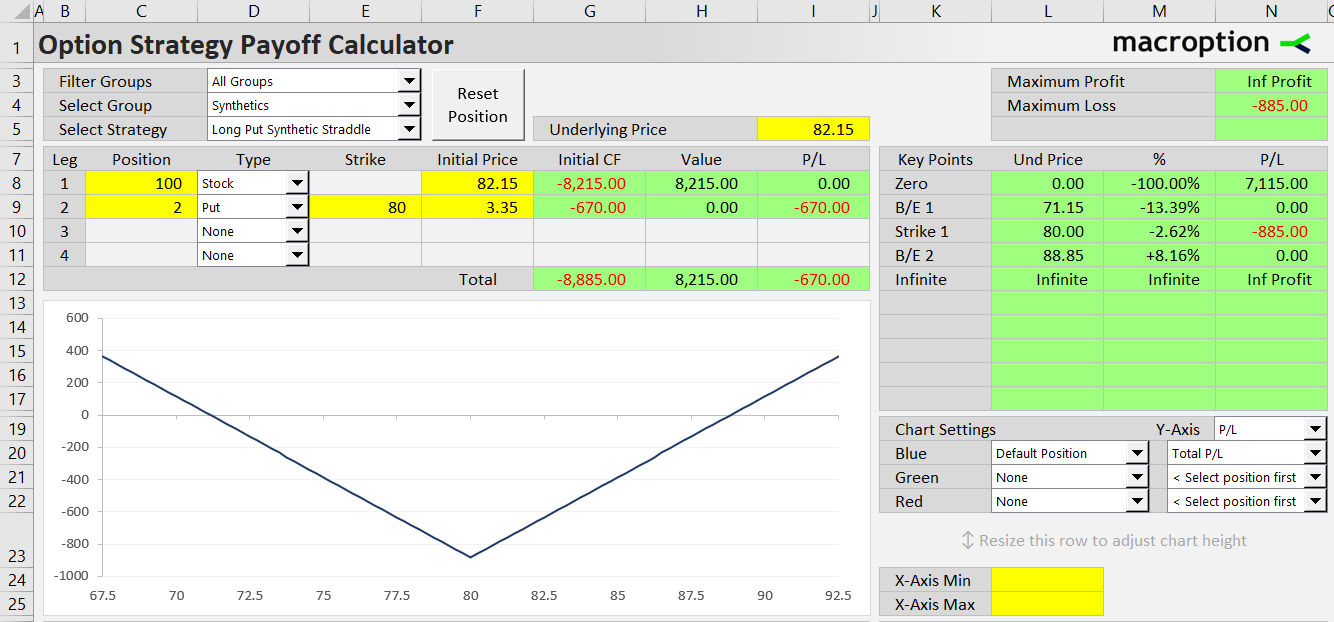

The setup is:

- Buy 2 put option contracts.

- Buy 100 shares of the underlying stock.

Position size of the put options must be double (in terms of underlying shares or units) relative to the long underlying size. For example, if one option contract represents 100 shares of stock (as for US traded stock options), two put option contracts are needed for every 100 shares in a synthetic straddle.

Differences from Long Call Synthetic Straddle

Under normal circumstances, it should not matter (for profitability and risk profile) whether we trade synthetic straddle with calls or puts.

The biggest difference is that the put variant includes long underlying position, while the call variant is short the underlying.

For many underlying markets (including stocks), long positions are easier to trade (and in some cases, short selling the underlying may not be possible at all).

The underlying direction has other important implications: mainly for dividends (long underlying holder receives dividends, while short seller pays) and initial cash flow (underlying buyer has to pay the underlying price, while short seller receives it).

To sum up, synthetic straddle with puts has the following differences from synthetic straddle with calls:

- It is often easier to trade (no short selling the underlying).

- It requires high initial cash outflow (to buy the underlying).

- Its holder receives dividends.

That said, the effects of dividends and interest rates (cash flow) are normally reflected in option prices and should not (by themselves) lead to differences in profitability.

Related Strategies

- Long call synthetic straddle – the other variant with calls instead of puts

- Short put synthetic straddle – the inverse position

- Synthetic long call – long underlying + long put

- Synthetic long put – short underlying + long call

- Synthetic long stock – long call + short put