This is a list of option strategies which have limited risk (limited maximum loss) and unlimited potential profit. Typical examples are long straddle, long strangle, or long call.

See also option strategies with limited risk and limited profit and strategies with unlimited risk.

The List

- Bear Call Ladder (also Short Call Ladder)

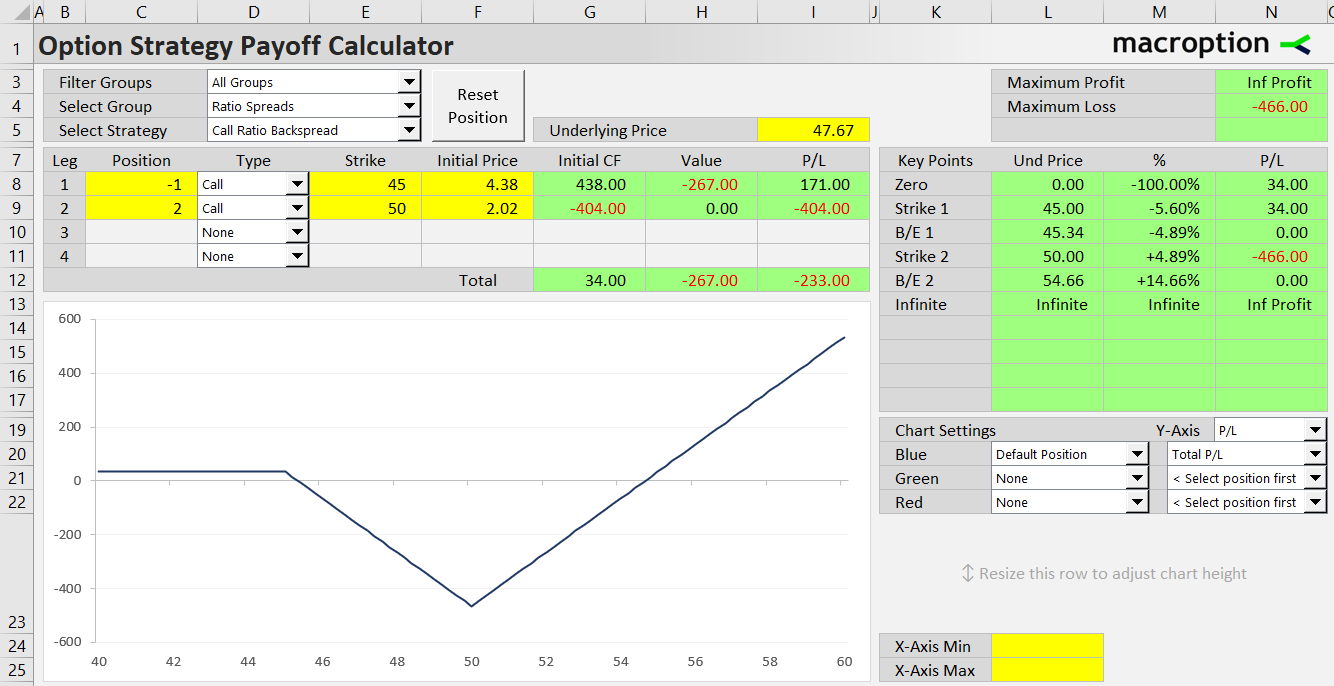

- Call Ratio Backspread

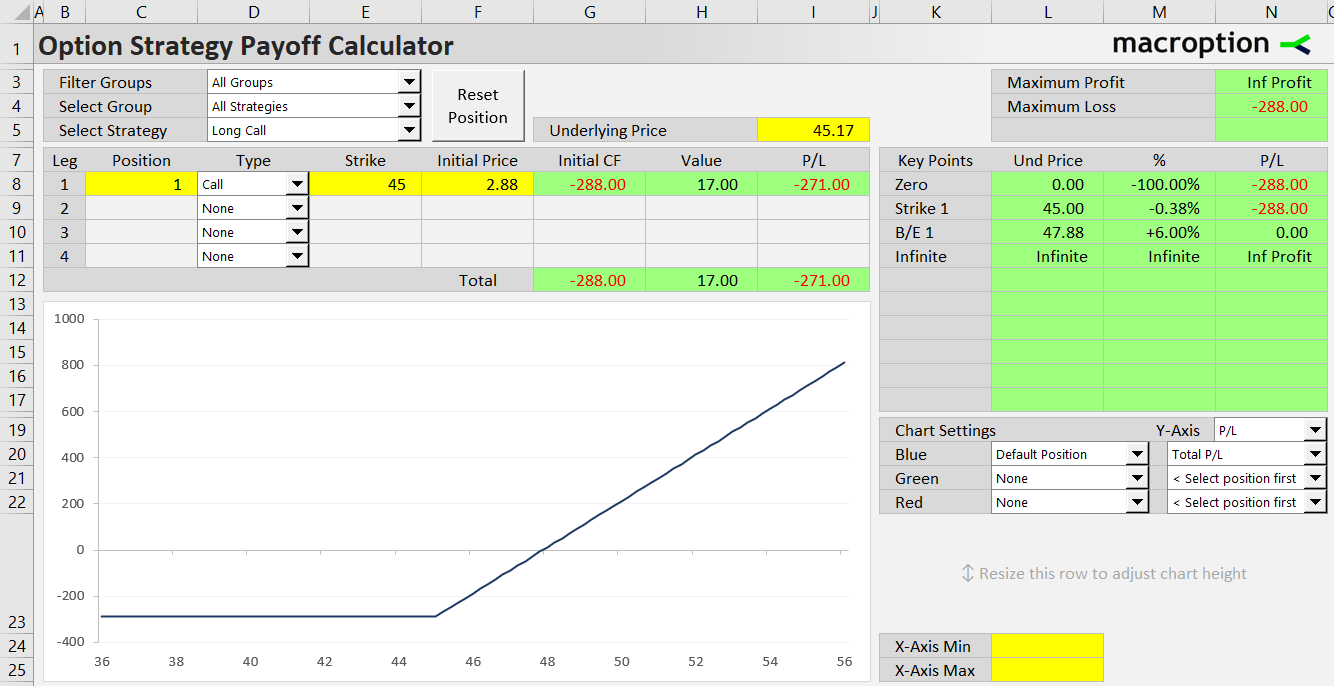

- Long Call

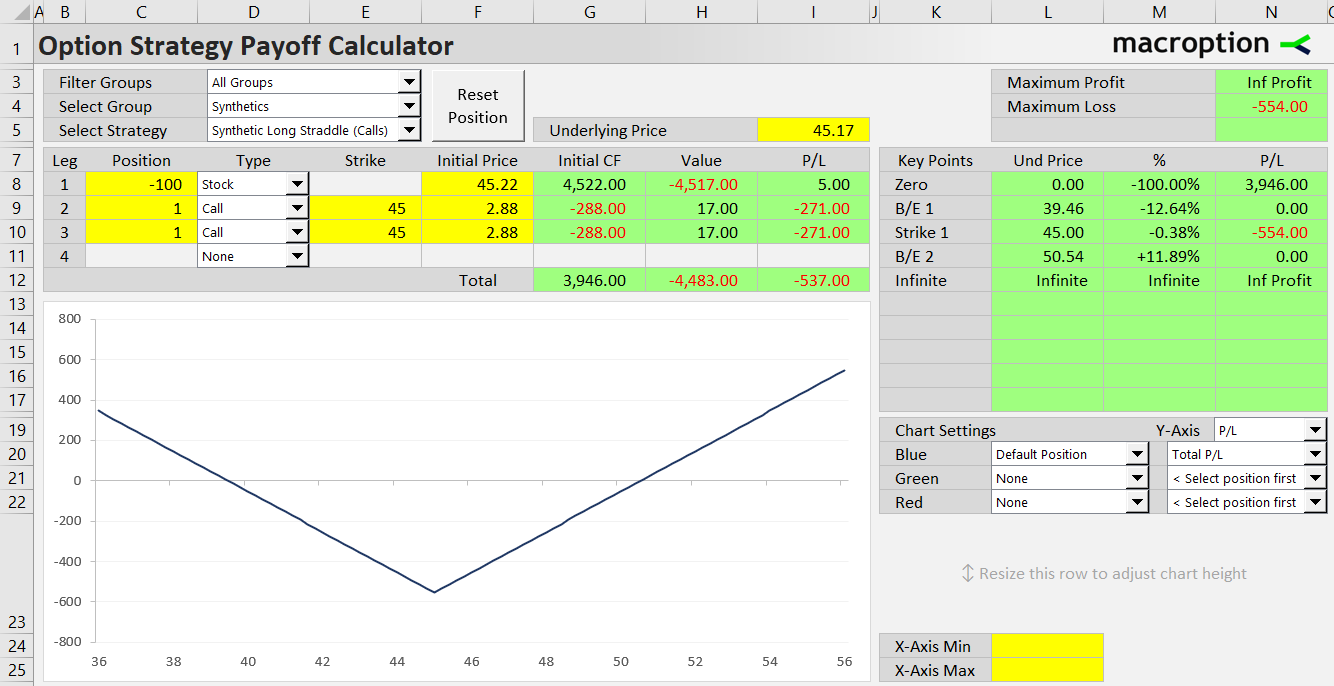

- Long Call Synthetic Straddle (also Synthetic Straddle)

- Long Call Synthetic Strangle (also Synthetic Strangle)

- Long Combo

- Long Guts (also Guts)

- Long Put Synthetic Straddle

- Long Put Synthetic Strangle

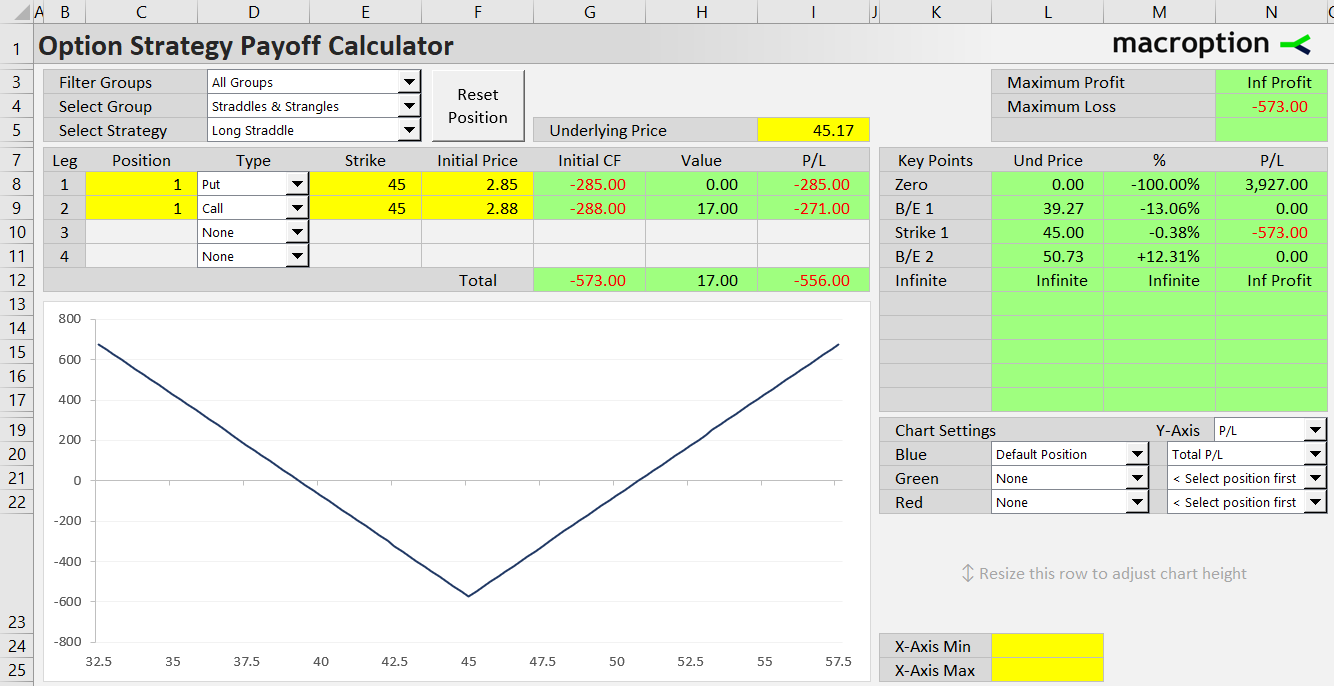

- Long Straddle (also Straddle)

- Long Strangle (also Strangle)

- Protective Put (also Married Put)

- Strap

- Strip

- Synthetic Long Call (also Synthetic Call)

- Synthetic Long Stock (also Synthetic Stock, Synthetic Long)

Strategy Groups with Unlimited Profit

Many strategies in the above list are quite similar. In fact, we can classify them all in a few groups.

Long Call

The simplest strategy with limited risk and unlimited profit is a plain and simple long call option. Its risk is limited to the premium paid, while profit is theoretically infinite as there is no cap on how high the price of most underlying assets can go.

Option Spreads

Other strategies from the list are ratio spreads and ladders, which include both long and short call options, but the number of long call contracts is greater than the short ones. As a result, these positions are net long call options and can profit from the unlimited upside potential when underlying price goes up.

Option Combinations

Long option combinations are some of the most common strategies with unlimited profit. These are long both call and put options, but it is the long call side which creates the unlimited profit potential.

Long combinations include long straddle and its variations, which differ in the relative call and put position sizes (strip, strap) or strikes (strangle, guts).

Synthetic Strategies

The last group with unlimited profit are synthetic positions which imitate the payoffs of the above listed strategies using other options.

For instance, a synthetic long straddle position can be created from a combination of short underlying and long call options.

What Causes Unlimited Profit Potential

All these strategies have one thing in common: the theoretically unlimited profit applies to an upside move in underlying price.

Each strategy is either bullish or long volatility.

Generally, for a position to have unlimited potential profit, it must be either net long call options or net long the underlying asset. Either allows the position's value to infinitely increase as underlying price keeps rising.

Bearish Strategies with Almost Unlimited Profit

There are some bearish strategies, such as long put, which can possibly reach very high profit when underlying price falls to zero. However, because most underlying assets can't have negative prices, potential profit of these strategies is still limited by zero underlying price.

Generally, these are strategies which are net long put options or net short the underlying asset.