Short call synthetic strangle is a non-directional synthetic option strategy with three legs. It replicates short strangle using a long underlying position and two short call options with different strikes. It has unlimited risk and limited profit potential.

Example

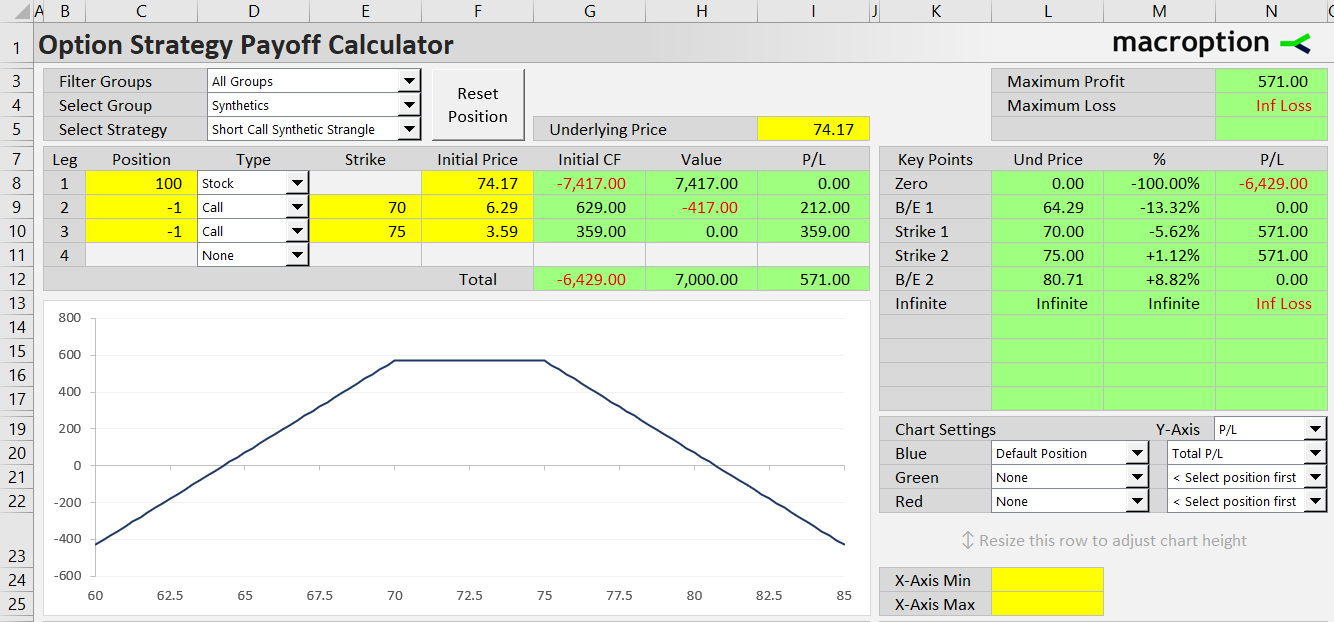

Let's say a stock is trading at $74.17. We can set up a short call synthetic strangle as follows:

- Buy 100 shares of the stock for $74.17 per share.

- Sell the 70-strike call option for $6.29.

- Sell the 75-strike call with same expiration for $3.59.

This position has risk profile similar to the 70-75 short strangle (short 70-strike put and short 75-strike call). The call option remains the same, while the 70-strike put option has been replaced by synthetic short put (long underlying and short 70-strike call).

Related Strategies

- Short put synthetic strangle – the other variant with put options

- Short strangle – the position replicated by these synthetics

- Long call synthetic strangle – the inverse position, replicating long strangle

- Short call synthetic straddle – both calls have same strike, replicating short-straddle