Short put synthetic strangle is a synthetic option strategy with three legs. It replicates short strangle using a short underlying position and two short put options with different strikes. Like short strangle, it is non-directional and has unlimited risk and limited profit.

Example

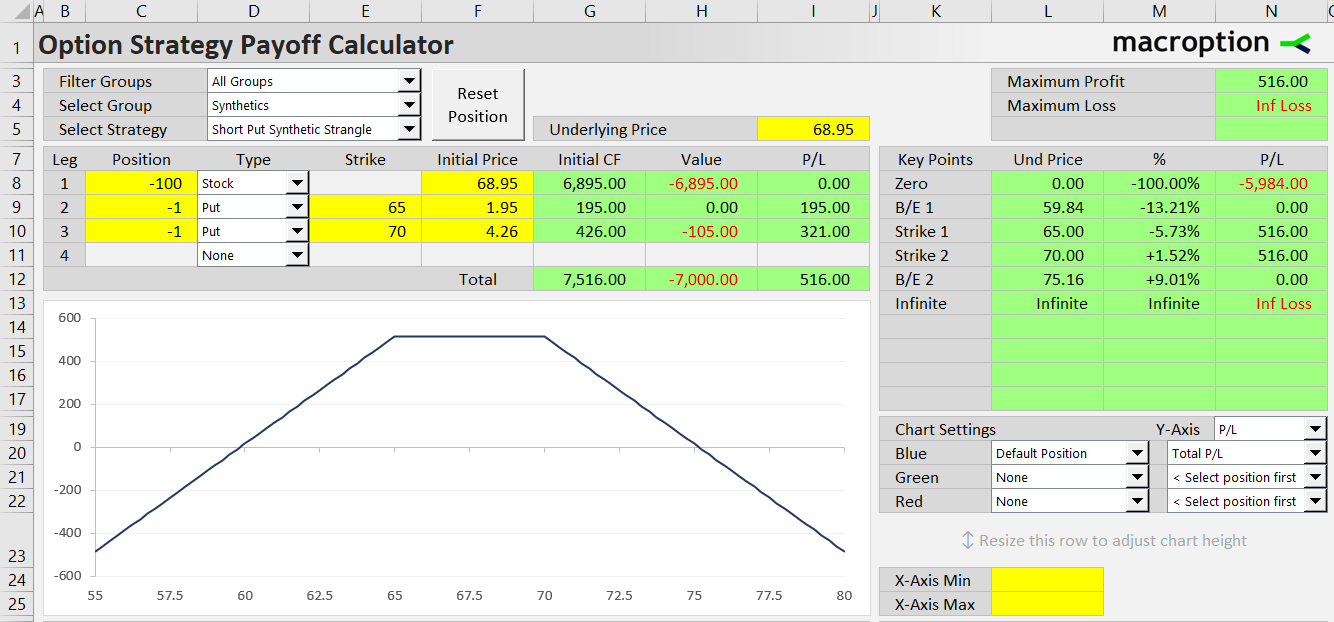

Consider a stock trading at $68.95. A short put synthetic strangle can be created with the following trades:

- Sell short 100 shares of the stock for $68.95 per share.

- Sell the 65-strike put option for $1.95.

- Sell the 70-strike put with same expiration for $4.26.

This position replicates a short strangle involving a 65-strike put option (which remains the same) and a 70-strike call option (which has been replaced by synthetic short call using the short stock and short 70-strike put).

Related Strategies

- Short call synthetic strangle - the other variant with call options

- Short strangle - the non-synthetic equivalent

- Long put synthetic strangle - the inverse position (replicating long strangle)

- Short put synthetic straddle - same strike for the two puts (replicating short straddle)