Short straddle is a non-directional option strategy with two legs. It has unlimited loss and limited profit.

Setup

Short straddle is the inverse of long straddle. A straddle position involves a call option and a put option with same strikes and expiration dates. To set up a short straddle:

- Sell a call option.

- Sell a put option with same strike and expiration.

Normally, the strike is selected at the money (the nearest strike to current underlying price). Selecting a strike further away from current underlying price creates a directional exposure.

The number of call and put contracts must be the same.

Example

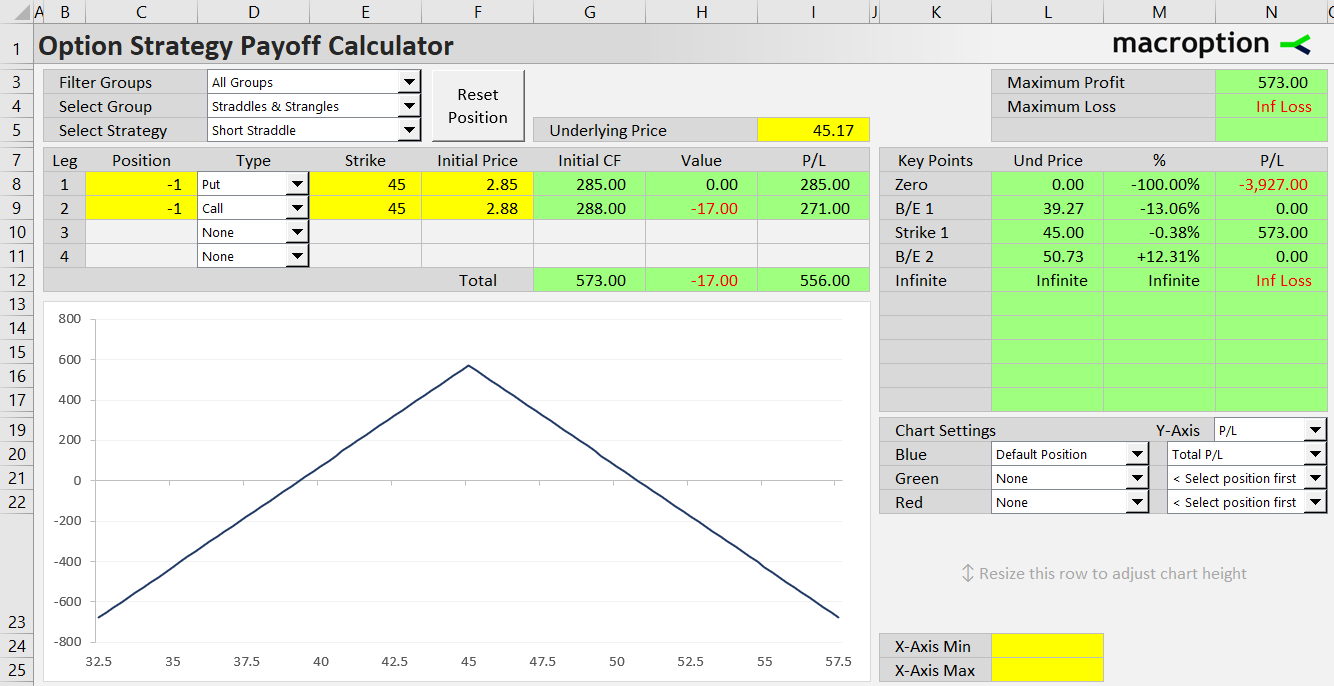

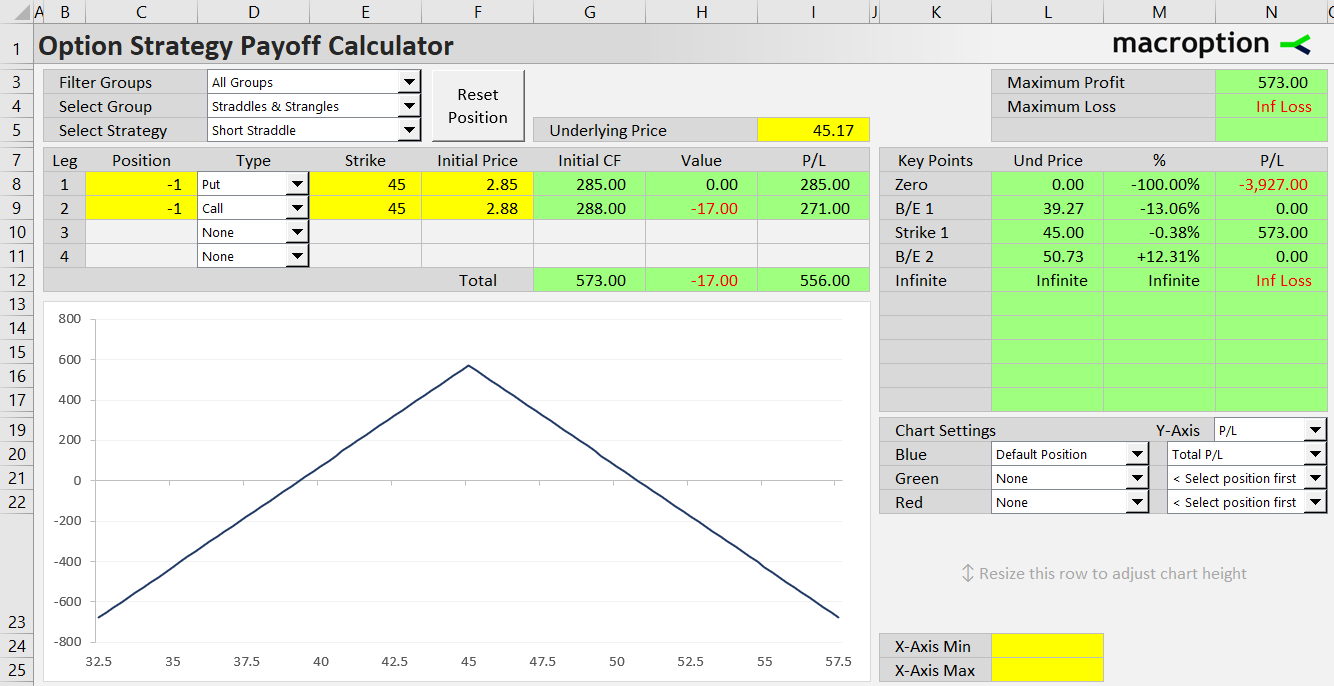

Consider a stock trading at 45.17 (current underlying price). We will set up a short straddle position and select the 45 strike (at the money – nearest strike to 45.17):

- Sell 45 strike call option for 2.88 per share ($288 for one contract).

- Sell 45 strike put option for 2.85 ($285).

Note we are taking the exact opposite side from the long straddle example.

Cash Flow

Initial cash flow is also the exact opposite to long straddle. Short straddle is a credit option strategy – because we are only selling options when opening the position, cash flow is positive.

In our example, we receive 2.88 per share for the call option plus 2.85 for the put, which is 5.73 per share for the short straddle, or $573 for one contract.

Payoff at Expiration

The objective with a short straddle is to defend the premium received – like other credit short volatility strategies such as short strangle, iron butterfly or iron condor. Ideally, the stock price will stay near the strike until expiration. The further away it moves, the more one of the options will be in the money, resulting in smaller profit or greater loss from the trade.

Payoff Diagram

Short straddle payoff diagram peaks exactly at the strike. From there is declines in a steady, linear way in both directions (the slope is the same, just inverse, assuming the call and put position size is the same).

Maximum Loss

The further away underlying price gets from the strike, the greater the loss. While it is limited by the stock price falling to zero on the put side, there is no theoretical limit on the call side, as most underlyings can reach an infinitely high price. Total loss is reduced by the premium received when opening the position, but still infinite.

Short straddle maximum loss = infinite

Maximum loss on the downside (when underlying price drops to zero) is strike price minus premium received.

Maximum Profit

Because a short straddle includes only short options and no long options, there is no way to gain anything at expiration. Therefore, maximum profit equals premium received at the beginning, in case underlying price ends up exactly equal to the strike at expiration.

Short straddle maximum profit = premium received

Risk-Reward Ratio

As with other unlimited loss strategies, risk-reward ratio does not make much sense – it is infinitely bad.

Break-Even Points

Short straddle has two break-even points, which are identical to long straddle break-evens, because the positions are just the two sides of the same trade.

Because total profit declines in a linear way and at the same pace as underlying price goes away from the strike to either side, the distance of each break-even from the strike price must be the same on both sides and it equals premium received (for both options).

Short straddle B/E #1 = strike price – premium received

Short straddle B/E #2 = strike price + premium received

Greeks

Delta

Short straddle is delta neutral when underlying price is near the strike.

Gamma

Gamma is negative. This means that delta increases when underlying price goes down, and vice-versa. Either is bad for the position – losses accelerate as underlying price moves away from the strike to either side.

Theta

Short straddle gains with time. Theta is positive. It is highest when underlying price stays near the strike and often increases as the options get closer to expiration.

Vega

Vega is negative. Increasing implied volatility means increasing option values – but we are short the options, therefore the positions loses.

Related Strategies

- Long straddle – the inverse of short straddle (long call and long put with same strike)

- Short strangle – call option strike is higher than put option strike

- Short guts – call option strike is lower than put option strike

- Covered short straddle – short straddle with long underlying position

- Iron butterfly – short straddle hedged with long out of the money call and put