Iron butterfly is a non-directional option strategy with four legs. It has limited loss and limited profit.

Setup

- Short call option.

- Short put option with the same strike price.

- Long put option with lower strike price.

- Long call option with higher strike price (than the short options).

All options must have the same expiration date. All legs must have the same size (number of option contracts).

The short options strike is typically chosen at the money – the strike which is closest to the current underlying price.

It is important for the difference between the long call and short call strike to be exactly the same as the difference between the long put and short puts strikes (the wing width). This ensures that the position is symmetric and has no directional bias.

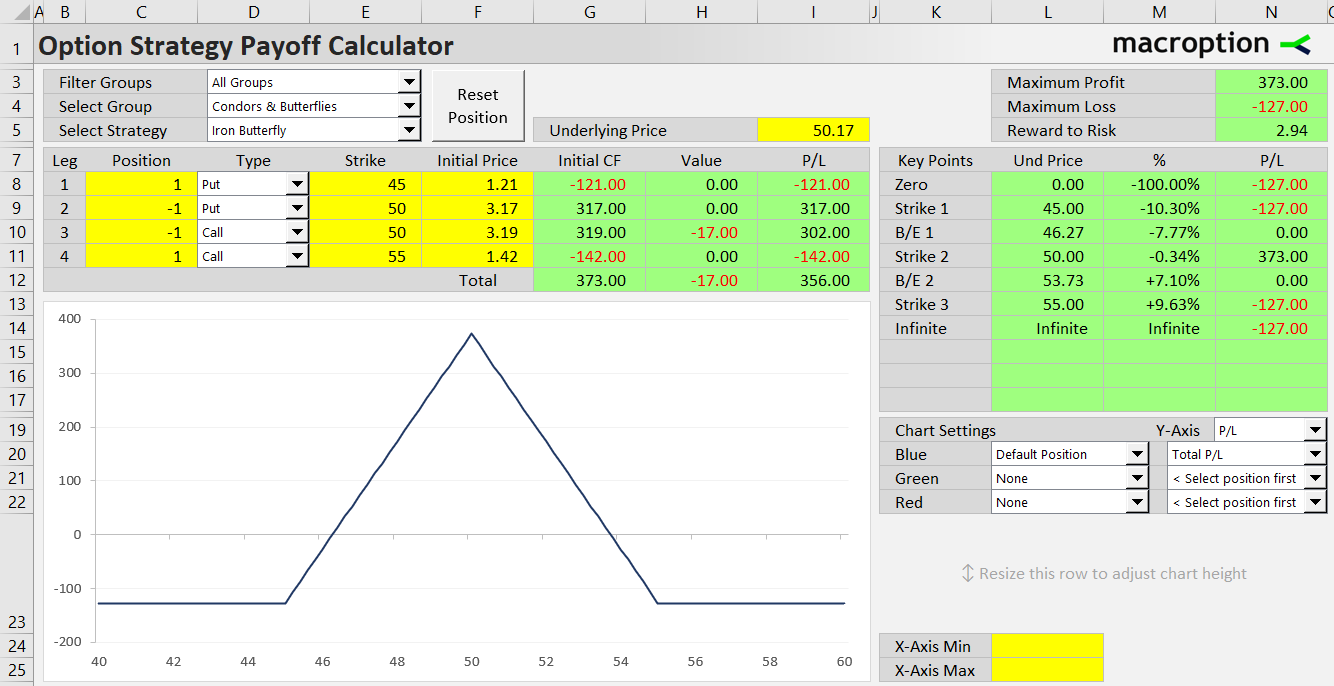

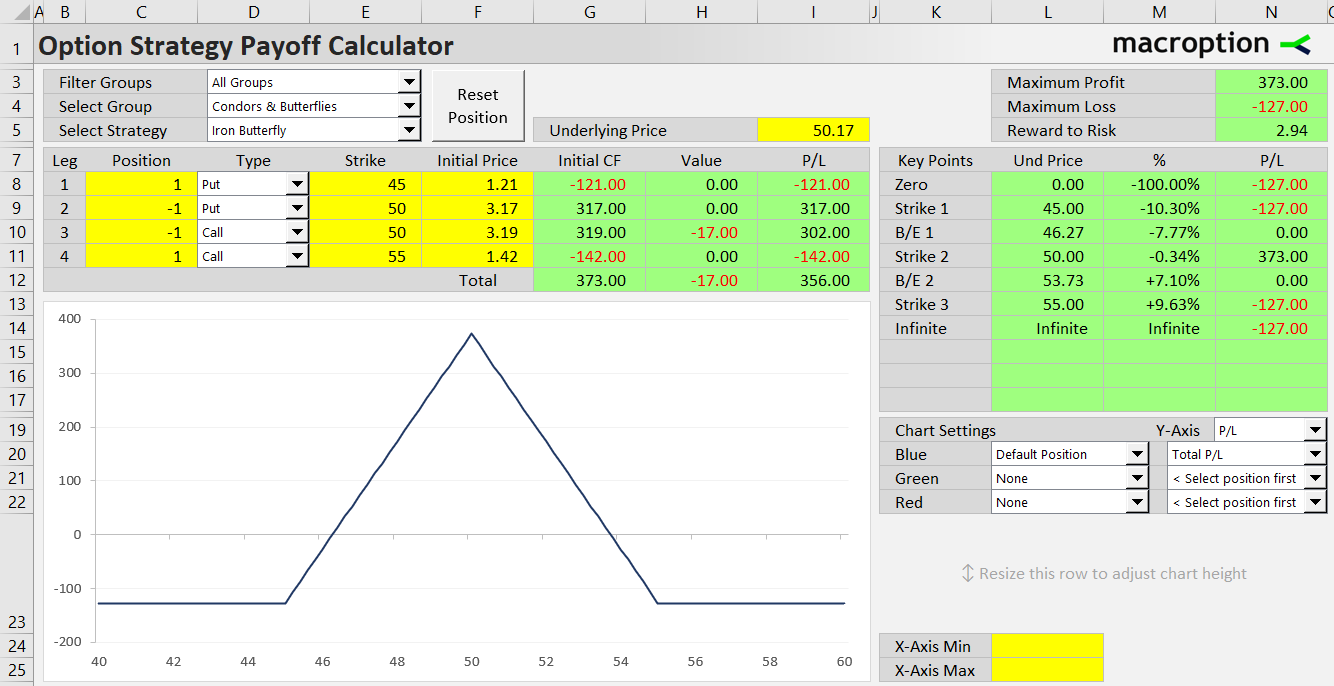

Example

- Sell 50 strike call option for 3.19 per share ($319 for one contract).

- Sell 50 strike put option for 3.17 ($317).

- Buy 45 strike put for 1.12 ($121).

- Buy 55 strike call for 1.42 ($142).

Cash Flow

Cash flow from opening an iron butterfly is positive – it is a credit option strategy.

Initial cash flow (or net premium received) equals premium received for selling the short call and short put, minus premium paid for the long call and long put. Because the short options are typically at the money, their premiums are greater than the long options' prices.

Payoff at Expiration

The objective of an iron butterfly trade is to defend the premium received. Ideally, the underlying price stays at the short options' strike and no options are in the money at expiration.

Payoff Diagram

The payoff diagram shows maximum profit when underlying price is exactly at the middle strike. The profit decreases and eventually turns to a loss as the underlying price goes aways from the middle strike to either direction. However, because the short options are hedges by the long options, the losses stop growing at the long option strike on both sides.

Maximum Loss

Maximum loss, reached at or above the long call strike or at or below the long put strike, depends on wing width (the distance between the long and short strike, which should be the same for the calls and the puts). The wing width is how much the short call or put can get in the money before it is hedged by the long call or long put, respectively.

Iron butterfly maximum loss = wing width – net premium received

Maximum Profit

Iron butterfly maximum profit = net premium received

Risk-Reward Ratio

The risk-reward ratio improves when wing width becomes smaller (but so does maximum profit).

Break-Even Points

Iron butterfly B/E #1 = middle strike – net premium received

Iron butterfly B/E #2 = middle strike + net premium received

Greeks

Delta

Near zero (when underlying price is near the middle strike).

Gamma

Negative.

Theta

Positive – position gains with passing time.

Vega

Negative – position loses with increasing implied volatility.

Related Strategies

- Reverse iron butterfly – the inverse of iron butterfly (long the middle strike, short the outer strikes, long volatility)

- Long call butterfly – all legs are calls

- Long put butterfly – all legs are puts

- Iron condor – the short call strike is higher than the short put strike (maximum profit is smaller overall but reached on a range of prices rather than at single point)

- Short straddle – no long legs (risky, unhedged version of iron butterfly, with higher potential profit but also unlimited potential loss)