Long straddle is a long volatility option strategy with two legs. It has limited loss and unlimited potential profit.

Setup

A straddle position consists of a call option and a put option with the same strike price and same expiration date. To set up a long straddle:

- Buy a call option.

- Buy a put option with the same strike and expiration.

Typically a long straddle is opened with at-the-money strike price (the strike price which is closest to current underlying price).

For a position to be a straddle, the number of long call contracts must be exactly the same as the number of long put contracts. Otherwise it is called a strip (more puts) or strap (more calls) and has a directional bias.

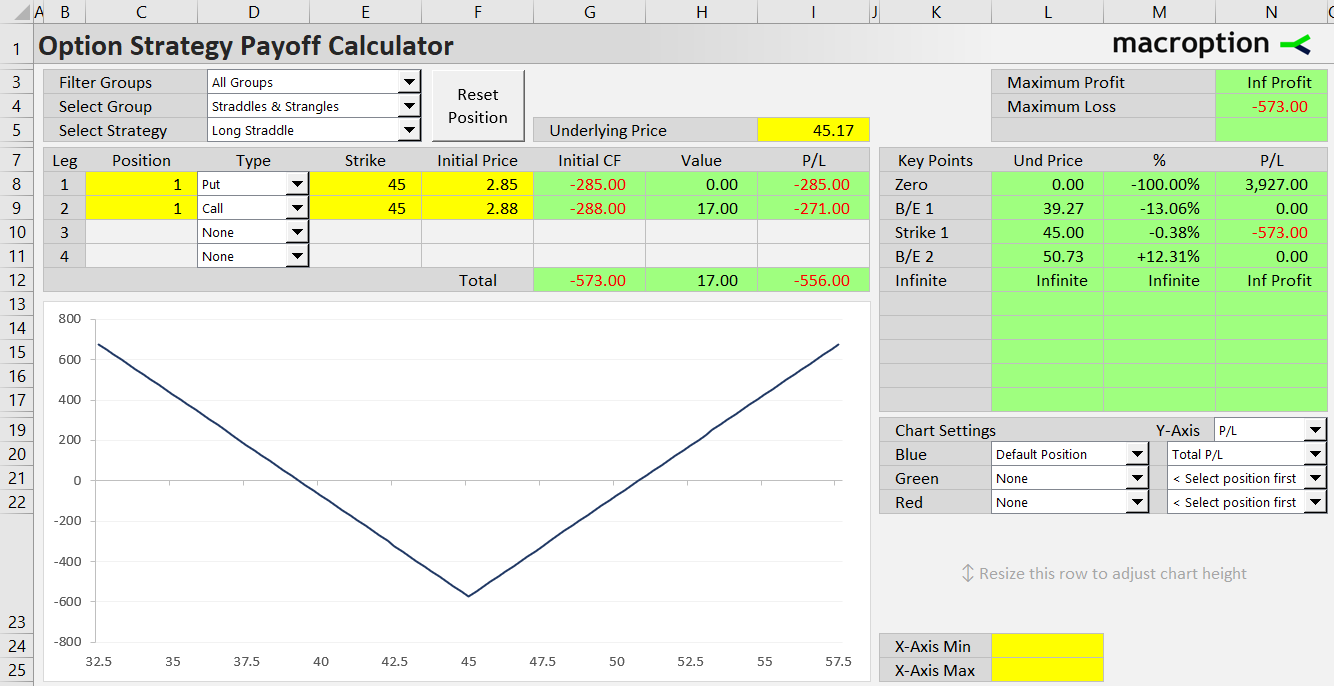

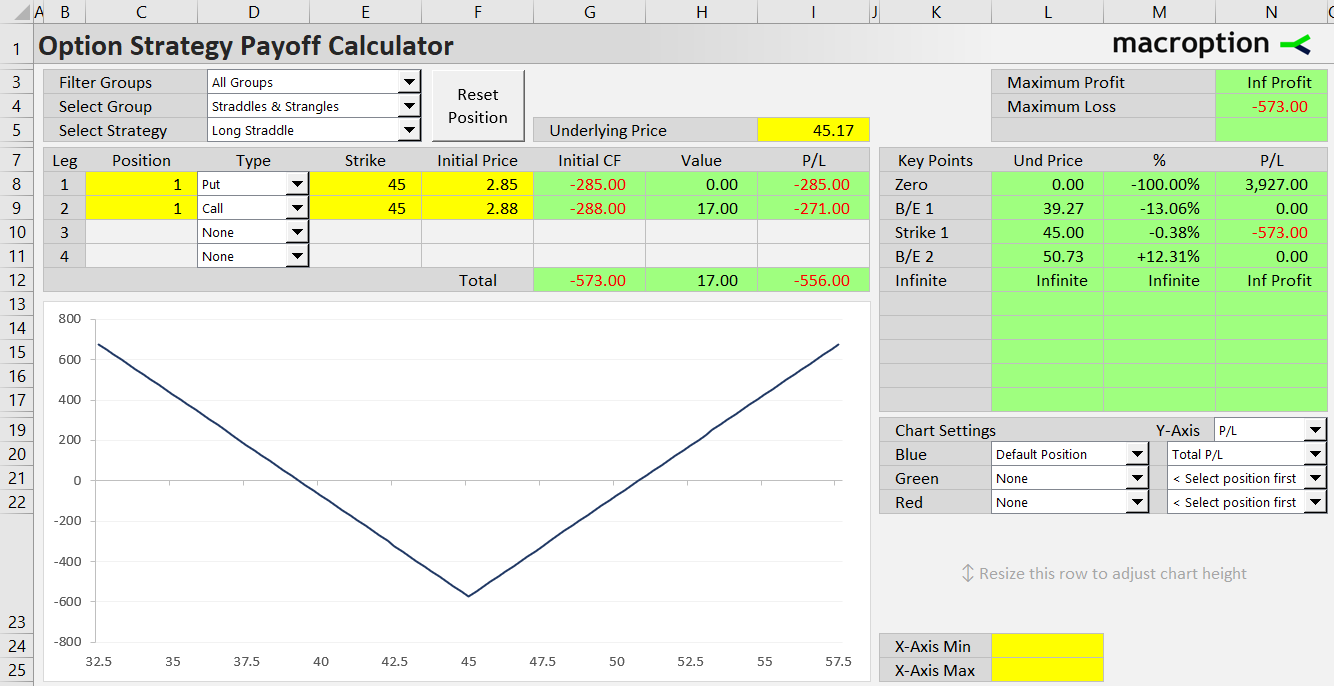

Example

Let's say the underlying stock is trading at 45.17. To enter a long straddle position, we choose the 45 strike (at the money):

- Buy 45 strike call option for 2.88 per share ($288 for one contract).

- Buy 45 strike put option for 2.85 ($285).

Cash Flow

Because we are buying options when opening a long straddle, initial cash flow is negative – it is a debit option strategy.

In our example, the cost is 2.88 for the call plus 2.85 for the put, which is 5.73 per share for the straddle, or $573 for one contract.

Payoff at Expiration

Long straddle is a long volatility strategy, which means that it profits from a big move in underlying price. When opened with at the money strike, it has no directional bias – it does not matter whether the big move is up or down. It just needs to be big enough for one of the options (either the call if underlying goes up or the put if it goes down) to get in the money enough to cover initial cost of both options and make a profit.

Payoff Diagram

The payoff diagram shows greatest loss when underlying price is at the strike and increasing profits as underlying price gets away from the strike to either side.

Maximum Loss

Because a long straddle only includes long options and no short ones, it can't lose anything (from option assignment or settlement) at expiration. The worst that can happen is that underlying price ends up exactly at the strike price (45 in our example) and both options expire worthless. In such case the total outcome from the trade equals initial cost (premium paid for buying both options), or 5.73 in our example.

Long straddle maximum loss = premium paid

Maximum Profit

The best case scenario is when underlying price gets as far away from the strike price as possible. The further it gets, the greater the profit – the relationship is linear.

For example, if the stock price in our example is 55 at expiration, the 45 strike call option is in the money and we get $10 per share for exercising it ($1000 for one contract). The put expires worthless. Total profit equals what we get for the in-the-money option (10) minus premium paid when opening the position (5.73), or $4.27 per share in this case, or $427 for one contract.

If underlying price is 60 at expiration, we get $15 per share for exercising the call and total profit is $9.27 per share, or $927.

If there is no upside limit on where the underlying price can go, which is the case with most underlying assets, maximum profit from a long straddle position is unlimited.

Long straddle maximum profit = unlimited

It is similar when underlying price gets down below the strike price. The only difference is that now the put option is the one that makes the profits, while the call expires worthless.

Because the price of most assets can't get below zero, the downside maximum profit is not unlimited, but it is still very large:

Long straddle maximum profit when underlying goes down = strike price – premium paid

Risk-Reward Ratio

Because potential profit is unlimited, there is not much sense talking about risk-reward ratio – it is infinitely favorable.

Break-Even Points

Long straddle has two break-even points, as you can also see from the payoff diagram above.

The first (lower) break-even price is when the gain from exercising the put option equals premium paid for both options (5.73). This happens when the distance of underlying price from the strike is 5.73, at underlying price 39.27.

Similarly, the second (upper) break-even price is when the gain from exercising the call option equals premium paid, which is at 50.73.

Long straddle B/E #1 = strike price – premium paid

Long straddle B/E #2 = strike price + premium paid

Greeks

Delta

When opened with at-the-money strike price, initial delta of a long straddle is near zero. This confirms that it does not matter which way the underlying price goes for the position to get profitable.

Gamma

Because a long straddle is long (typically at-the-money) options, it has high positive gamma.

Gamma measures how delta changes with underlying price. Positive gamma means that these changes are favorable to the profitability of the position (accelerating profits and decelerating losses).

As underlying price gets above the strike price, delta increases. This means out profits accelerate if the underlying continues to go up (because the delta, which also increases, measures how the position's value grows with each $1 increase in underlying price).

Conversely, when underlying price goes down, delta falls. Below the strike price is means that delta becomes a bigger negative number the further down we get. This also means that total profit accelerates.

Theta

The downside of holding a long straddle is negative theta – the position loses value with passing time. This makes sense, as we buy the straddle for a premium in the beginning ($5.73 in our example), but if underlying price stays at the strike, the position's value gradually drops to zero at expiration (the maximum loss scenario).

If the underlying price does stay near the strike, theta (the rate of time decay) tends to increase in the last days before expiration.

This is not be the case if the underlying price gets further away from the strike. Now one of the options is deep in the money and the other is far out of the money. Both ITM and OTM options have smaller time value and smaller theta than ATM options, and their time value tends to erode earlier, in relative terms. In other words, when underlying price moves away from the strike and the straddle becomes profitable, its theta actually decreases – it is not as sensitive to passing time as near the strike.

Vega

Long straddle vega is positive, as long options generally benefit from an increase in implied volatility. Like theta (and also gamma), vega is greatest when underlying price is near the strike and both options are at the money.

Related Strategies

- Short straddle – the inverse of long straddle (short call and short put with same strike)

- Long strangle – call option strike is higher than put option strike

- Long guts – call option strike is lower than put option strike

- Strip – put size is greater than call size

- Strap – call size is greater than put size