There are only four possible option strategies which involve only one leg (a single option) – a long position or a short position in each of the two option types (call and put):

- Long Call

- Long Put

- Short Call (also Naked Call, Uncovered Call)

- Short Put (also Naked Put, Uncovered Put)

- Synthetic Covered Call

- Synthetic Covered Put

See also list of option strategies with two, three, and four legs.

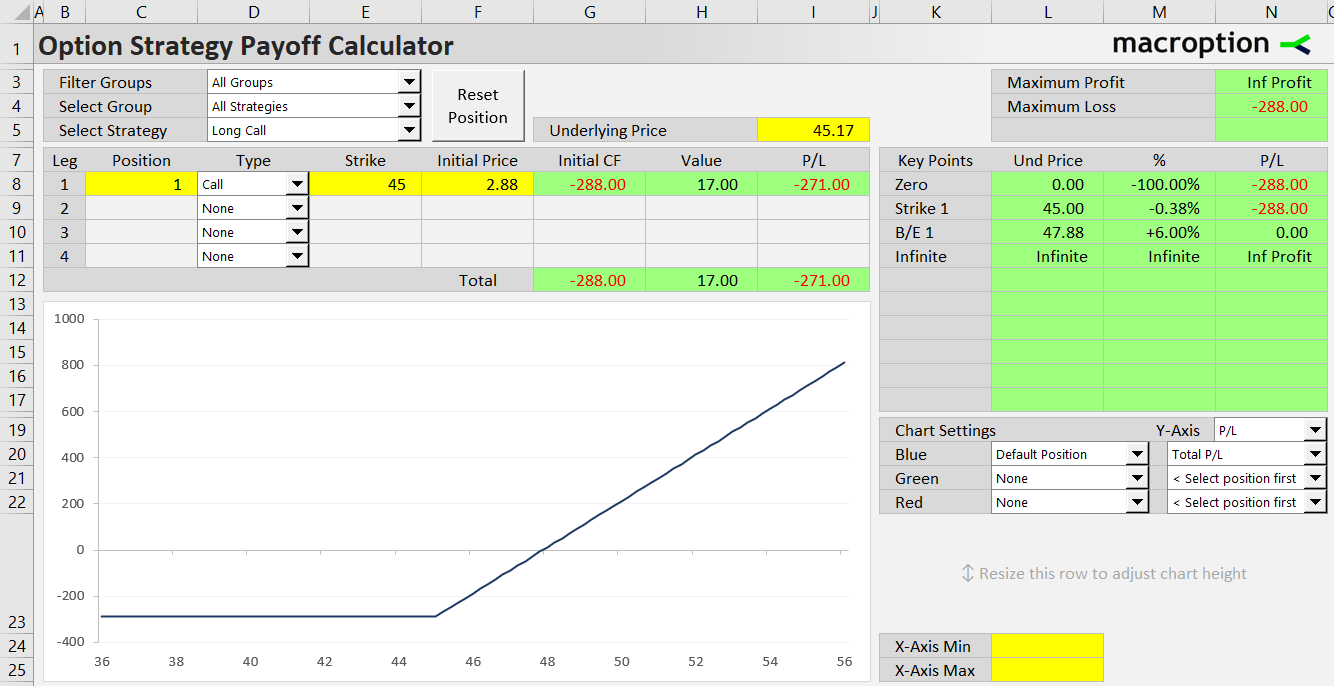

Long Call

Long call is a bullish option strategy – there is theoretically unlimited profit when the underlying asset goes up and limited risk when it goes down (maximum loss equals initial premium paid).

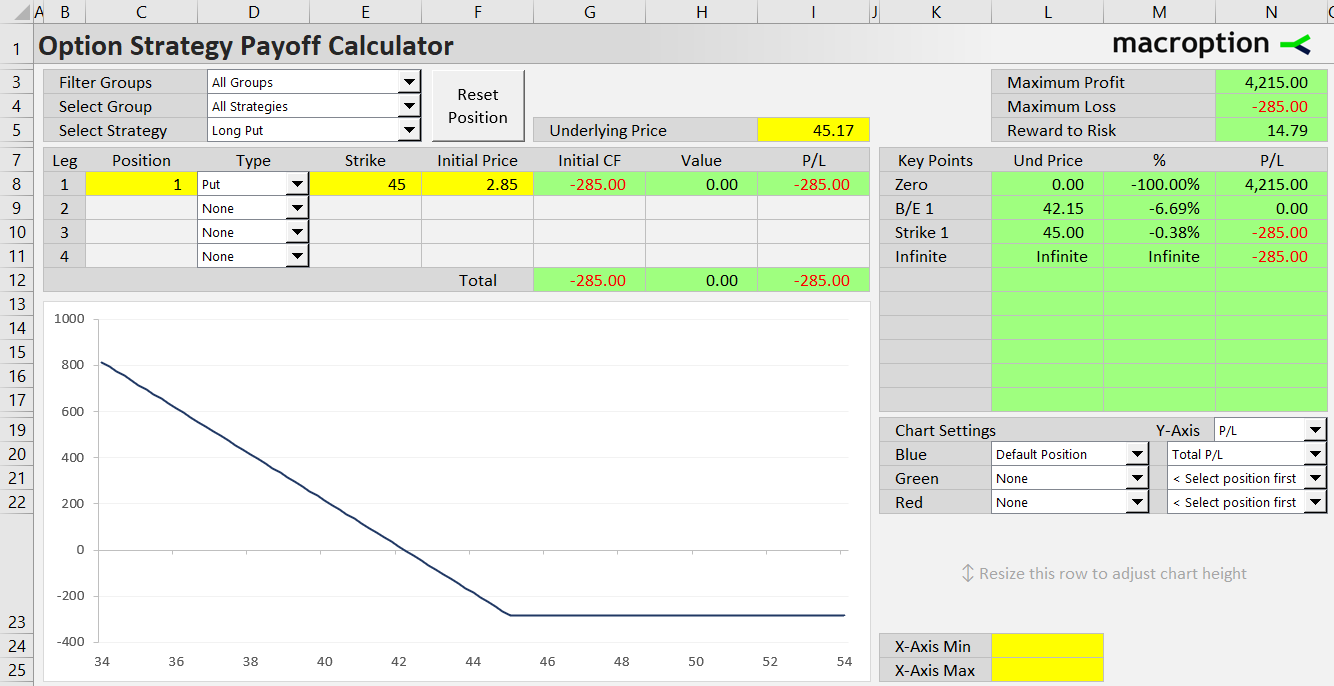

Long Put

Long put is a bearish option strategy – it profits when underlying price goes down. Like long call, it has limited loss (equal to premium paid) and almost unlimited profit (when the underlying falls to zero).

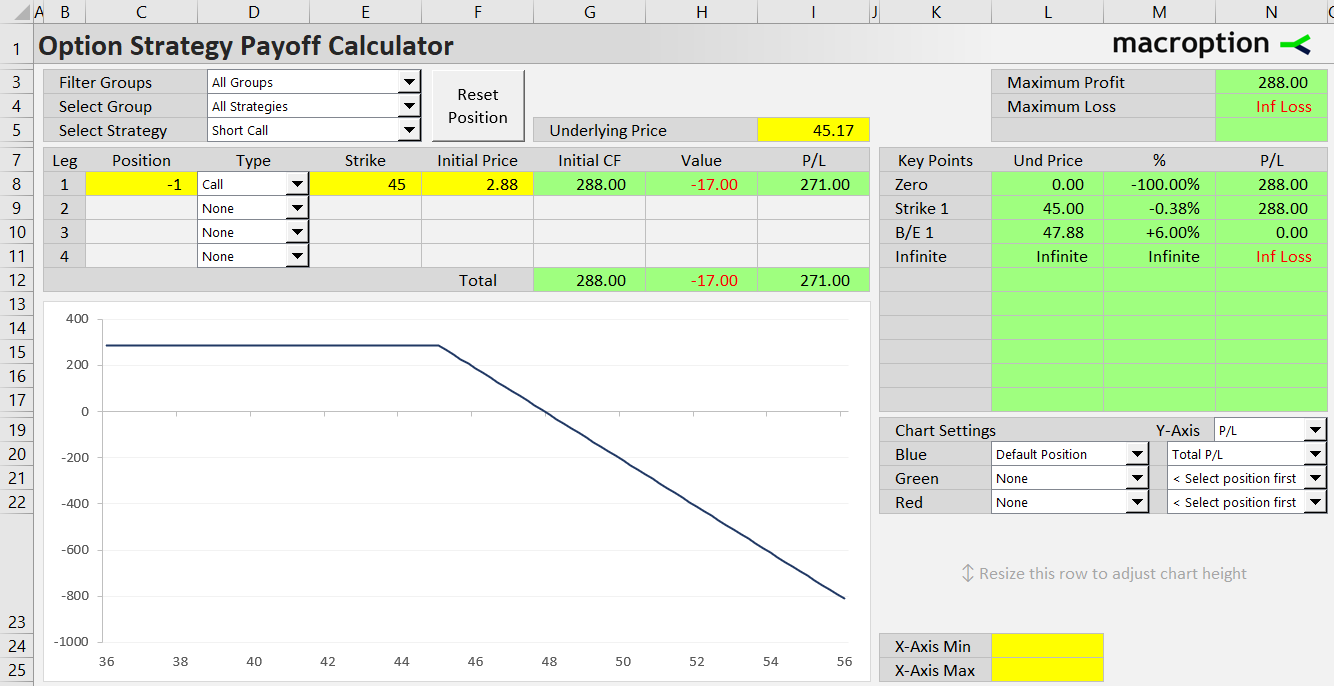

Short Call

Short call is the opposite position to long call. Its payoff diagram is exactly inverse. It is the riskiest of all the four single leg strategies – it can lose theoretically unlimited amount if underlying price goes up.

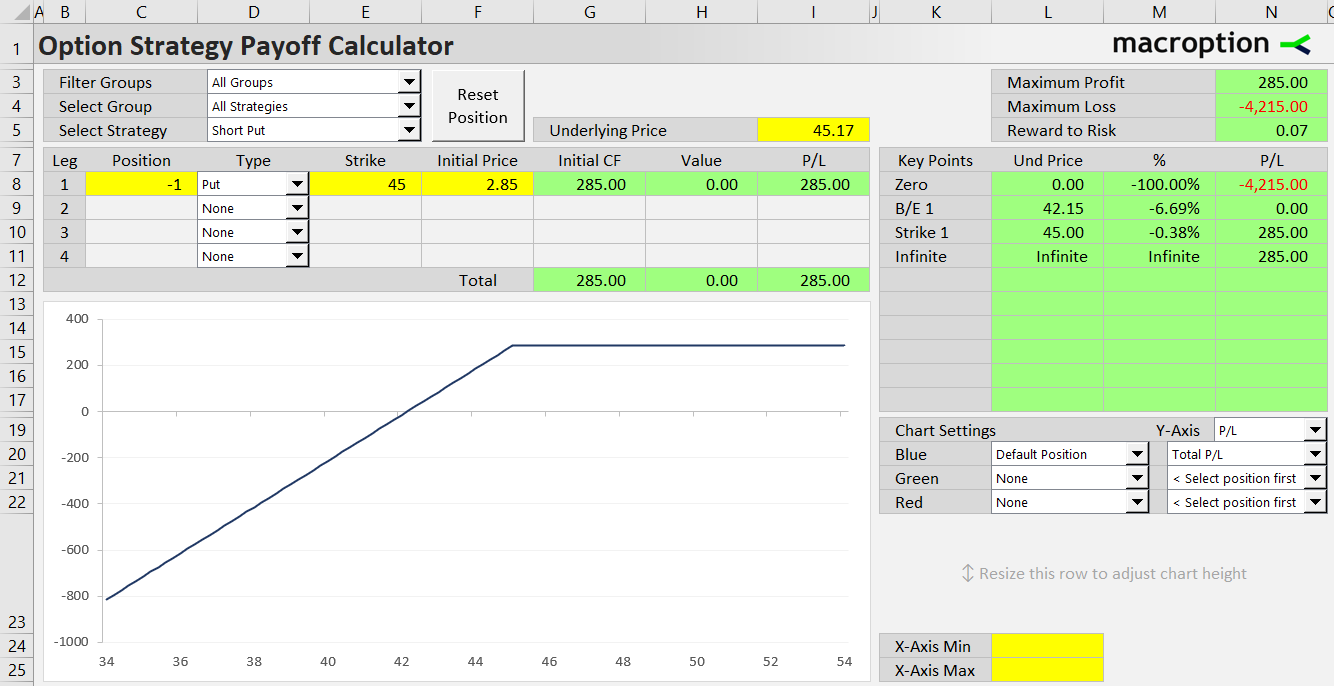

Short Put

Short put is inverse to long put. In the ideal case, it gains the option premium received in the beginning (if underlying price stays above the strike). It can lose a lot if the underlying falls, but unlike short call, maximum theoretical loss is limited at zero underlying price.