Synthetic short put is a bearish synthetic option strategy with two legs. It replicates short put option using short call and long position in the underlying asset. It has limited profit potential and limited risk (although losses can be very big in case of large downward move in underlying price).

Setup

Thanks to the relationship between call and put options known as the put call parity, a position with risk exposures similar to a put option can be created by adding a short underlying position to a (long) call option. This strategy is known as synthetic put (or synthetic long put).

Synthetic short put is the position inverse to synthetic long put - the other side of the trade. It includes two legs:

- Long underlying.

- Short call option.

Example

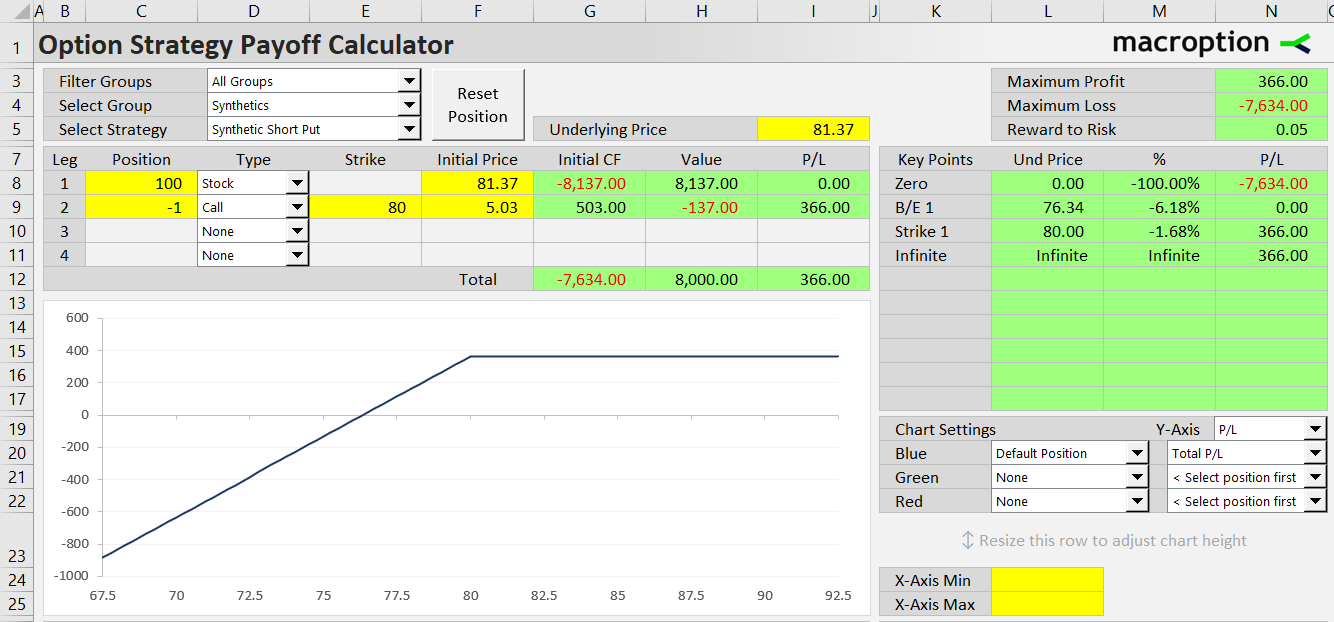

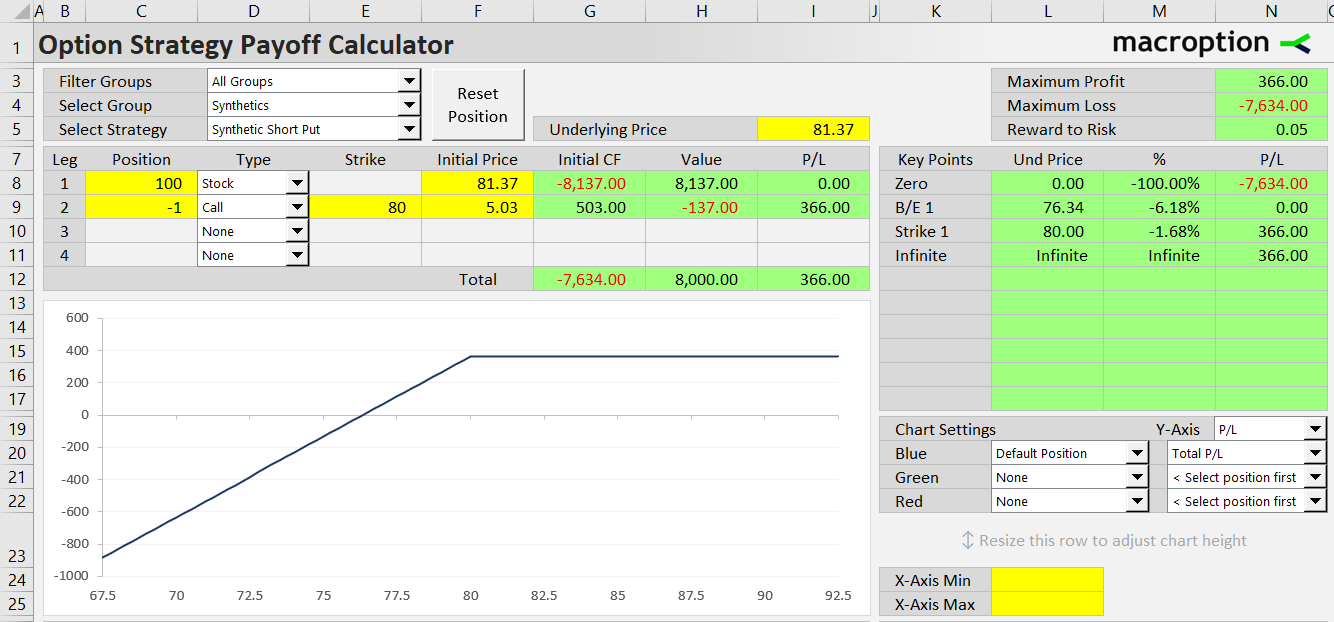

Consider a stock trading at $81.37. We can create a synthetic short put position with the following trades:

- Buy 100 shares of the underlying stock for $81.37.

- Sell one contract of the 80-strike call option for $5.03.

This creates a position similar to short put option with same strike (80) and expiration as the call option used.

Cash Flow

Cash flow is one important difference between classic and synthetic short put.

Classic short put is a credit strategy - we sell the put option and collect premium.

Synthetic short put requires buying the underlying asset and therefore a large initial cash outlay. The premium received for selling the call option only partially reduces the cost.

Synthetic short put initial cost = stock price paid - call premium received

Payoff

Payoff at expiration is the same as for classic short put.

Below the call option strike, the short call is out of the money and the entire position's value equals underlying price (the value of the long underlying leg).

Therefore, total profit or increases proportionally to underlying price.

At the strike, profit stops growing, as the short call option gets in the money and offsets any additional gains in the underlying leg value.

Maximum Loss

Maximum loss occurs at zero underlying price. It is theoretically limited, but can be very large. The position is worth zero, therefore total loss equals initial cost.

Maximum loss = initial cost

Break-Even Point

The position breaks even not far below the call strike. The break-even price equals initial cost (per share), because at this point, the underlying leg value (which equals underlying price) must be the same as initial cost for net profit or loss to be zero.

Synthetic short put break-even = initial cost

Related Strategies

- Short put - the position which this synthetic strategy replicates

- Synthetic long put - the inverse position (short underlying + long call)

- Synthetic short call - short underlying + short put

- Synthetic short stock - long put + short call