The following is a list of all option strategies which consist of three legs.

The List

- Bear Call Ladder (also Short Call Ladder)

- Bear Put Ladder (also Long Put Ladder)

- Bull Call Ladder (also Long Call Ladder)

- Bull Put Ladder (also Short Put Ladder)

- Collar

- Covered Short Straddle

- Covered Short Strangle

- Long Call Butterfly

- Long Put Butterfly

- Short Call Butterfly

- Short Put Butterfly

Typical Strategy Groups with Three Legs

Three main groups of strategies with three legs include ladders, call and put butterflies, and covered straddles and strangles.

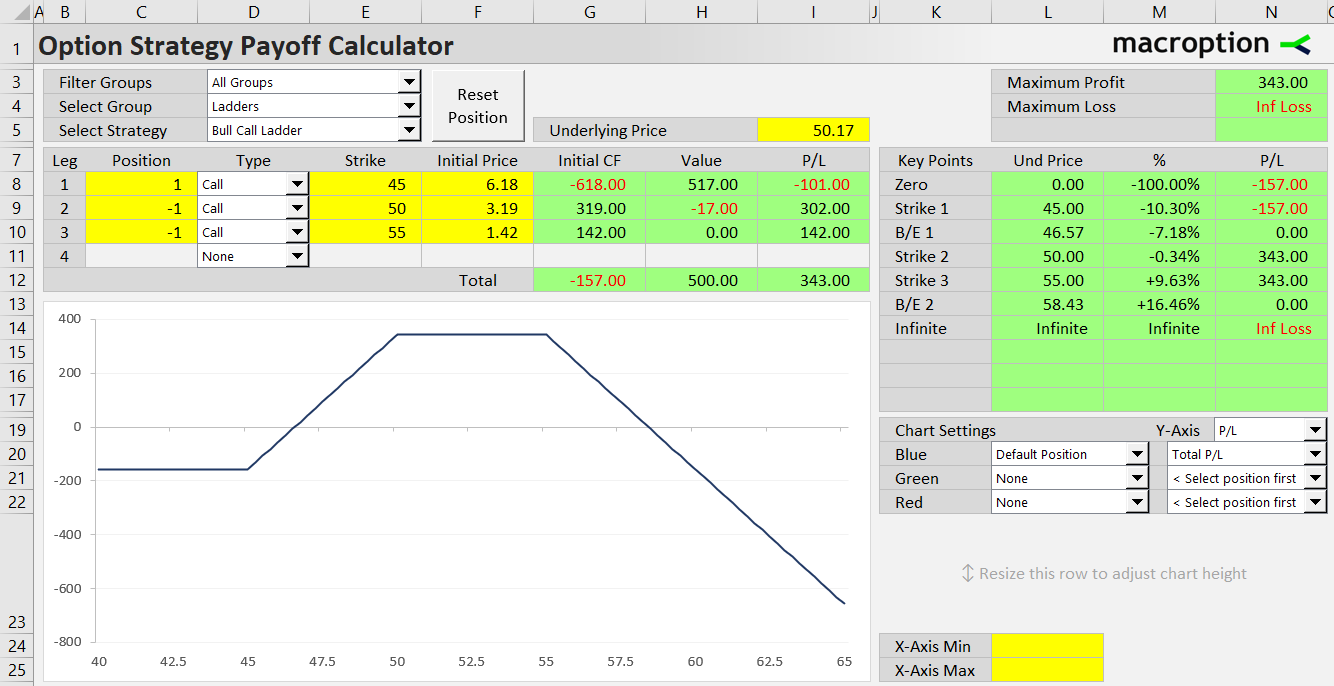

Ladders

Ladders are typical examples of three-legged strategies. They are like vertical spreads with an additional leg - usually out of the money and always of the same type (call or put) as the other options.

Their payoff diagram has a shape similar to ratio spreads, only with a gap between strikes. For instance, this is bull call ladder payoff:

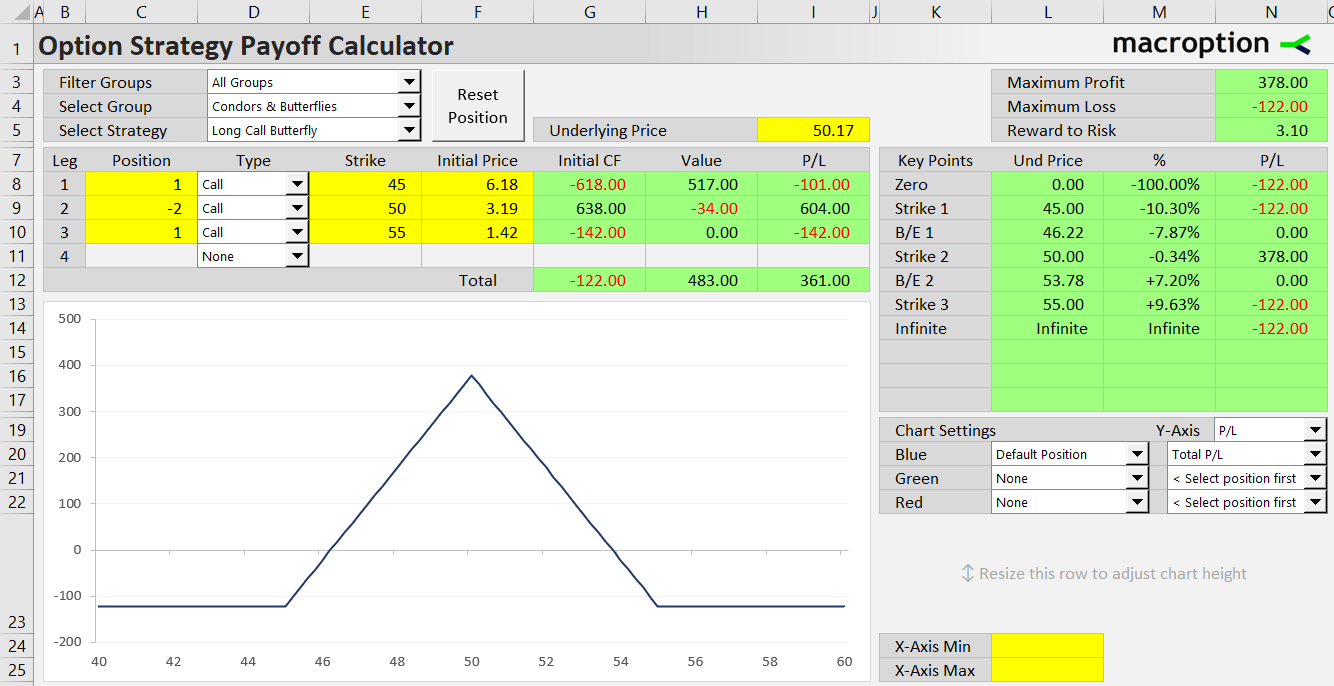

Butterflies

The call and put butterflies are sometimes considered to have four legs, because the middle strike has double position size. But in fact, they only involve three different strikes and three different options, so three legs is more correct.

On the contrary, iron butterfly has four legs, as there is a short call and a short put at the middle strike. All condors (call, put, iron) also have four legs.

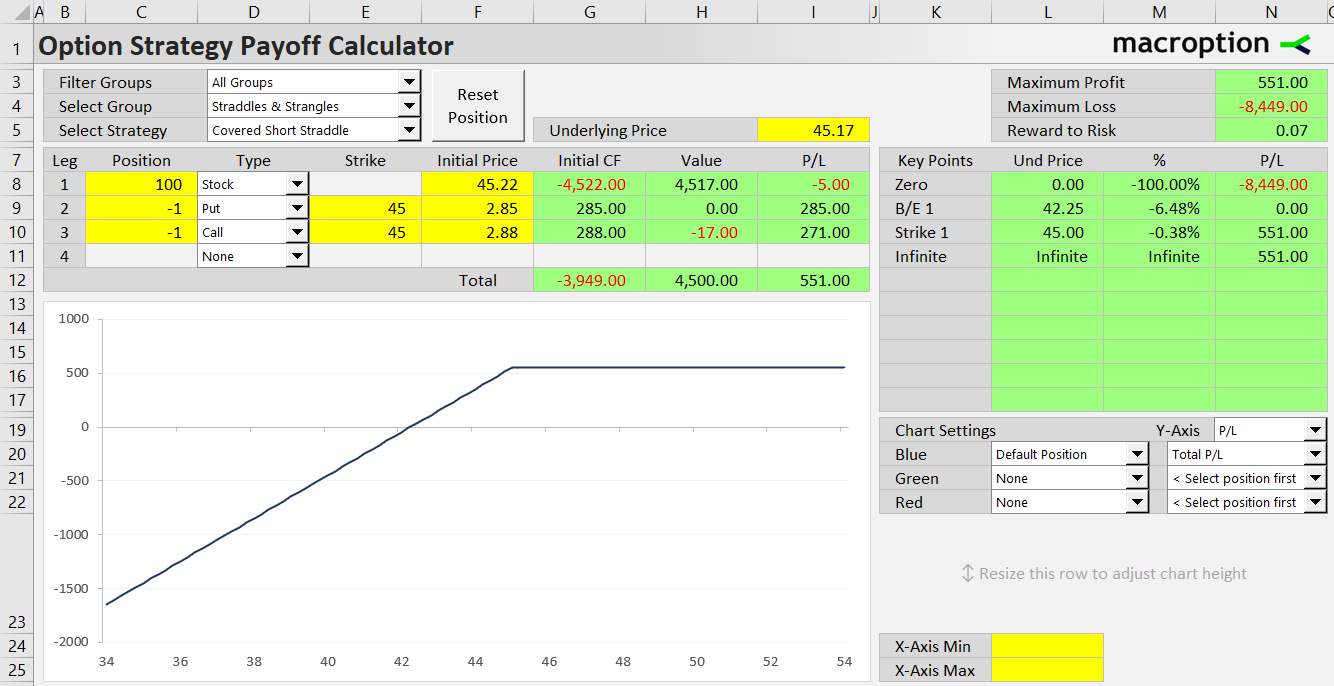

Covered Straddles and Strangles

Short straddle or strangle can be hedged by adding a long underlying position, which eliminates the unlimited risk in case of upside underlying price move (just like a short call is hedged by long underlying in covered call). These strategies are called covered short straddle (or strangle) and have three legs - two legs from the straddle or strangle, plus the underlying position.

Other Option Strategies

See also list of option strategies with two legs and four legs.