Covered short straddle (or just covered straddle) is a bullish option strategy with three legs. It has limited loss and limited profit (although the loss can be very large if underlying falls a lot).

Setup

Covered short straddle is short straddle with added long underlying position. The strategy is set up with three legs:

- Buy the underlying asset.

- Sell a call option.

- Sell a put option with same expiration and same strike.

The number of shares or units of the underlying must match the number of shares represented by the option contracts sold. For example, 100 shares of the underlying stock are needed to create a covered short straddle with one contract of a call and one contract of a put option (assuming US traded stock options, where one contract represents 100 shares).

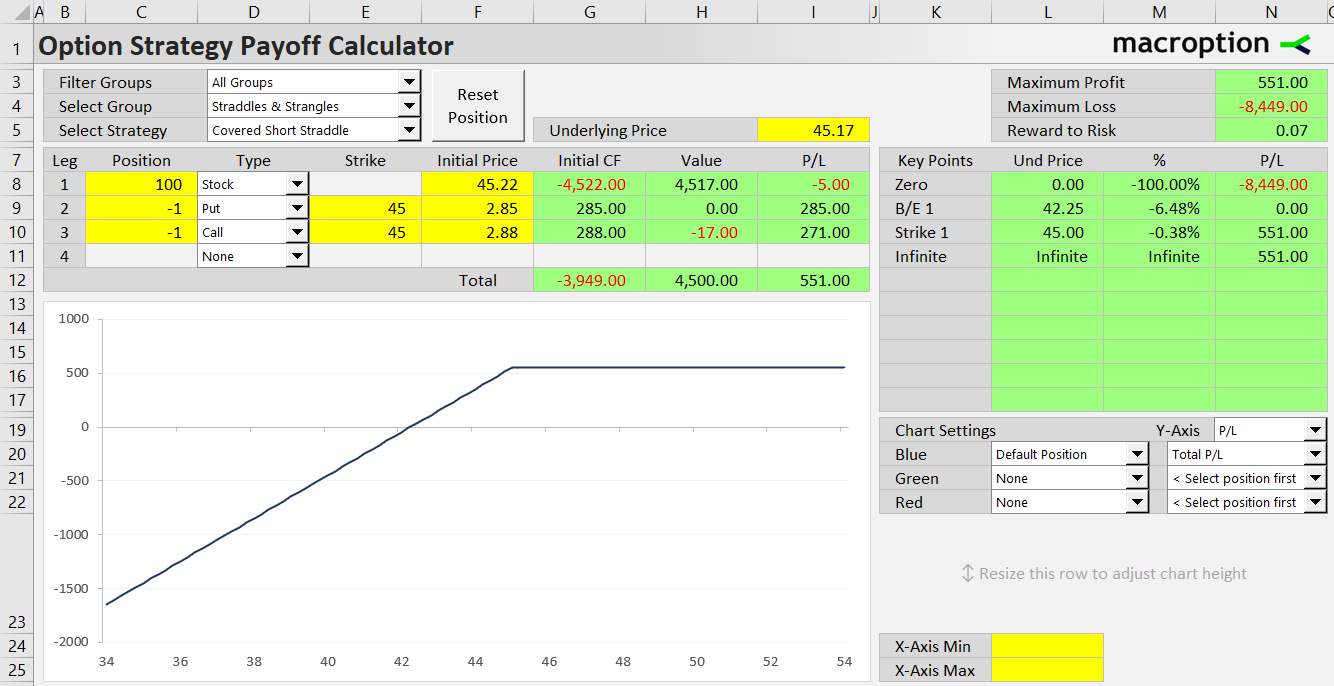

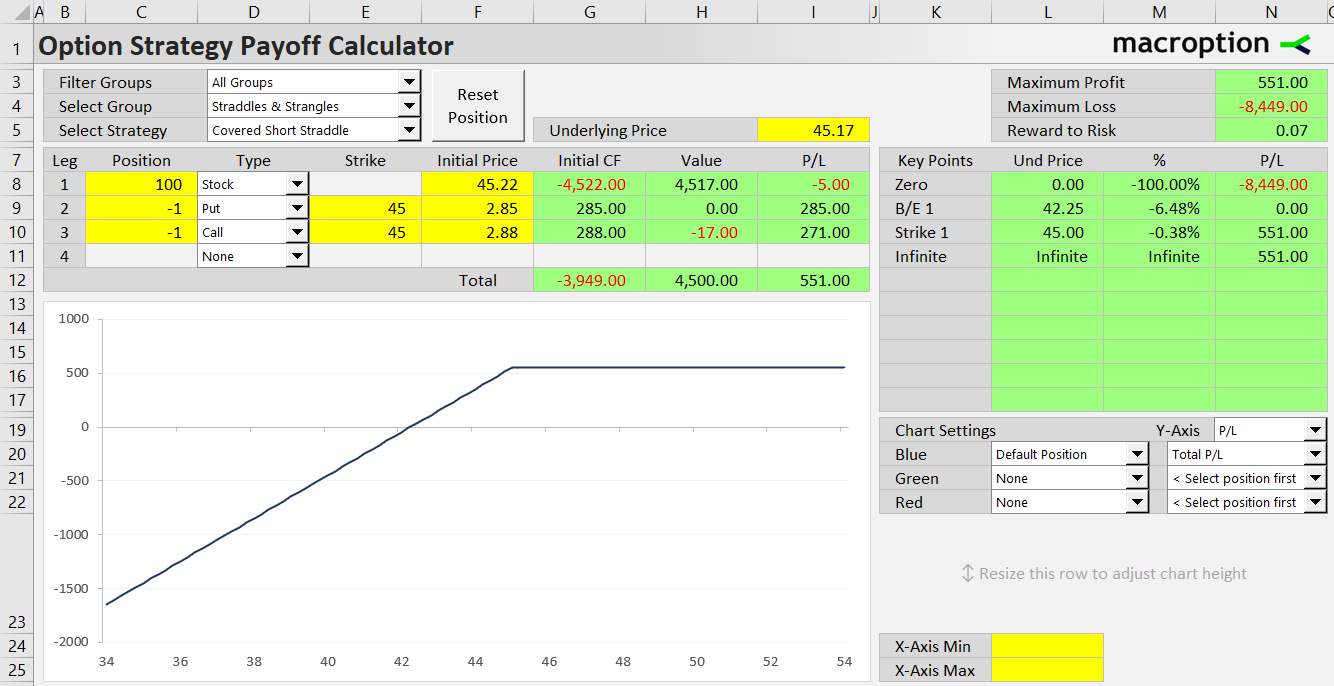

Example

For example, let's set up a covered short straddle position on a stock which is currently trading at $45.22:

- Buy 100 shares of the stock for $45.22 per share ($4,522 total).

- Sell a 45 strike call option for $2.88 per share ($288 for one contract).

- Sell a 45 strike put option for $2.85 per share ($285 for one contract).

Strike Selection

Like with plain short straddle, at the money strike is typically used when opening the position (the strike closest to underlying price).

Different strikes can be used when directional bias is desired. Lower strike makes the position initially bullish, while higher strike makes it bearish.

Cash Flow

Unlike plain short straddle, covered short straddle is a debit strategy. Initial cash flow is negative, as the amount paid for the underlying position is far greater than premium received for the short straddle.

Covered short straddle initial cost = initial stock price – call and put premium received

In our example, initial cost is 45.22 – 2.88 – 2.85 = $39.49 per share or $3,949 for one contract (and 100 shares of the underlying stock).

Payoff at Expiration

Although the word "covered" in the strategy name indicates some form or hedging, the protection which the long underlying position provides to the short straddle only applies to one half of the price range – the part above the strike. On the downside, it actually makes losses worse.

The payoff diagram looks like short straddle payoff rotated counter-clockwise, although this is geometrically imprecise. More accurately, the upward sloping long underlying P/L line is added to the short straddle P/L line.

Above the Strike

If underlying price ends up above the strike at expiration, the short put expires worthless, while the short call is in the money, causing losses which are the greater the higher underlying price climbs.

However, any growth in the short call loss is offset by gains in the long underlying position (hence covered short straddle). As a result, total P/L is constant at and above the strike. It is the maximum possible profit.

Exactly at the strike, the position is worth an amount equal to the strike price (all of that is the long underlying position, as the short options expire worthless). By subtracting net initial cost (stock price paid – option premium received) we get total profit at the strike (which is equal to total profit anywhere above the strike):

Covered short straddle max profit = strike – initial cost

... or:

Covered short straddle max profit = strike – initial stock price + total premium received

In our example, maximum profit is 45 – 39.49 = $5.51 per share or $551 for one contract (and 100 shares).

Below the Strike

The improved payoff profile above the strike is paid for in accelerating losses once underlying price drops below the strike. The short call is out of the money and expires worthless, but losses grow not only on the short put (which gets deeper in the money as price keeps falling), but also on the long underlying position.

As a result, the slope of the P/L line is actually double the slope on plain short straddle, which means losses grow twice as fast.

Maximum loss occurs when underlying price drops to zero. The long underlying position is worthless (loss equals initial stock price paid), the short put is worth the strike price (net loss is strike less premium paid), and only the call leg is profitable (we keep the premium received).

Covered short straddle loss at zero underlying price =

initial stock price + strike – total option premium received

... which is the same as:

strike + initial cost

In our example, maximum loss is 45 + 39.49 = $84.49 per share of $8,449 for one contract (and 100 shares).

Break-Even Point

The break-even point is below the strike. Its calculation is slightly more complicated than on most other option strategies, due to the double growth of losses below the strike (from the long underlying and the short put).

At the break-even underlying price, loss on the long underlying position and value of the short put option must equal initial premium received for both options.

Loss on the long underlying position is:

S – B

... where S is initial stock price. We denote the break-even price B rather than B/E to avoid confusing it with B divided by E.

The short put (with strike K) is in the money by this amount, which adds to our loss:

K – B

The short call is worthless. Initial premium received for the call and the put is:

C + P

Therefore, the following equation must hold:

Loss on underlying + short put value = total premium received

(S – B) + (K – B) = C + P

S + K – 2B = C + P

2B = K + S – (C + P)

B = 0.5 * (K + S – (C + P))

Covered short straddle B/E = 0.5 * (strike + initial stock price – total premium received)

Notice the multiplying by 0.5, which reflects the doubled pace of loss growth below the strike.

In our example, the break-even price is 0.5 * (45 + 45.22 – (2.85 + 2.88)) = 42.245

At this point, the position loses 45.22 – 42.245 = 2.975 on the long stock. The short put is worth 45 – 42.245 = 2.755 at expiration, so we have actually gained 0.095 on the short put when including the initial premium received. Adding the call premium received (the call option is worthless at expiration), total profit or loss is 2.975 + 0.095 – 2.88 = 0.

Related Strategies

- Short straddle – without the long stock "cover"

- Covered short strangle – similar strategy based on short strangle (call strike higher than put strike)

- Covered call – long underlying and short call, without the short put