Covered short strangle (also just covered strangle) is a bullish option strategy with three legs. It has limited loss and limited profit (although the loss can be very large if underlying falls a lot).

Setup

Covered short strangle is a combination of short strangle and long position in the underlying asset. To open a covered short strangle trade:

- Buy the underlying stock.

- Sell a put option on that stock.

- Sell a call option with same expiration and higher strike.

The position sizes must match: the number of call and put contracts must be the same; the number of shares of the underlying stock must correspond to the option contract multiplier (e.g. 100 shares for one option contract in case of US traded stock options).

Example

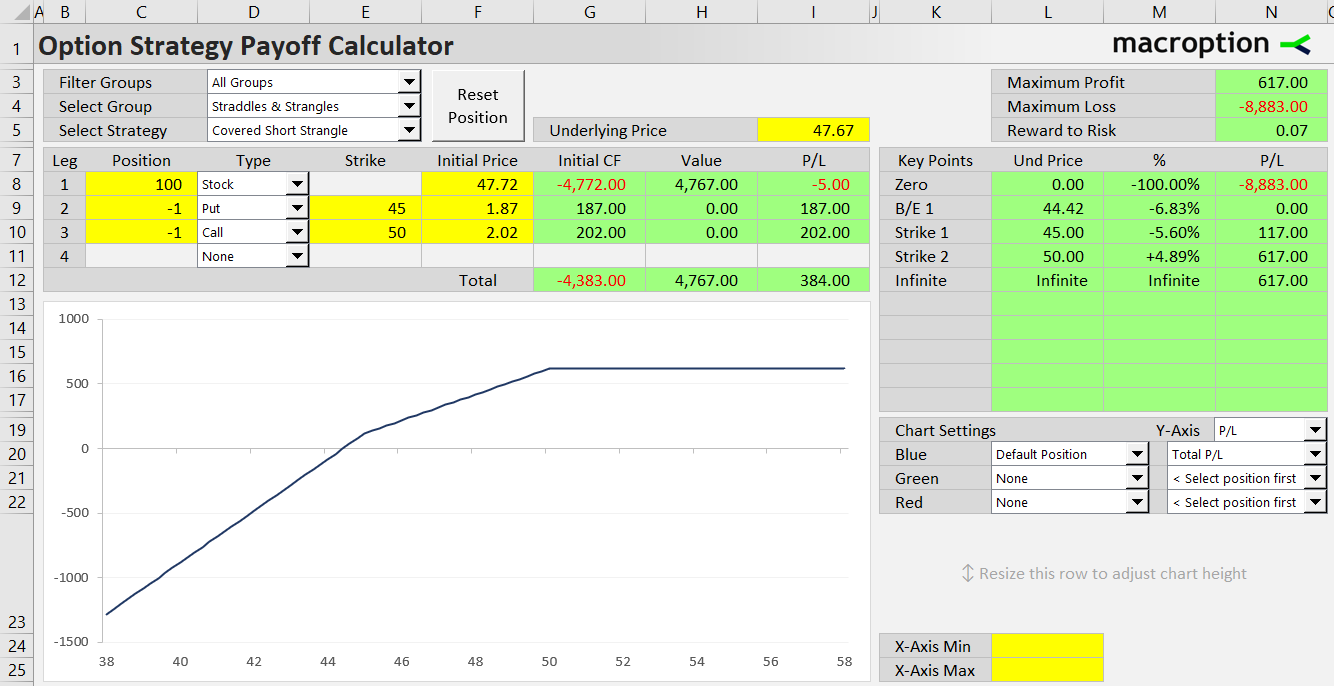

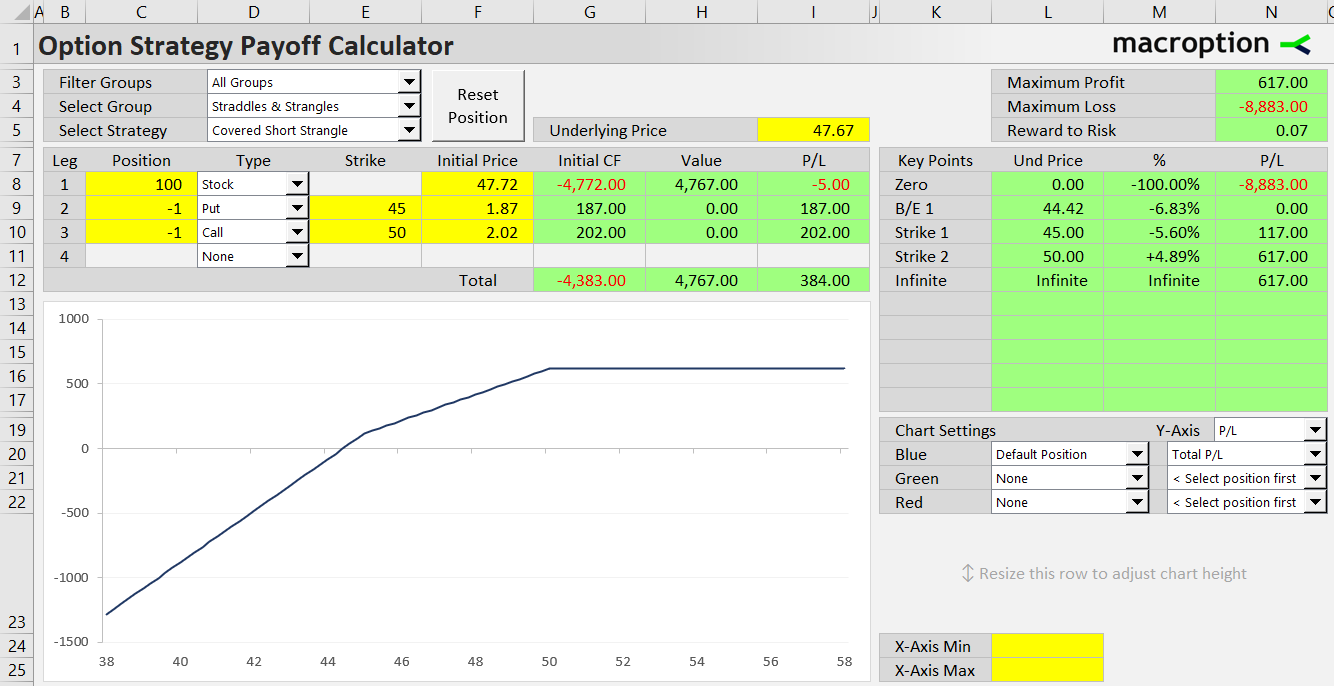

Consider a stock currently trading at $47.72. We can set up a covered short strangle position using the following transactions:

- Buy 100 shares of the stock for $47.72 per share ($4,772 total).

- Sell a 45 strike put option for $1.87 per share ($187 for one contract).

- Sell a 50 strike call option for $2.02 per share ($202 for one contract).

Cash Flow

Opening the position requires large initial cash payment for the shares. Premium received for the options covers only a small fraction of it.

Covered short strangle initial cost = underlying price – call and put premium received

In our example, initial cost is 47.72 – 1.87 – 2.02 = $43.83 per share = $4,383 for a position with 100 shares and one contract of the short strangle.

Payoff at Expiration

The word "covered" in the strategy name can be misleading. The long underlying position does hedge the short strangle against large increase in underlying price, but that protection comes at a cost: on the downside, when the underlying falls below the put strike, losses grow at double the pace compared to plain short strangle. For every dollar the stock price decreases, we lose one dollar per share on the short put and another on the long stock.

The resulting payoff diagram shows an upward sloping P/L line with gradually decreasing slope. The two strikes split it into three zones:

- Double slope ($2 for $1) below the put strike (short put and long stock)

- Single slope ($1 for $1) between the strikes (long stock only)

- Constant profit above the call strike (long stock and short call offset one another)

Maximum Profit

Maximum profit from covered short strangle is reached when underlying price ends up at or above the (higher) call strike at expiration. The short put expires worthless. The short call is in the money, but any losses from further price increase are exactly offset by increasing value of the long underlying position.

Covered short strangle max profit = call strike – initial cost

Maximum Loss

The worst case scenario is when underlying price drops to zero and the position loses a sizable amount on two out of its three parts: on the long underlying position (which is worthless now) and on the short put (which is deep in the money). Only the short call leg expires worthless and makes a profit, but that is too small relative to the losses on the other two legs.

Covered short strangle max loss = put strike + initial cost

In our example, maximum loss (with underlying price at zero) is $88.83, which is the sum of $45 (the short put value at expiration) and $43.83 (initial cost, which is $47.72 paid for the shares minus $1.87 and $2.02 of option premium received).

Break-Even Point

The strategy has one break-even point (the underlying price where total outcome turns from profit to loss and vice-versa). It is the point where initial option premium received (for the short call and short put) equals amount lost on the long stock plus the amount by which the short put is in the money.

Depending on the relative size of total option premium received, initial stock price, and the (lower) put strike, the break-even can be either above or below the put strike.

If put strike > initial stock price + total premium received:

Covered short strangle B/E = initial stock price – total premium received

If put strike < initial stock price + total premium received:

Covered short strangle B/E = put strike – 0.5 * (total premium received + put strike – initial stock price)

... which is the same as:

Covered short strangle B/E = 0.5 * (initial stock price + put strike – total premium received)

Our example is the second case, because 45 < 47.72 + 3.89, therefore the break-even price is:

45 – 0.5 * (3.89 + 45 – 47.72) = 44.415

... or:

0.5 * (47.72 + 45 – 3.89) = 44.415

Related Strategies

- Short strangle – without the long stock "cover"

- Covered short straddle – similar strategy based on short straddle (call and put strike the same)

- Covered call – long underlying and short call, without the short put