Short call synthetic straddle is a non-directional synthetic strategy with two legs. It replicates short straddle with long underlying position and short call options. Like short straddle, it has unlimited risk and limited profit.

Setup

Short call synthetic straddle is the inverse position to long call synthetic straddle.

It replaces the short put part in classic short straddle with synthetic short put, which is the combination of long underlying position and short call option.

Short straddle = short call + short put

Short call synthetic straddle = short call + synthetic short put

Synthetic short put = long underlying + short call

Short call synthetic straddle = long underlying + 2x short call

The setup is:

- Long underlying position.

- Short call option with double size relative to the underlying.

Example

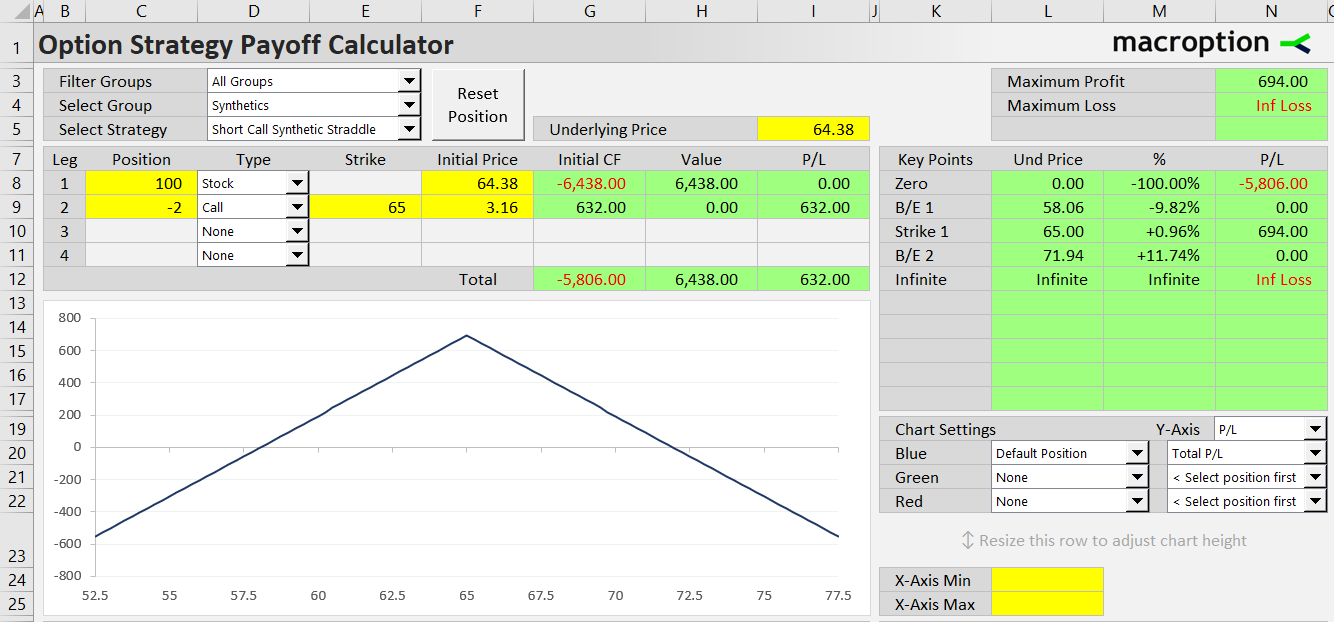

For example, we can replicate a 65-strike short straddle (65-strike short call and 65-strike short put) by replacing its short put component with long stock and another 65-strike short call:

- Buy 100 shares of underlying stock.

- Sell 2 contracts of 65-strike call options.

If we are long 100 shares of the underlying stock and one option contract represents 100 shares (as for US traded stock options), we need to sell two call option contracts (which represent 200 shares). The option position size is double relative to the underlying size, as there is one short call from the original (non-synthetic) short straddle and another short call from the synthetic short put.

Related Strategies

- Short put synthetic straddle - the other variant of synthetic short straddle with put options

- Long call synthetic straddle - the inverse position

- Synthetic short call - short underlying + short put

- Synthetic short put - long underlying + short call

- Synthetic short stock - short call + long put