Like protective put, protected call strategy is designed to insure a position in the underlying asset against losses from adverse price movement. The difference is that protective call protects a short position in the underlying with a call option.

Setup

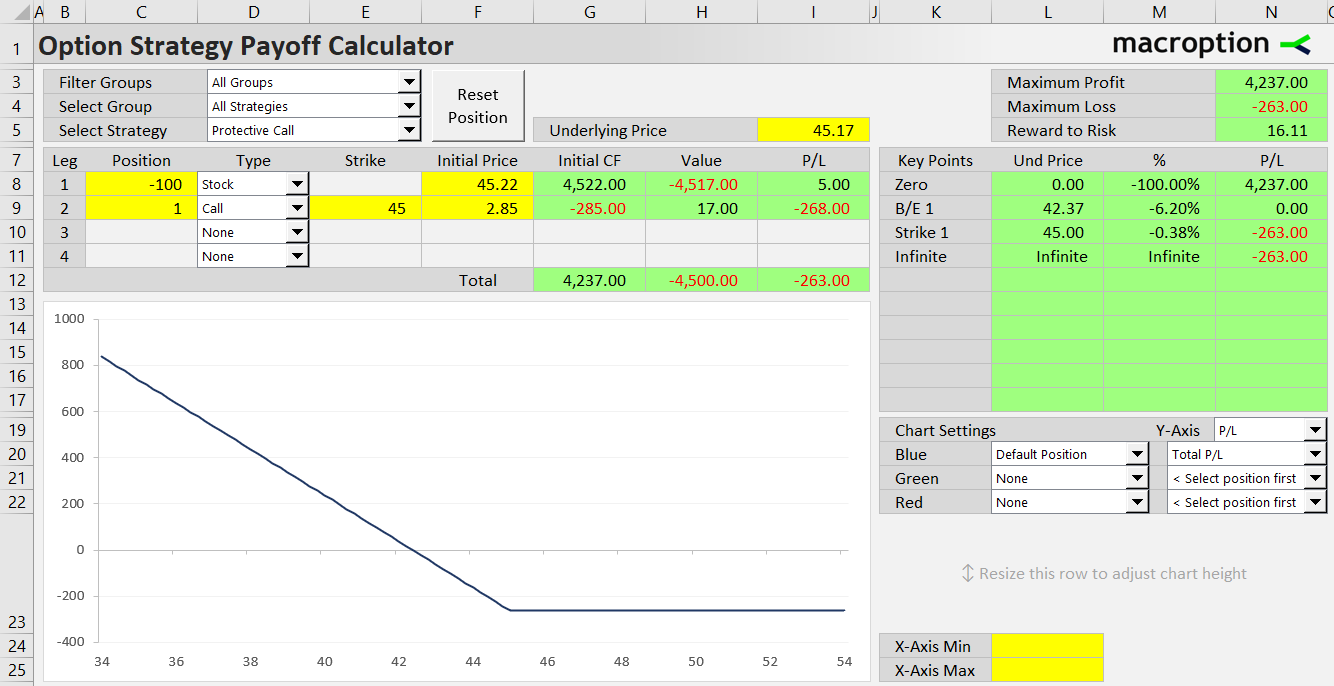

A protective call position has two legs:

- Short underlying

- Long call option

Initial Cash Flow

Unlike protective put, we are short the underlying. When opening the position, we receive cash equal to initial underlying price. At the same time, we pay cash for buying the call option. Total initial cash flow is:

Initial CF = initial underlying price – call premium paid

Payoff at Expiration

If the position is held until expiration, total profit or loss depends on where the underlying price is relative to the call option strike price.

If underlying price is at or below the strike, the call option is out of the money and expires worthless. The short underlying position is worth the underlying price (with minus sign, because we are short). Together with initial cash flow, total P/L is:

P/L = initial underlying price – call premium paid – underlying price at expiration

Maximum possible profit from a protective call position is when underlying price goes to zero and equals the initial cash flow.

If underlying price goes up and ends up above the call strike, the call option is worth underlying price minus strike. Its value offsets losses from the short underlying position above the strike, as both legs change in value at the same rate. Total P/L is:

P/L = initial CF – underlying value + call value

P/L = initial CF – underlying price at expiration + (underlying price at expiration – call strike)

P/L = initial CF – call strike

P/L = initial underlying price – call premium paid – call strike

Above the call strike. Underlying price at expiration does not affect total P/L, which is constant. It is the maximum possible loss.

Break-Even Point

The break-even point is below the strike. It is the underlying price when the short underlying position is worth exactly the same as initial cash flow:

B/E = initial underlying price – call premium paid

Below the break-even price, the position is profitable; above it loses.

If we buy the call option when the short underlying position is already profitable, we may be able to set up the protective call position in such way that it can't lose. This happens when:

Initial underlying price – call premium paid > call strike

In such case there is no break-even point and maximum loss (at and above the strike) is actually minimum profit.

When to Trade

Although it involves a long call option, protective call strategy is still bearish – it benefits from a decrease in underlying price. It should be traded when we expect the underlying to go down, want to profit from the decline using a short underlying position, but also want to be protected from an unexpected price increase.

Without a protective call option, a short underlying position has infinite risk (there is no limit on how high underlying price can go, at least with most underlyings). With the call option, we buy insurance and limit our risk. The price we pay for that insurance is the call option premium, which reduces the profit potential if the trade goes in our favor.

Strike Selection

The call strike decides how much protection we want and how big portion of our profit potential we are willing to sacrifice for it. It is the same logic as with protective put, only reversed.

The lower the strike, the sooner the insurance kicks in, the lower our maximum risk, but the more expensive the insurance is, because call option premiums increase with lower strike.

Expiration Selection

Expiration selection also follows the same logic as protective put (not reversed):

If underlying price stays more or less the same, it is more profitable to buy a longer expiration call and hold it. If underlying price makes a bigger move in either direction, it is better to buy shorter expiration calls repeatedly. Of course, we never know in advance what the underlying price will do.

Liquidity is another concern when choosing expirations. Longer dated options are usually less liquid, have wider bid-ask spreads, and on some underlyings may not be available at all.

Protective Call vs. Long Put

Like protective put is similar to a long call, protective call has similar risk and payoff profile as a long put option position (see put-call parity). The differences are again mainly in cash flow and dividends, and depend on the type of underlying.