This page explains how to calculate maximum profit for the iron butterfly option strategy, factors which affect it, and how maximum profit relates to other risk profile statistics.

Iron Butterfly Setup and Risk Profile

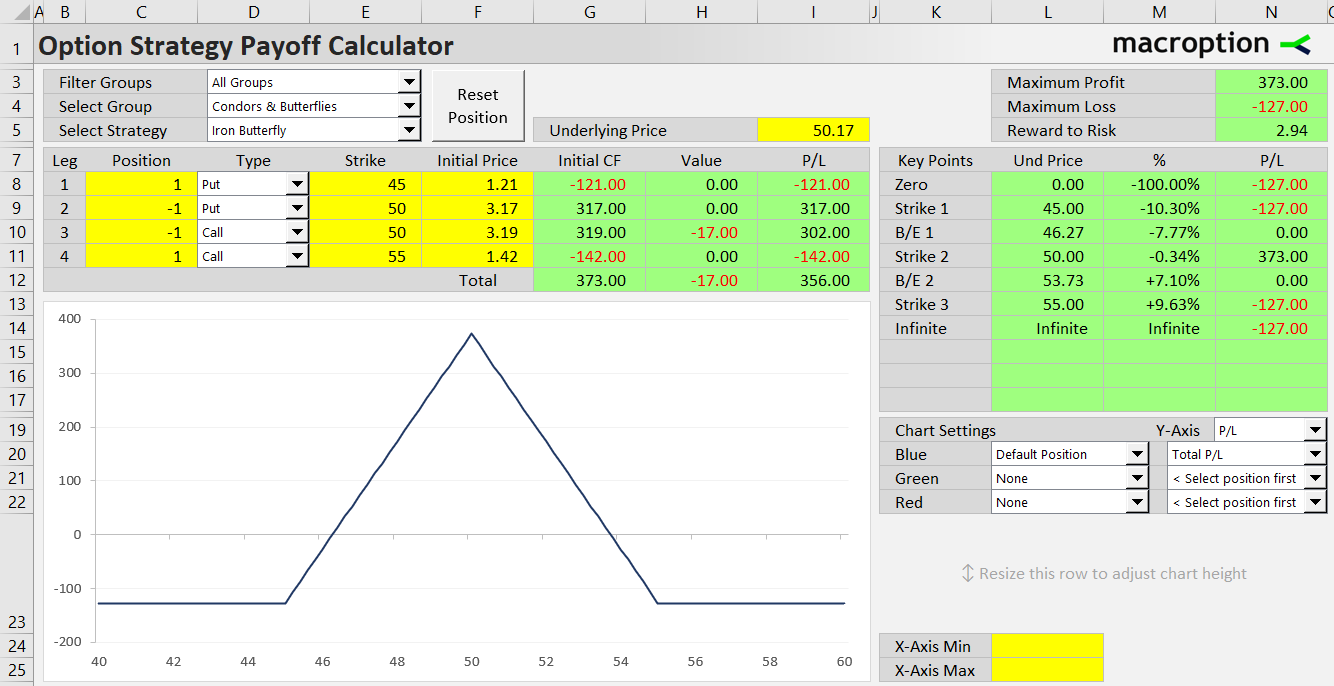

Iron butterfly consists of a short call and put option with the same strike, a higher strike long call option, and a lower strike long put option.

It is a non-directional option strategy. Its objective is for underlying price to not move much. Ideally, underlying price stays exactly at the short call and put strike at expiration, which is where iron butterfly makes maximum profit.

Maximum Profit Calculation

Maximum profit from iron butterfly is very easy to calculate: It equals net premium received when opening the position.

Iron butterfly max profit = net premium received

Why Maximum Profit Equals Premium Received

Because the short call option is always more valuable than the long call, and the short put option is always worth more than the long put, net premium received is always positive. We get more cash for selling the short options than what we pay for buying the long options.

However, this works both ways. When we exit the iron butterfly position, we always pay more for buying back the short call and short put than what we receive for selling the long call and long put.

The objective of the iron butterfly strategy is to defend the premium received – pay as little as possible to close the position. In ideal case, underlying price stays exactly at the short strike, all options expire worthless, there is no more cash flow at expiration, and we keep all of the premium received when opening the position.

Maximum profit from iron butterfly equals net premium received.

Factors which Affect Iron Butterfly Maximum Profit

Two main factors which decide the profit potential of an iron butterfly trade are time to expiration and strike distance.

Time to Expiration

Options are generally more valuable with more time remaining to expiration. Furthermore, the difference between values of at the money options (the short call and short put in iron butterfly) and out of the money options (the long call and long put) is greater.

As a result, the more time to expiration, the greater net premium received when opening an iron butterfly, and therefore also higher maximum profit.

That said, opening iron butterflies with longer time to expiration means we won't be able to trade them as often and total premium received in the long run may actually be higher if we trade them more frequently (with shorter time to expiration).

Time value of at the money options decays fastest in the last month before expiration, which is a good time to hold an iron butterfly position.

Strike Distance

By strike distance we mean the difference in the long and short strikes in iron butterfly. It is always the same on the call side (long call strike minus short call strike) and the put side (short put strike minus long call strike) – otherwise the position is not an iron butterfly.

Other things being equal, greater strike distance (wider gaps between strikes) makes iron butterfly maximum profit higher.

The reason is that greater strike difference makes the differences in option premiums bigger (between the short call and the long call, and between the short and long put), and therefore net premium received when opening the iron butterfly is also greater, as is maximum profit.

However, greater strike distance also makes the position potentially more expensive to exit. It increases not only maximum profit, but also maximum loss.