Covered put is a bearish option strategy with two legs, including short position in the underlying asset. It has potentially unlimited loss and limited profit.

Setup

Like the better known covered call strategy, covered put is a short option hedged with a position in the underlying asset. As the strategy name suggests, the short option is a put. Because an uncovered short put loses money when underlying price goes down, it is protected with a short (rather than long) position in the underlying (because a short underlying position profits when underlying price falls).

To set up a covered put position:

- Sell a put option.

- Sell the underlying asset.

Number of shares or units of underlying sold must match the number of shares represented by the short put option contract(s). For instance, if we sell 5 contracts of put options on a US traded stock (where one option contract represents 100 shares), we need to simultaneously sell 500 shares of the underlying to create a perfectly hedged covered put position.

Example

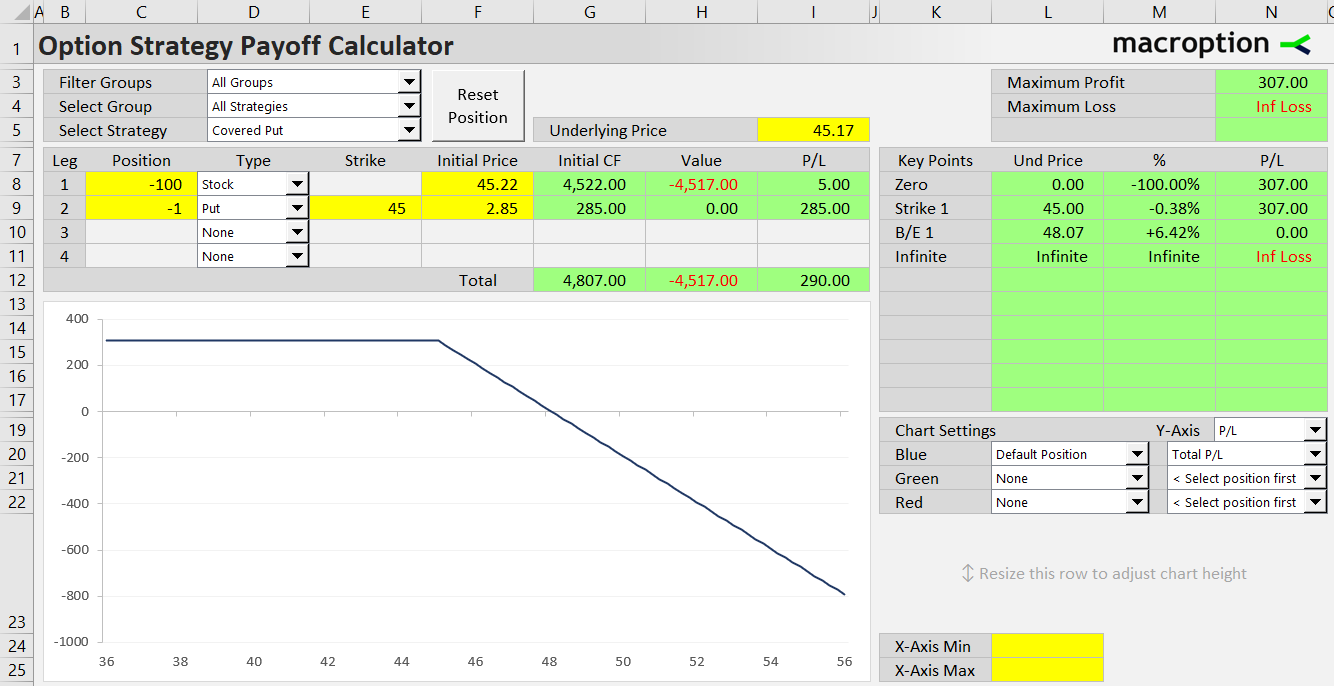

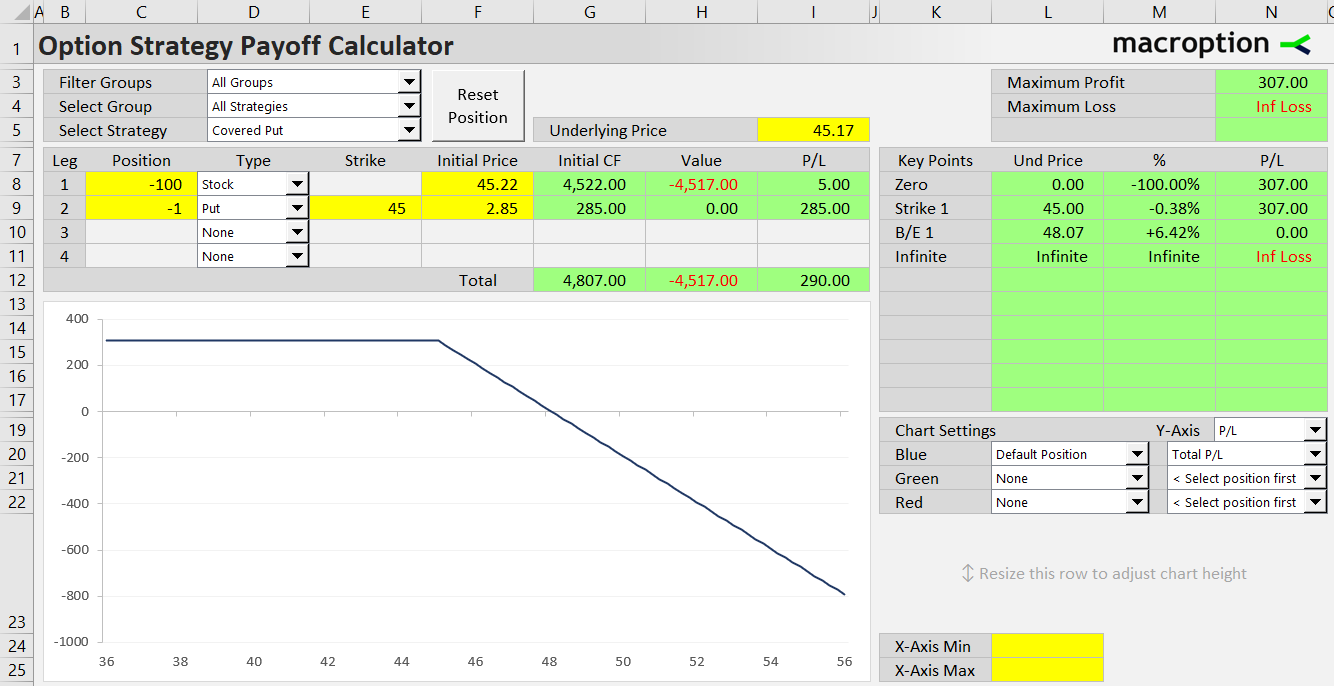

For example, we can set up a covered put position by the following transactions:

- Sell one contract of the 45 strike put option.

- Sell 100 shares in the underlying stock.

Cash Flow

Covered put is a credit option strategy, which means initial cash flow is positive. After all, when opening the position we sell both the put option (and receive option premium) and the underlying stock.

Covered put initial cash flow = initial stock price received + put premium received

In our example, we have sold the put option for $2.85 per share and have received $285 for one contract. We have sold the underlying stock for $45.22 per share, or $4,522 for 100 shares. In total we have received $4,807, or $48.07 per share.

Payoff at Expiration

At expiration, the payoff from covered put is similar to short call option.

If underlying price ends up at or anywhere below the put strike, the trade is profitable. Above the strike, profit starts to decline and eventually turns to a loss, which grows proportionally with further increases in underlying price.

Maximum Profit

Maximum profit, which occurs at and below the put strike, is calculated as the difference between the cash collected when opening the position and the put strike.

Covered put max profit = initial cash flow – put strike

= initial stock price received + put premium received – put strike

Maximum Loss

The word covered in the strategy name can be misleading – the cover only applies to downside moves in underlying price.

When underlying goes up, maximum loss is theoretically unlimited. Above the strike, the put option is out of the money and has no effect. Total loss can grow to theoretically infinite due to the short underlying position.

Break-Even Points

Above the put strike, total profit or loss declines by one dollar for every dollar increase in underlying price. Therefore, the distance from put strike to break-even point equals profit at the strike (the maximum profit).

Covered put B/E = put strike + max profit

Because maximum profit is the difference between initial cash flow and put strike, the break-even price must equal initial cash flow:

Covered put B/E = initial cash flow

= initial stock price received + put premium received

Related Strategies

- Protective put – the inverse position to covered put (long underlying and long put)

- Covered call – long underlying and short call

- Collar – long underlying, short call, and long put