Short box spread is an arbitrage option strategy with four legs. It is the inverse position to long box spread. Because the payoff profiles of individual legs cancel each other, total outcome of the position is fixed (a small profit or a small loss).

Setup

The four options involved in a short box spread are the following:

- Short call with lower strike

- Long call with higher strike

- Short put with higher strike

- Long put with lower strike

Like long box, short box is a combination of two vertical spreads with identical strikes: this time a bear call spread and a bull put spread (the two credit vertical spreads, unlike long box which includes the two debit spreads).

Example

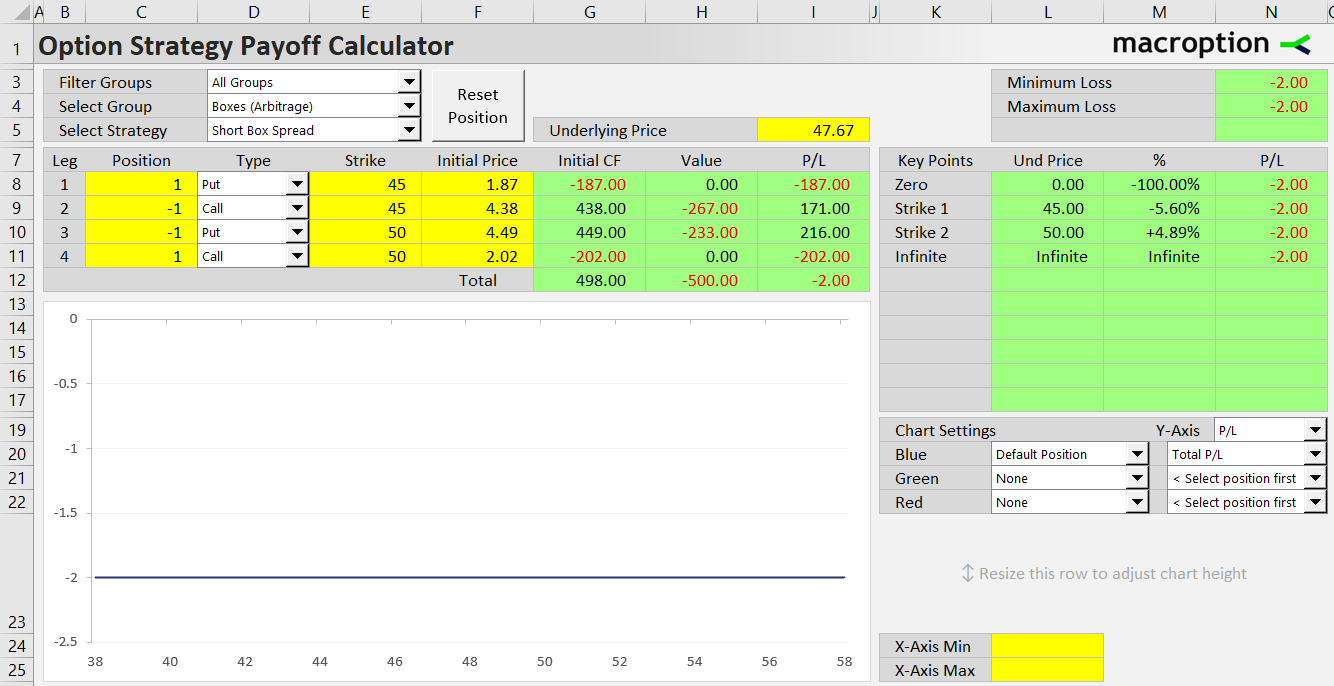

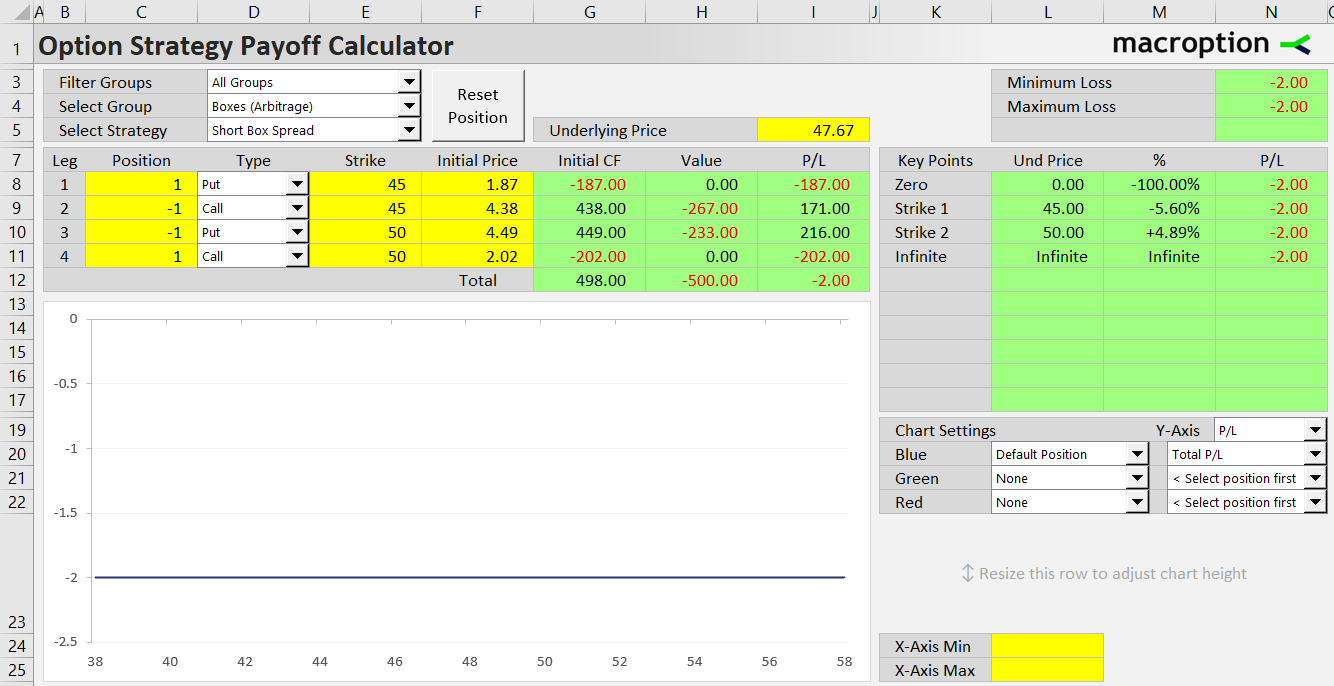

The following are the transactions needed to open an example short box spread:

- Sell a call with 45 strike.

- Buy a call with 50 strike.

- Sell a put with 50 strike.

- Buy a put with 45 strike.

The two calls represent a bear call spread (short call strike is lower), while the puts form a bull put spread (short put strike is higher).

Payoff

Because a short box spread is the inverse position to long box spread, its payoff at expiration is also constant.

For an explanation why the payoffs from the two vertical spreads cancel one another, see long box spread payoff.

Cash-Flow

Although total profit or loss from a short box spread is constant, its initial cash-flow is positive, while cash-flow at expiration is negative. After all, it is a combination of two credit vertical spreads.

Therefore, opening a short box position is quite like taking a loan, which will be repaid at expiration.

Short Box Spread as Synthetic Loan

If the options are fairly priced, total result from the trade will be a small loss that corresponds to the interest rate paid on that loan. This implied interest rate is not much higher than riskless money market rates.

That said, while short box spread may seem like an interesting way to get financing, there are many problems which make it less viable in reality, including transaction costs (bid-ask spread and commissions on four legs), possible margin requirements, and not least, risks.

Risks

Despite having fixed payoff at expiration, a short box spread is not without risks.

Firstly, being a complex position with four legs, there is always a risk of things going wrong when executing the trades.

Secondly, if the options are American, there is a risk or early assignment. This can be particularly dangerous when a trader, thinking of the strategy as riskless, takes a position that it too large for his available capital.