This page explains differences between long call and short put option positions. Using an example, we will compare their cash flows and payoff profiles. We will conclude with recommendations when to trade which strategy.

What Long Call and Short Put Have in Common

Long call and short put are among the simplest option strategies, each involving just a single option. Both are bullish, which means they make money when the underlying security goes up and they lose when the underlying declines.

Therefore it might seem they are the same and it doesn't matter which one you choose when you think a stock will go up.

It does. In fact, these two strategies differ in many ways, which we will illustrate on an example.

Example

Let's say you think a stock, currently trading at $35 per share, might go up. You are deciding between:

- buying a $35 strike call option and

- selling a $35 strike put option.

Both options are currently trading at $2 per share, or $200 for one option contract (representing 100 shares of the underlying stock).

Initial Cash Flow Difference

Long call position is created by buying a call option. To initiate the trade, you must pay the option premium – in our example $200.

Short put position is created by selling a put option. For that you receive the option premium.

Long call has negative initial cash flow. Short put has positive.

From this alone it would seem short put is a better trade than long call. Nevertheless, the advantage of cash flow goes hand in hand with numerous disadvantages, particularly a less favorable risk and return profile.

Maximum Profit Difference

What is the most you can possibly gain from each trade?

Long call makes money when underlying stock goes up. If the stock ends up above the strike price $35 at expiration, the call option's value increases dollar for dollar with the stock. For example, if the stock ends up at $40, the call will be worth 40 – 35 = $5 at expiration. Net of initial cost, the long call trade will make $3 per share, or $300 for one contract. If the stock ends up at $50, the option's value will be 50 – 35 = $15 and overall profit $13 per share, or $1,300 for one contract. The higher the stock, the higher the profit.

Short put is also profitable when the stock goes up, but the profit is limited to the $200 received for selling the put in the beginning. There is no way you can gain more, regardless of the stock going to $40, $50, or $500. You keep the option premium received, but that's it.

Long call has unlimited potential profit. Short put has it limited to premium received (initial cash flow).

Maximum Loss Difference

If you are wrong and the stock price falls, how much can you lose in the worst case?

With long call, the worst case scenario is that the stock ends up below $35 and the option expires worthless. You will lose the option premium paid in the beginning, but nothing more. Maximum possible loss is $200.

A short put position is much riskier. The put option will increase in value as the stock falls. Because you are short the option, its value is your loss. For example, if the stock ends up at $30 at expiration, the put will be worth 35 – 30 = $5 and you will lose $500. With the $200 premium received in the beginning your overall loss will be $300.

Theoretically, in the worst case, the stock can fall to zero and the put option's value will be equal to its strike price: $35 per share, or $3,500 for one contract. With premium received your overall loss will be $3,300.

Maximum risk of a long call trade is limited to initial cost (option premium paid). Maximum risk of a short put is typically very high and equal to strike price minus option premium received.

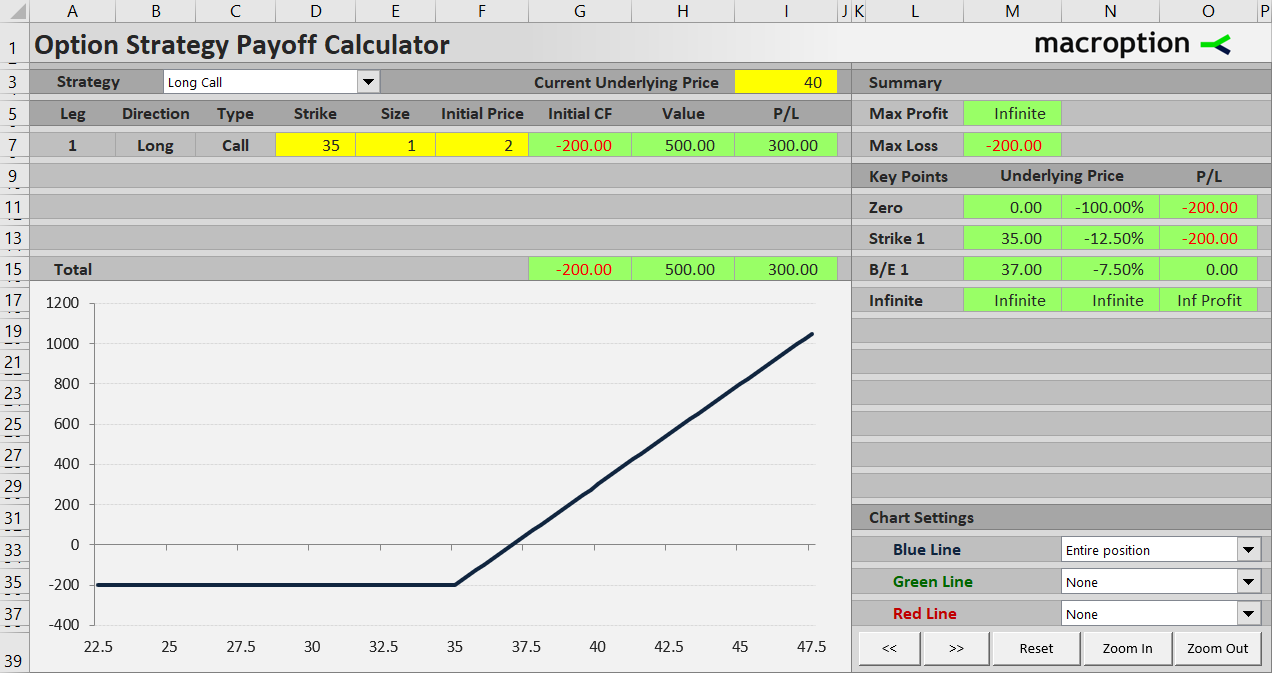

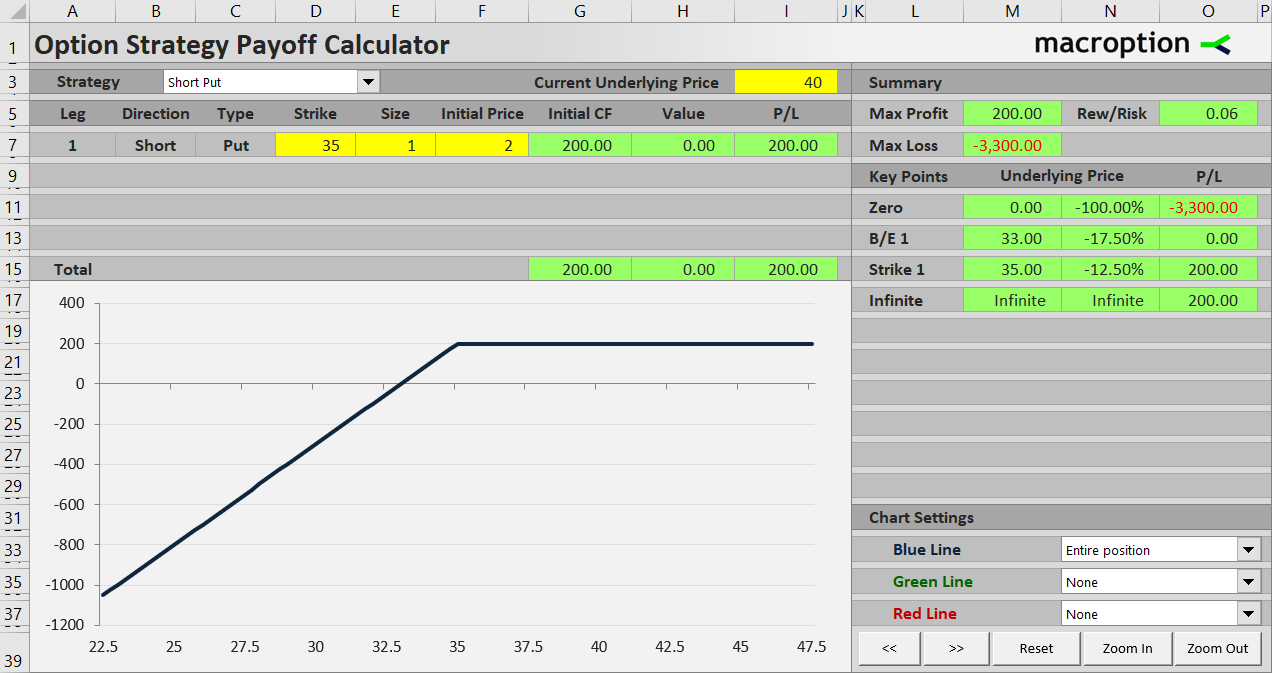

Long Call and Short Put Payoff Diagrams

The difference in profit and loss profile is easiest to understand when visualized in a payoff diagram. This is a chart that shows how an option strategy's total profit or loss (Y-axis) changes with underlying price (X-axis).

The long call position loses $200 when underlying price ends up below the strike price at expiration. Beyond that point, the P/L rises proportionally to underlying price. There is no limit on the upside.

The short put position makes $200 when underlying price ends up above the strike. Below the strike, its P/L declines.

From the charts it might seem that long call is a much better trade than short put. Limited risk and unlimited profit looks certainly better than limited profit and (almost) unlimited risk. Is there a scenario when short put is actually better than long call?

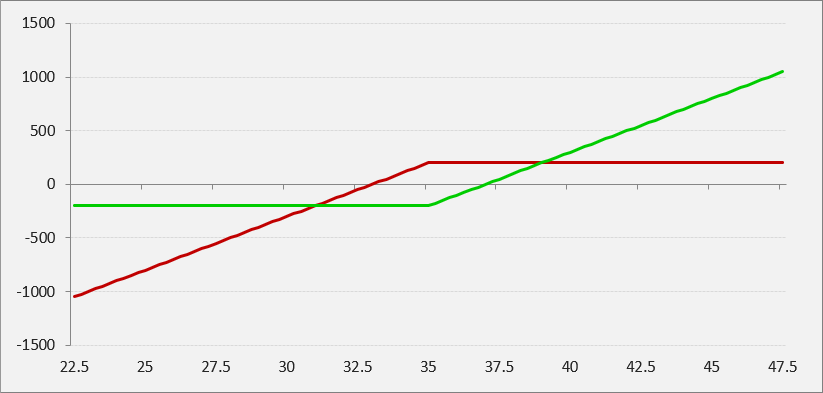

When Short Put Beats Long Call

If you draw both payoffs in one chart, you will see there is a small window of stock prices where the short put's outcome (red) is better than long call (green).

It is the area around the strike price. More precisely, in this particular example, the short put trade beats the long call trade when the underlying stock ends up between $31 and $39. At $31 both strategies lose $200. At $39 both gain $200.

The general formula for calculating the borders is strike price plus or minus the sum of the two option premiums (in our example 35 – 2 – 2 = 31 and 35 + 2 + 2 = 39).

Break-Even Point

In the chart above, notice where the P/L for each strategy crosses the zero line – this is where the trade starts to be profitable.

The break-even point for a long call position is above the strike price. More precisely, it is strike price plus option premium paid. The long call position in our example starts to be profitable with underlying stock at 35 + 2 = $37 at expiration.

For a short put, the break-even point is below the strike, exactly at strike price minus option premium received. In our example, the short put is profitable above 35 – 2 = $33.

This is a big advantage of short put. It is profitable even when the stock doesn't move anywhere (it may even go down a little). A long call typically requires the stock to go up to make a profit.

When to Trade Long Call vs. Short Put

You can see that both long call and short put have strengths and weaknesses. Advantages of long call are smaller risk and unlimited profit potential. Benefits of short put include positive initial cash flow and lower break-even point (for the same strike).

In fact, the outcome of long call is better than short put if the underlying stock moves a lot – to either side. Conversely, if the stock doesn't move much (in our example if it stays between $31 and $39), short put does better.

This is very common with options. Buying options (being "long volatility") is generally better when the underlying moves a lot. Selling options (being "short volatility") is generally better when it doesn't move much.

To sum up, when deciding between a possible long call and short put trade, think more deeply about your expectations regarding the underlying stock price – not only in terms of direction, but also in terms of volatility:

- If you think the stock could make a big move up, but at the same time you don't want to lose too much if it falls, choose long call.

- If you think the stock will probably increase only moderately, but it is unlikely to go down too much (it might as well trade in a range for a while), choose short put.

In practice, it gets more complicated than this. Your selection will also depend on how much volatility is currently being priced in the options. If you expect rangebound trading, but the option market expects it too and option premiums are low, selling a put may not be a good idea. This is slightly more advanced and requires good understanding of implied volatility and option pricing.