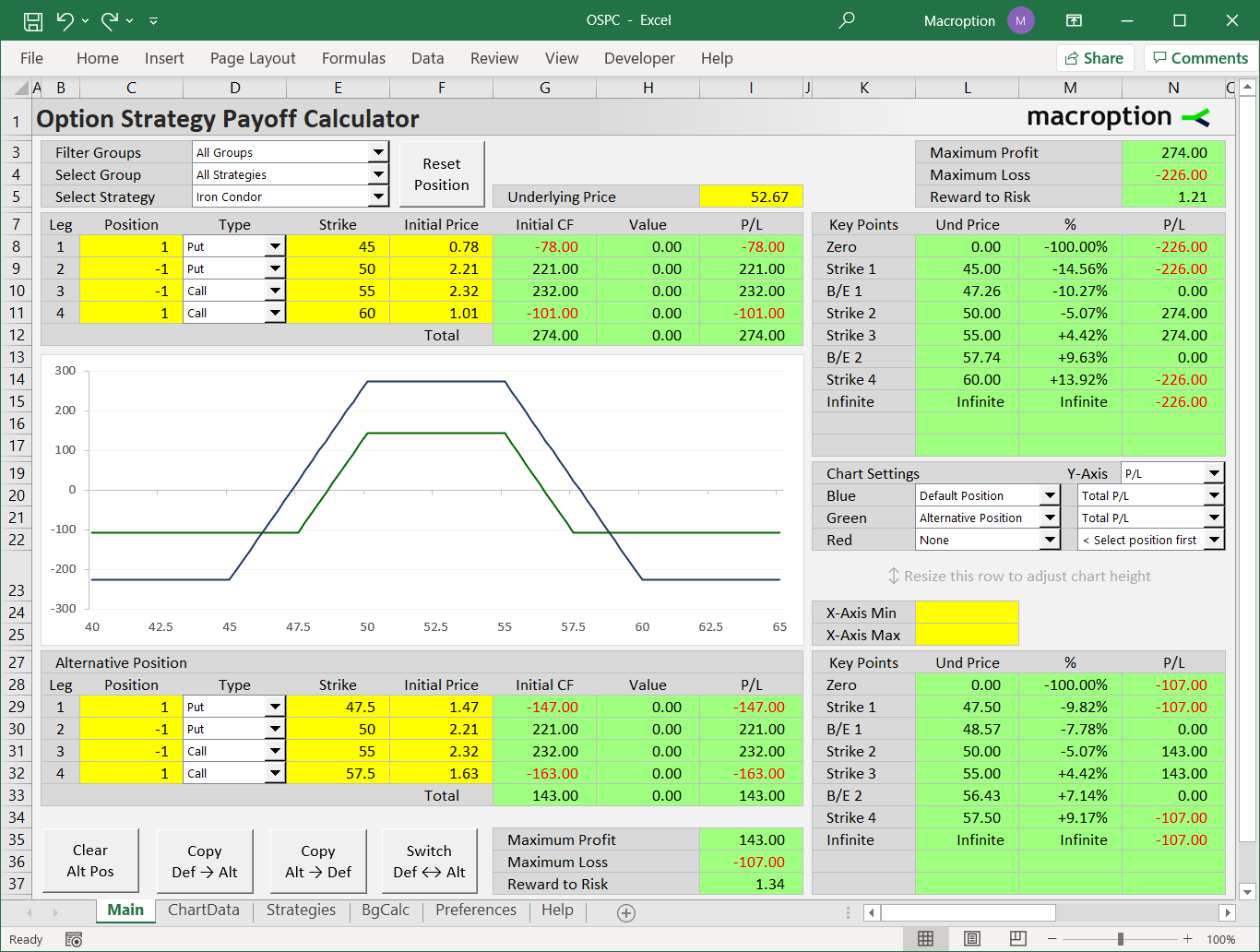

- Calculate option strategy profit/loss, break-even points and risk-reward ratios

- Payoff diagrams of entire position and/or individual legs

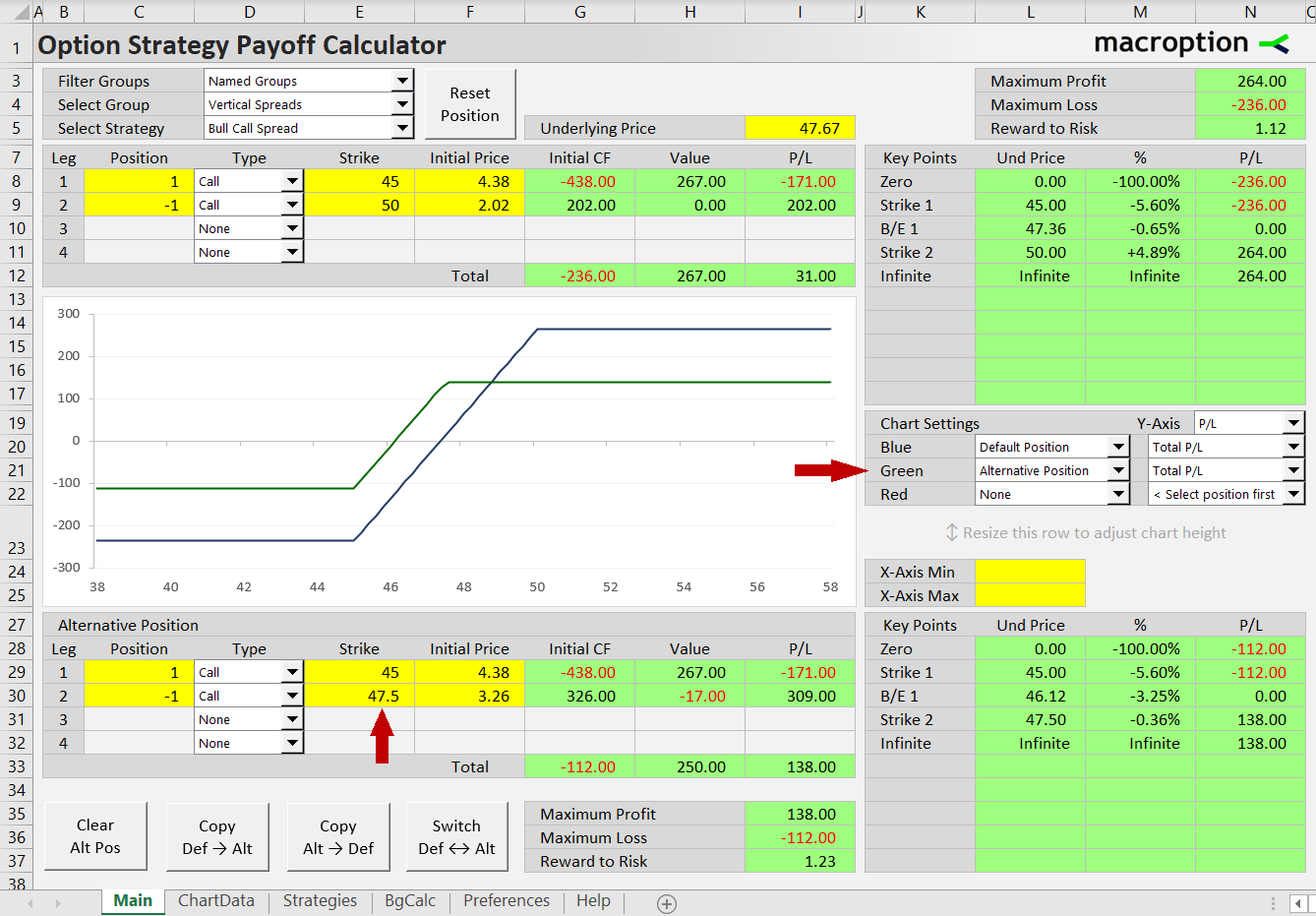

- Compare two different strategies in one chart

- Model position adjustments or variations (e.g. different strikes, broken wings...)

- Select from 66 predefined strategies (condors, straddles, vertical spreads, covered calls...)

- ... or set up your own custom strategy (any combination of long/short, calls/puts/underlying)

- Works in all versions of Excel (from Excel 97 to Excel 365), Excel for Mac, Google Sheets, LibreOffice, OpenOffice and other spreadsheet software (see available versions)

- Good for all major markets (US, Europe, Australia, India... – just set correct contract size)

- All cells and formulas are open to view and edit – easy to adjust the calculator to your needs

- Simple navigation, easy to use even with limited Excel or finance skills

- Detailed user guide with plenty of examples + email support

$39 one-time payment

Instant download

How It Works & Screenshots

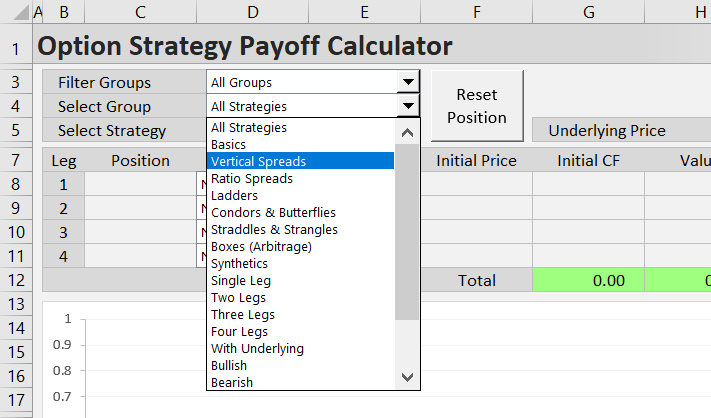

Selecting a Strategy

The easiest way to start is by selecting an option strategy from the dropdown box in cell E5.

For easier navigation through the long list of strategies, you can filter them by strategy group using the dropdown boxes in E3, E4. This way you can narrow down the list of strategies to only those fitting your criteria (for instance, only vertical spreads, or only bullish strategies, or only strategies with two legs, or only strategies with limited risk); this is also a good way to discover new strategies which you may not know yet.

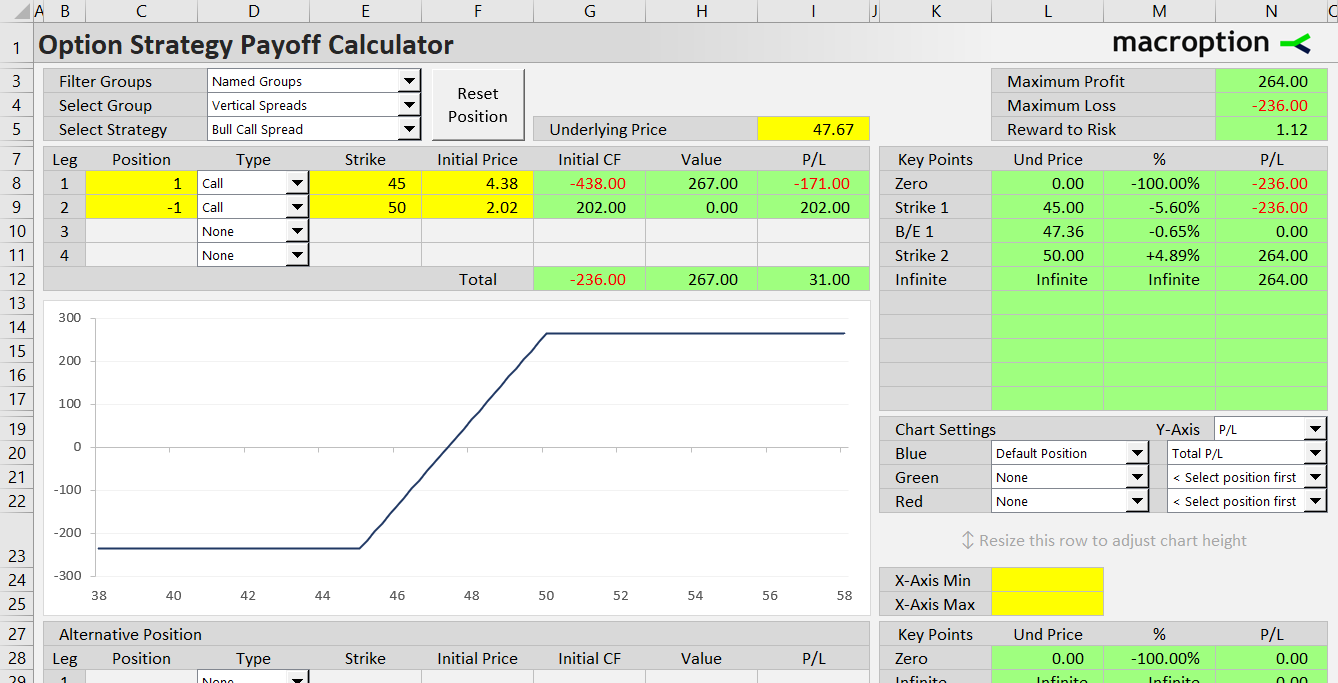

Setting Strikes and Position Sizes

Once you select a strategy, the calculator loads the correct combination of long/short, call/put/underlying in each leg, with example strikes. Then you can change the strikes (E8-E11), position sizes (C8-C11), and initial prices (F8-F11) to model your position (initial price is the price for which you have bought or sold the options when entering the position).

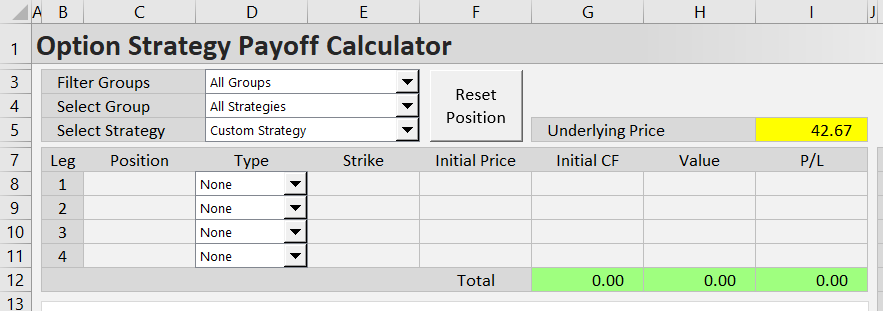

Custom Strategy

Alternatively, you can select "Custom Strategy" in the dropdown box in cell E5 (it is always the first item) and all legs will be blank. Then you can set each leg to anything you like.

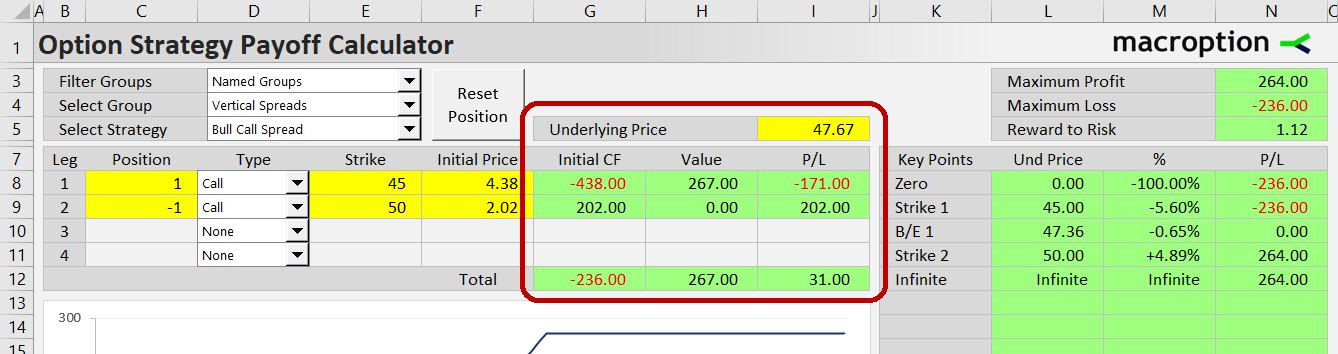

Inputs vs. Results

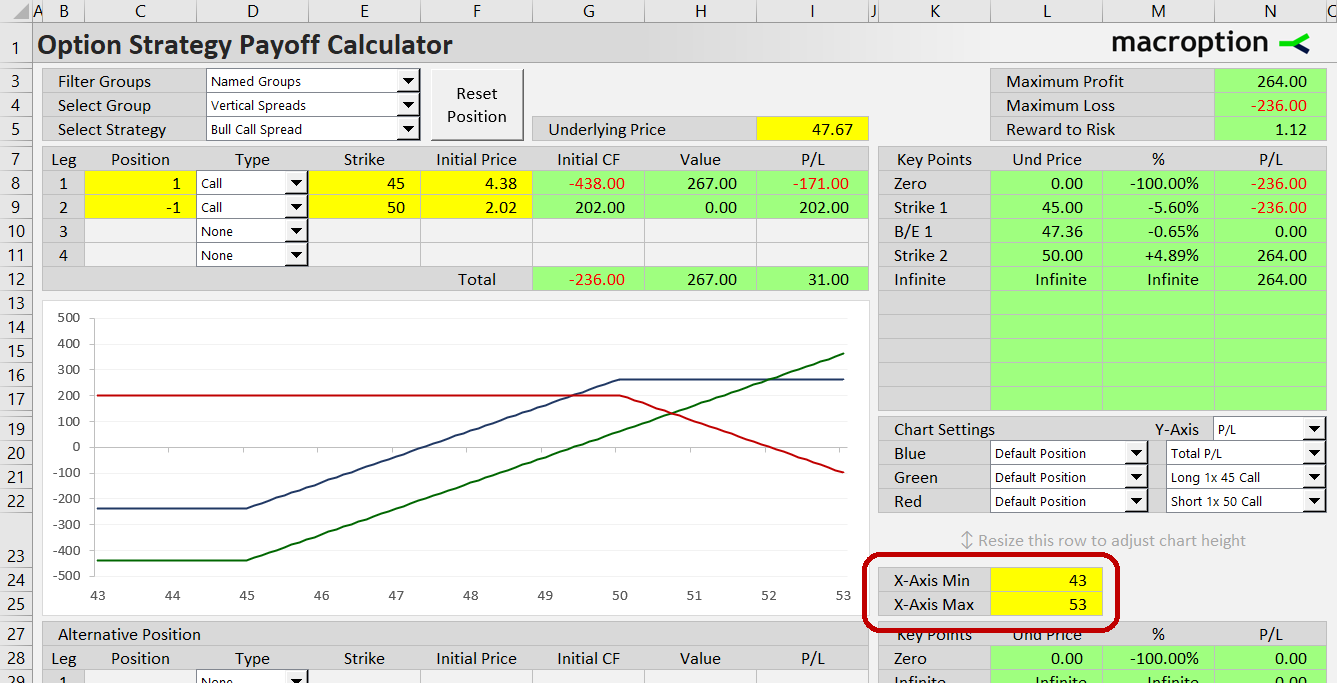

Working with the calculator is very simple: yellow cells (and dropdowns) for user input, green cells for results.

For each leg (row 8-11) and the combined position (row 12), the green cells in columns G-I show initial cash-flow (based on initial prices set in column G), position value (at underlying price set in the yellow cell I5), and profit or loss (sum of initial cash flow and position value).

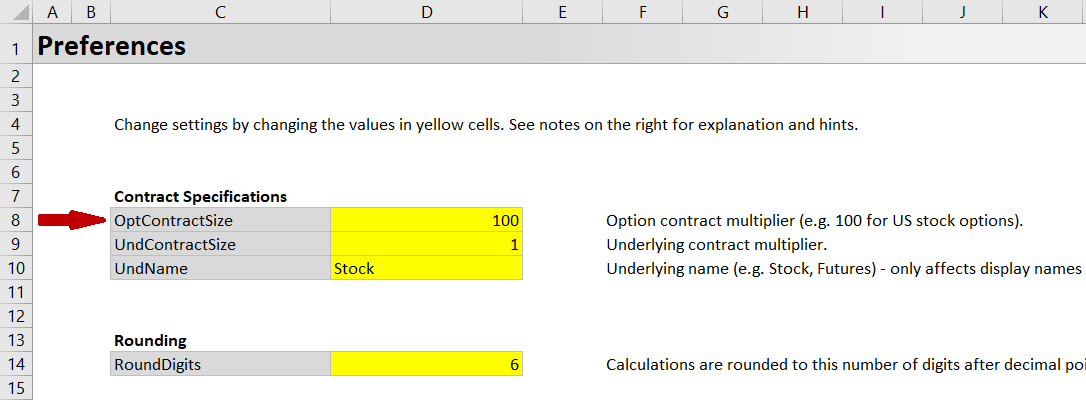

Changing Contract Size

The calculator works for all types of options in all major markets. By default, option contract size is set to 100 (as for US stock options), but it is easy to change in the Preferences sheet, cell D8.

In the same way you can change underlying contract multiplier in cell D9, for example when working with futures options.

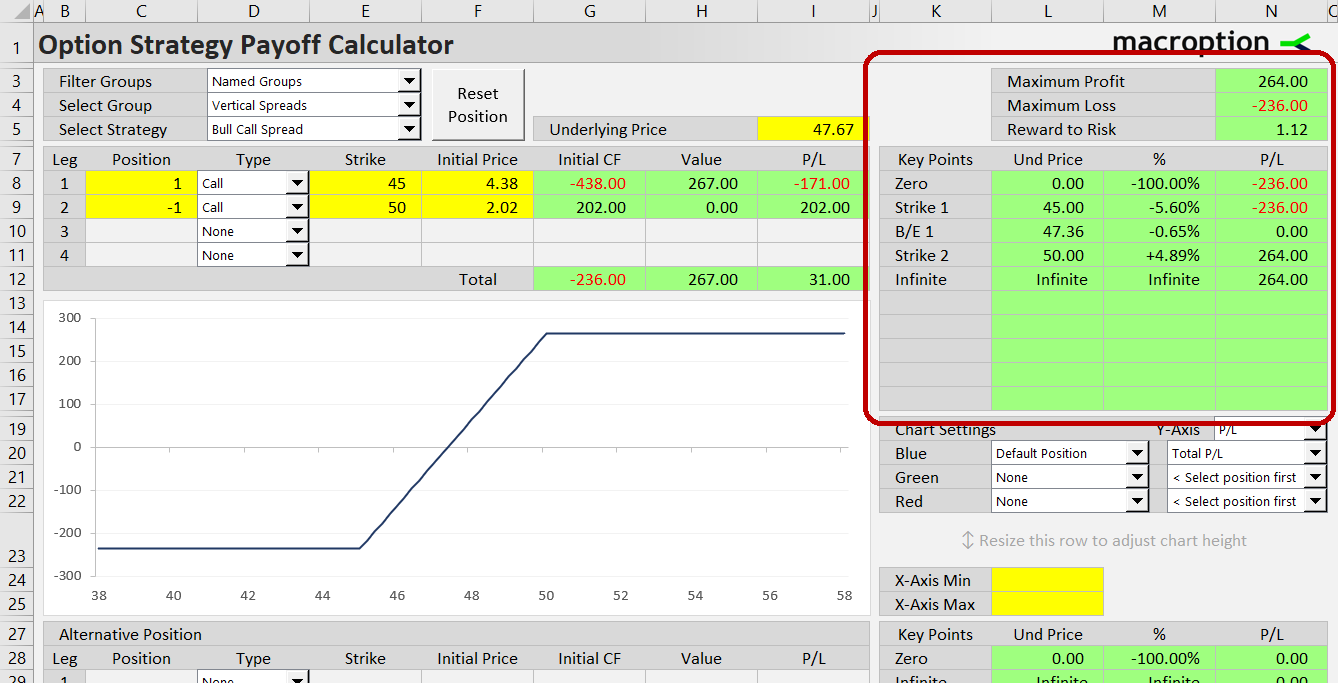

Risk Profile

In the top right corner (back in the Main sheet) you can see the maximum possible profit (cell N3), maximum loss (N4), and risk-reward ratio (N5).

There is also an overview of P/L at all important points, including all strikes, break-evens, zero, and infinite underlying price. These are essential for understanding the risk and profit potential of a trade.

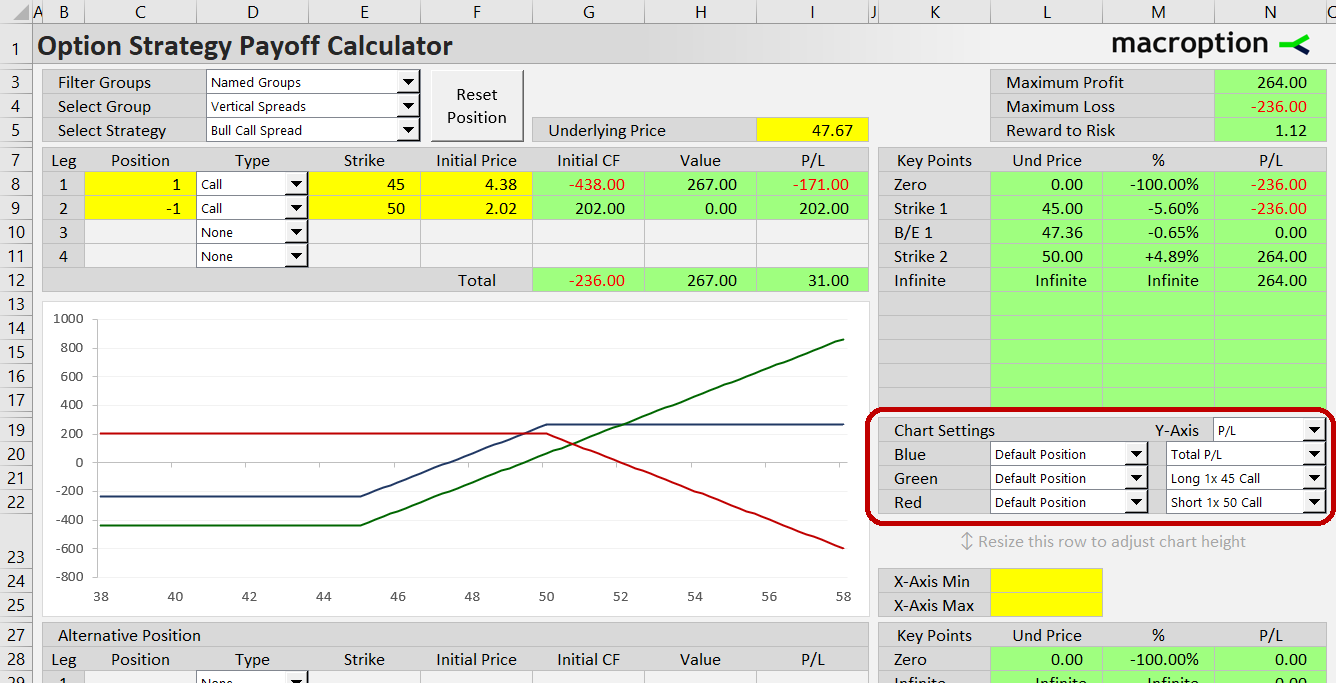

Payoff Diagrams

The chart shows payoff diagram (P/L as function of underlying price) of the entire position and/or individual legs (this can be set in cells K19-N22). For example, you can see how each individual leg contributes to total payoff of a bull call spread.

In the yellow cells L24-L25 you can adjust the X-axis minimum and maximum to zoom in and inspect a particular area in more detail (if you keep them blank, the scale is calculated automatically to cover all strikes and important points).

Alternative Position

Besides the "default" position in rows 8-11 you can set an "alternative" position below the chart in rows 29-32. Then you can display both positions in the chart and compare two different option strategies, or adjustments or variations of the same strategy (for example, when deciding between two different strikes).

The buttons at the bottom (row 35-37) allow you to quickly copy the default position to alternative position or switch them. For example, when you want to compare two versions of the same strategy with different strikes, it is fastest to use the "Copy Def>Alt" button to copy the default position to the alternative position, and only then change the particular strike, rather than set the alternative position from scratch.

More Details and Examples

This was a short overview of main features. For more detailed explanation how everything works, and more examples, see the user guide (or if you have any questions, contact me).

$39 one-time payment

Instant download

List of Option Strategies

Basics

Long Stock

Short Stock

Long Call

Short Call

Long Put

Short Put

Covered Call

Covered Put

Protective Call

Protective Put

Collar

Vertical Spreads

Bull Call Spread

Bear Put Spread

Bear Call Spread

Bull Put Spread

Ratio Spreads

Ratio Call Backspread

Ratio Put Backspread

Ratio Call Spread

Ratio Put Spread

Ladders

Bull Call Ladder

Bull Put Ladder

Bear Call Ladder

Bear Put Ladder

Condors and Butterflies

Long Call Butterfly

Long Put Butterfly

Iron Butterfly

Long Call Condor

Long Put Condor

Iron Condor

Short Call Butterfly

Short Put Butterfly

Reverse Iron Butterfly

Short Call Condor

Short Put Condor

Reverse Iron Condor

Straddles, Strangles, and Similar

Long Straddle

Short Straddle

Long Strangle

Short Strangle

Long Guts

Short Guts

Strip

Strap

Covered Short Straddle

Covered Short Strangle

Boxes (Arbitrage)

Long Box Spread

Short Box Spread

Synthetics

Synthetic Long Call

Synthetic Short Call

Synthetic Long Put

Synthetic Short Put

Synthetic Long Stock

Synthetic Short Stock

Long Combo

Short Combo

Long Call Synthetic Straddle

Long Put Synthetic Straddle

Short Call Synthetic Straddle

Short Put Synthetic Straddle

Long Call Synthetic Strangle

Long Put Synthetic Strangle

Short Call Synthetic Strangle

Short Put Synthetic Strangle

Synthetic Covered Strangle

Synthetic Covered Call

Synthetic Covered Put

Adding Your Own Strategies

You can add your own strategies in the designated "Strategies" sheet, then you will be able to select them from the dropdown boxes.

Alternatively, you can just use the "Custom Strategy" option to model any combination of long/short calls/puts/underlying.

$39 one-time payment

Instant download

Available Versions

All users get access to all these versions:

- OSPC.xlsm = default version, for Excel 2010 or newer, also including Excel for Mac

- OSPC_for_Excel_97-2007.xls = for Excel 2007 or older

- OSPC_ODF.ods = open document format version, for Google Sheets, LibreOffice, OpenOffice, and similar apps which don't support Excel VBA and macros

- OSPC_NoVBA.xlsx = when you have Excel but can't or don't want to use macros, or for iPad or iPhone "Excel" apps (the ODF version should also work, but this one is better for iPad or iPhone apps)

Frequently Asked Questions

Is it a one-time payment or monthly/recurring?

One-time payment, yours forever.

Does it work in my version of Excel?

The calculator works in all versions of Excel from Excel 97 to the latest, also including Office 365 and Excel for Mac. The default version is a standard macro-enabled xlsm file, but there is also a xls (for older Excel versions) and xlsx version (if you can't or don't want to use macros). All users get access to all versions.

Does it work in Google Sheets / LibreOffice / OpenOffice / other spreadsheet software?

There is also an open document format (ods) version, which has been tested in Google Sheets, LibreOffice, and OpenOffice, and should work in all spreadsheet software which supports the ods format. All users get access to all versions.

Does it work for options in my country?

Yes. The calculator does not depend on a particular country or currency – you just need to set the correct contract multiplier in a designated cell (cell D8 – Option Contract Size – in Preferences sheet). Since 2016, the calculator has been used by customers all over the world, including the US, Europe, Australia, India, China, Japan, Russia, Brazil, and many other countries.

Why are calendar/diagonal spreads missing in the list of strategies?

Payoff or profit/loss at expiration can't be calculated for calendars, diagonals, and generally strategies which involve multiple expiration dates. The reason is that you would need to make an assumption about implied volatility and time value of the remaining options. You can model strategies with multiple expiration dates in the Option Strategy Simulator.

How do I pay? Is it secure?

You can pay by credit/debit card or PayPal. All payments are processed by PayPal, but you don't need a PayPal account to check out when paying with a card. If you can't or don't want to use PayPal, contact me for alternative ways to pay (wire transfer, bitcoin, card payment outside PayPal).

I have other questions / need more information.

Please contact me.

$39 one-time payment

Instant download

Related Calculators – Often Bought Together

Option Strategy Simulator – Simulates option strategies not only at expiration, but at any time, including intraday. Works with volatility, Greeks and more advanced option concepts.