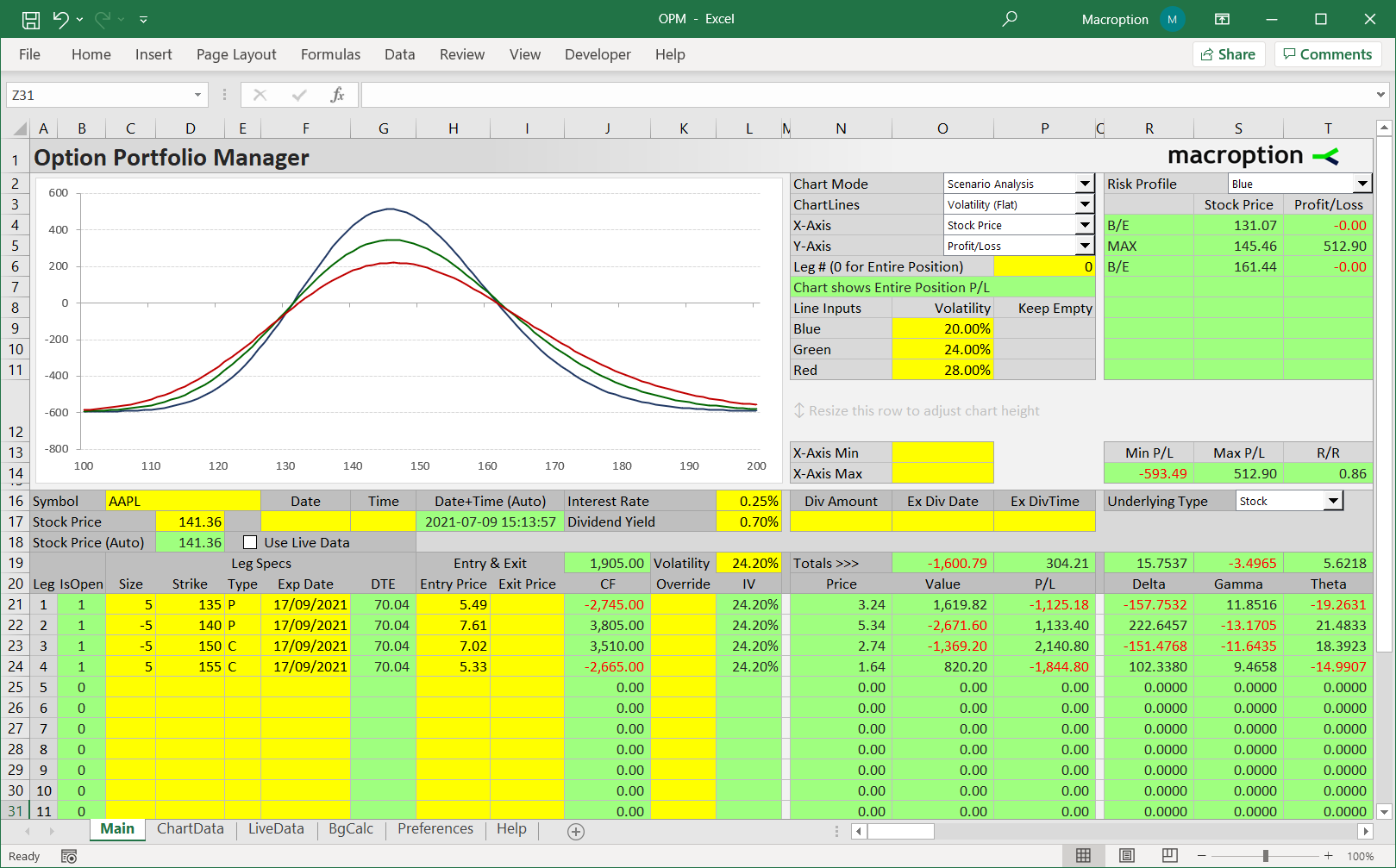

Spreadsheet to model complex option positions and larger option portfolios:

- 20 legs (and easy to add more)

- Modeling of rollovers and position adjustments (record entry and exit prices)

- Multi-dimensional scenario analysis (model combined effects of two inputs at the same time, such as underlying price and volatility, on P/L and Greeks)

- Advanced volatility modeling (flat volatility or different IV for each leg, effects of parallel shifts in vol)

- Ability to use live data feed from your broker (set up for Interactive Brokers data, but can use any data source that can be linked to Excel)

- Support of different kinds of underlyings (stock, ETF, index, forex, futures options)

- Discrete dividends

- ... and more.

Works in Excel 2007 and newer or Excel for Mac 2011 and newer, also including Office 365.

For more information see the user guide.

$99 one-time payment

Instant download