- Calculate implied volatility from option prices in Excel

- One click – quick, easy and accurate – much better than the trial and error approach

- Model effects of IV changes on option prices and Greeks

- Works with both European and American options, dividends, commodity/FX options

- Works in all versions of Excel (from Excel 97 to Excel 365), Excel for Mac, Google Sheets, LibreOffice, OpenOffice and other spreadsheet software (see available versions)

- Very simple navigation – start using it immediately

- Detailed user guide if you need to know more

$39 one-time payment

Instant download

How It Works & Screenshots

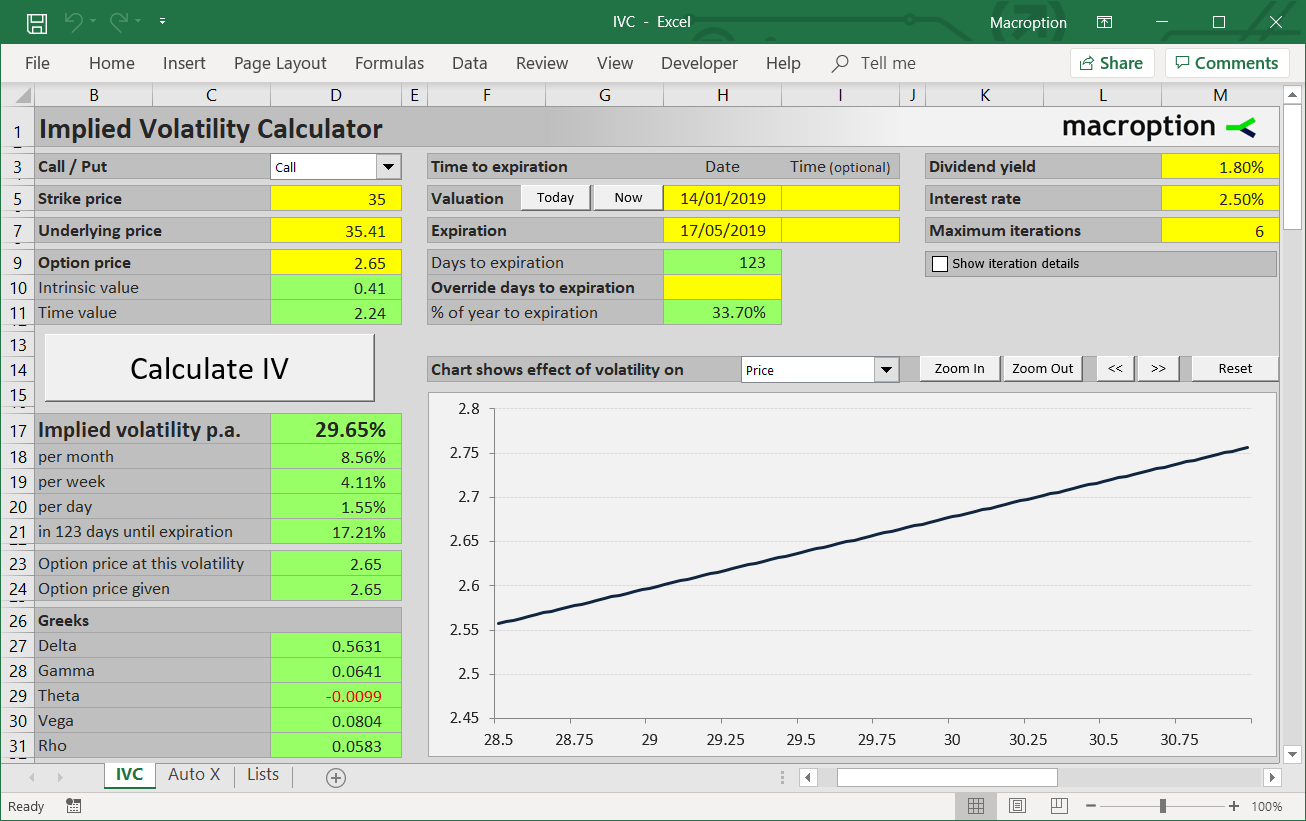

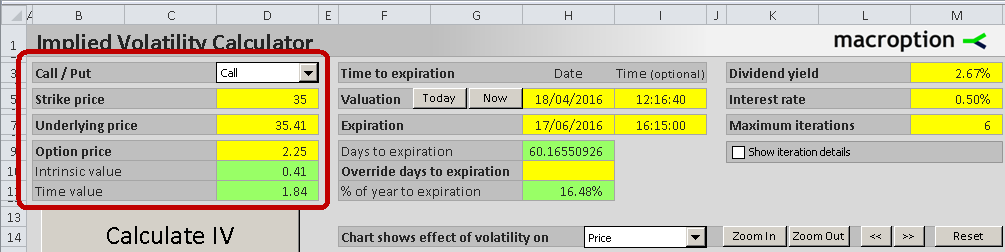

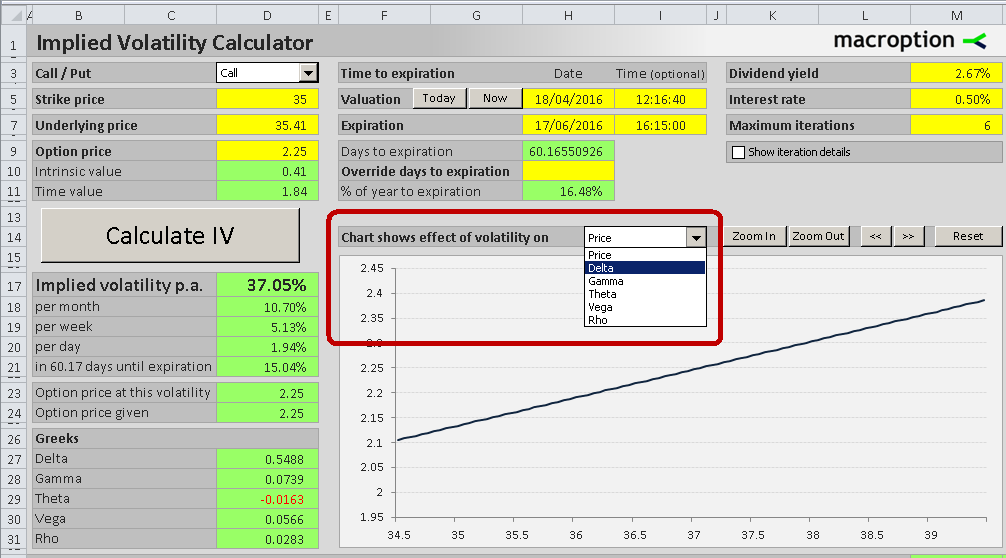

Select call or put. Enter strike, underlying price and option price. You may also enter dividend yield and interest rate.

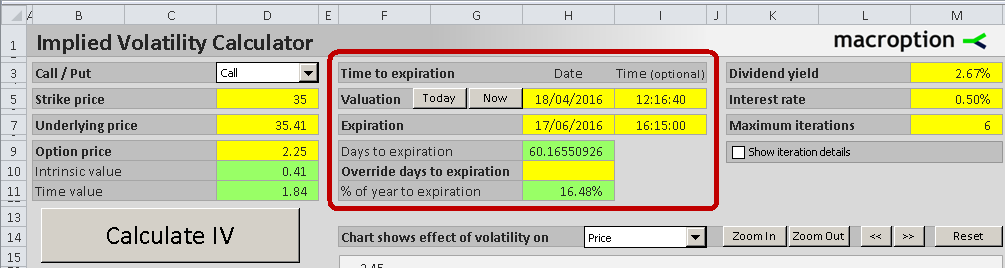

You can set time to expiration either as current and expiration date, or as number of days left to expiration. Intraday is fine – the calculator can work with fractions of days.

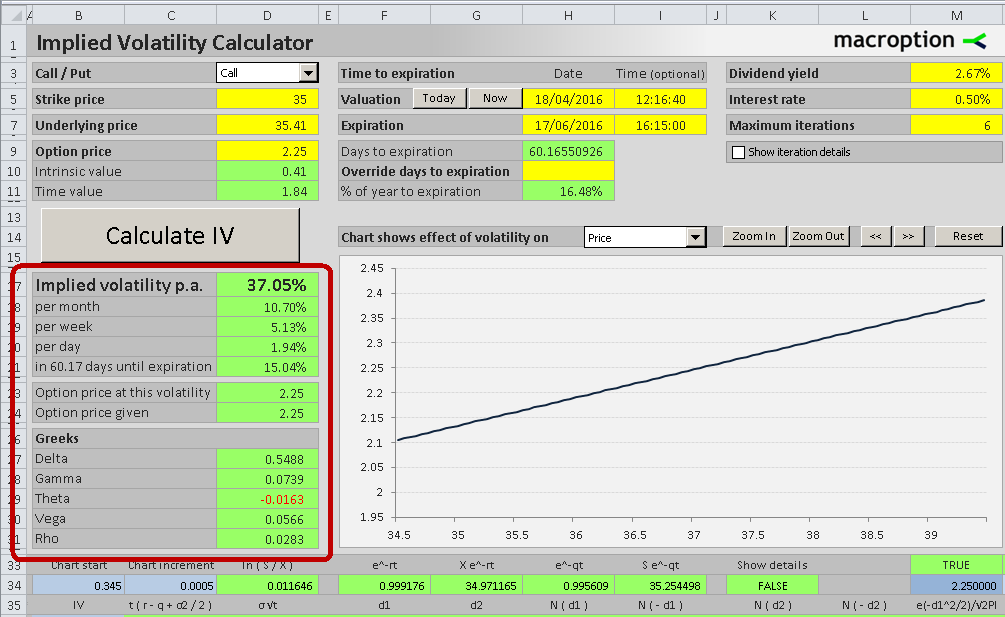

Click the big button and see implied volatility immediately. It is shown annualized, as well as per month, per week, per day and for the time period left to expiration. You can also see the Greeks for the given option price and IV.

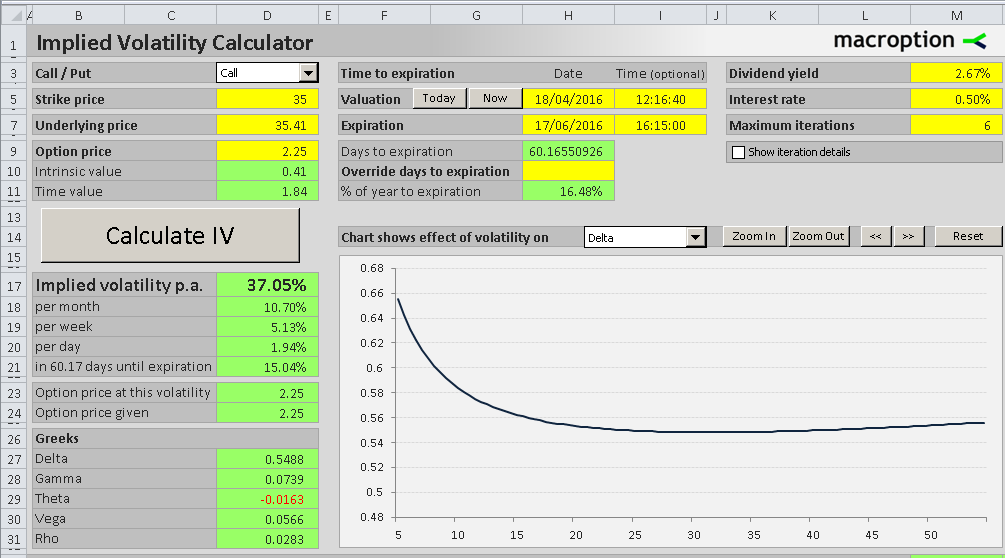

With the chart you can model the effects of volatility changes on option price or individual Greeks.

The example below shows the effect of volatility changes on a (slightly-in-the-money) call option's delta.

Volatility is the most important factor driving option prices and thereby option trading success. This calculator helps you better understand volatility and work with it effectively when making decisions.

$39 one-time payment

Instant download

Available Versions

All users get access to all these versions:

- IVC.xlsm = default version, for Excel 2010 or newer, also including Excel for Mac

- IVC_for_Excel_97-2007.xls = for Excel 2007 or older

- IVC_ODF.ods = open document format version, for Google Sheets, LibreOffice, OpenOffice, and similar apps which don't support Excel VBA and macros

Frequently Asked Questions

Is it a one-time payment or monthly/recurring?

One-time payment, yours forever.

Does it work in my version of Excel?

The calculator works in all versions of Excel from Excel 97 to the latest, also including Office 365 and Excel for Mac. For older versions you may need to use a different version of the calculator, which is also included.

Does it work in OpenOffice / LibreOffice / Apple Numbers / other spreadsheet software?

There is also an open document format (ods) version, which has been tested in Google Sheets, LibreOffice, and OpenOffice, and should work in all spreadsheet software which supports the ods format. All users get access to all versions.

How do I pay? Is it secure?

You can pay by credit/debit card or PayPal. All payments are processed by PayPal, but you don't need a PayPal account to check out when paying with a card. Contact me for alternative ways to pay (wire transfer, bitcoin).

I have other questions / need more information.

Please contact me.

$39 one-time payment

Instant download

Related Calculators – Often Bought Together

Black-Scholes Calculator – Does the inverse – calculates option prices when given implied volatility and the other parameters.

Option Strategy Simulator – Does the inverse for multiple options, allowing you to simulate strategies such as condors, straddles, spreads or covered calls.