VIX futures are futures on CBOE Volatility Index, better known as the VIX and sometimes nicknamed "the Fear Index", as it tends to spike when stocks fall and investors are fearful. CBOE Volatility Index measures implied volatility of near term options on S&P500 stock index.

On this page:

- Background

- Why Trade VIX Futures

- VIX Futures Curve

- VIX Futures Quotes

- VIX Futures Historical Data

- VIX Futures Contract Specifications

- Exchange

- Official name and symbol

- Underlying asset, expiration and settlement

- Contract size

- Tick size

- Trading hours

- Contract months available

- Mini VIX Futures

- ETFs and ETNs Based on VIX Futures

- Trading VIX Futures

Background

VIX futures were introduced on 26 March 2004 as one of the first innovations in the now rapidly growing volatility derivatives market. They have gained solid popularity and liquidity and now tens of thousands or more VIX futures contracts are traded every day.

Why Trade VIX Futures

VIX futures can be used for hedging equity portfolios (the VIX Index has strong negative correlation to S&P500) or as a pure volatility speculation vehicle. Because of the specific characteristics of VIX Index and its derivatives (including highly skewed distribution of VIX Index value changes, its mean reverting nature, and unsuitability of commonly used analytical models for analyzing the VIX), VIX futures and other VIX derivatives offer wide opportunities for research and trading.

VIX Futures Curve

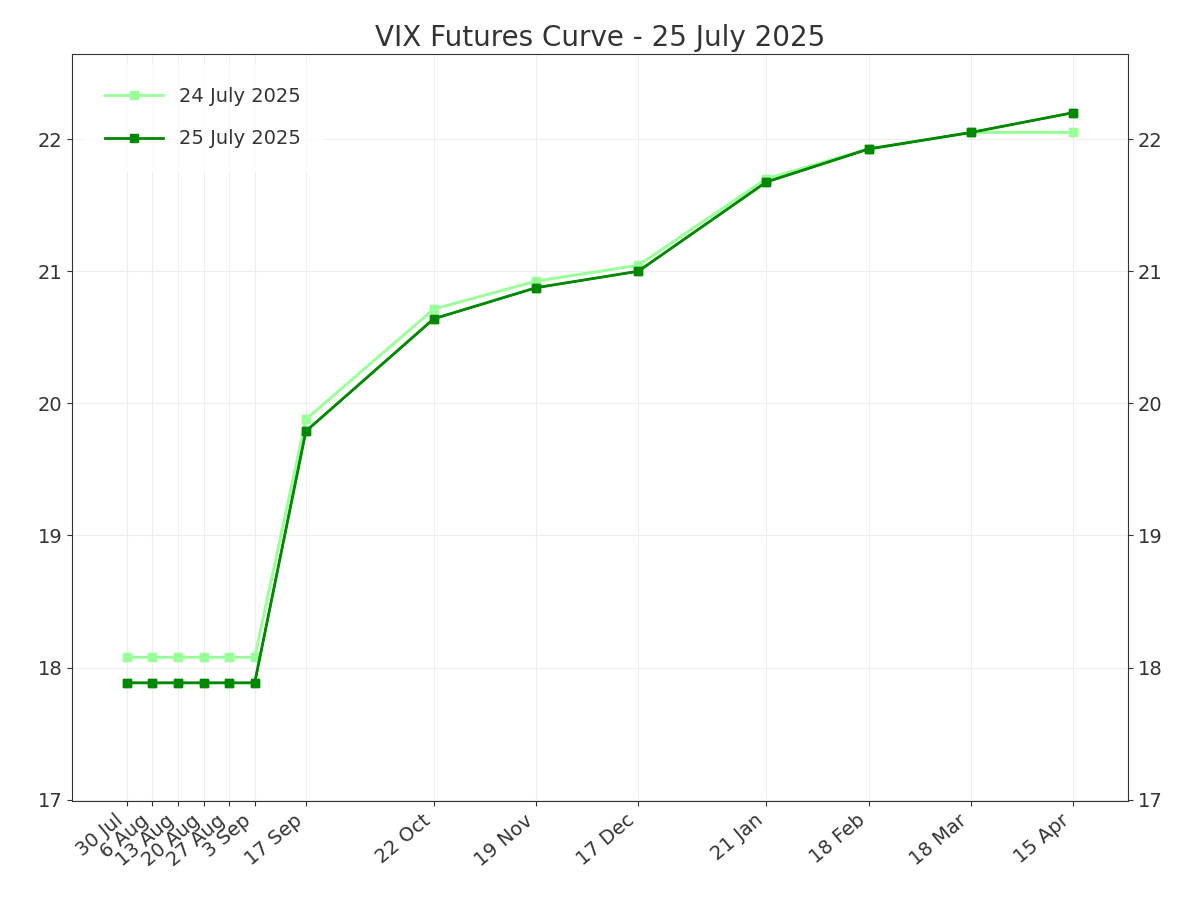

The following chart is the VIX futures curve – a useful tool for comparing prices of individual VIX futures contracts and getting an idea about the VIX futures market's volatility expectations.

Don't try to trade VIX futures without good understanding of the curve and how the prices of different VIX futures contracts relate to each other and to the spot VIX index. More information about that and an explanation of contango vs. backwardation is available here: More about the VIX Futures Curve.

VIX Futures Quotes

Delayed VIX futures quotes are available on the official website of CFE.

VIX Futures Historical Data

Here you can find basic instructions for getting VIX futures historical data from CFE (it's free).

VIX Futures Contract Specifications

The following is for a quick first orientation only. Macroption is not related to or affiliated with CBOE or CFE in any way. For official detailed and up-to-date information, see VIX Futures Contract Specifications at CFE website.

Exchange

VIX futures are traded on CBOE Futures Exchange (CFE), a part of Chicago Board Options Exchange (CBOE).

Official name and symbol

The official name of VIX futures as stated on the website of CFE is "CBOE Volatility Index (VIX) Futures".

The ticker symbol of VIX futures is VX, but the symbols VIX or VI are also used in some trading platforms or market data sources.

Underlying asset, expiration and settlement

The underlying for VIX futures is the CBOE Volatility Index, mostly known by its ticker symbol VIX. Because the VIX itself can't be bought or sold (it's just a number), there can't be any kind of physical delivery and VIX futures are cash settled.

The final settlement date is 30 days before the third Friday of the following month, providing that the time period between VIX futures settlement and the respective S&P500 options expiration is constant 30 days (the time period used for VIX Index calculation). VIX futures expiration is therefore usually on Wednesday (unless there's public holiday interfering with the regular conventions) and the last trading day of VIX futures is the day before – usually Tuesday.

Here you can find VIX futures expiration calendar and full expiration dates history.

The final settlement value of VIX futures is determined by opening prices of the respective S&P500 options – the so called Special Opening Quotation (SOQ).

Contract size

The contract multiplier of VIX futures is 1,000. The value of one VIX futures contract is 1,000 times the respective forward VIX Index value (in USD). In other words, when you are long one VIX futures contract and its price increases by 1 point, you make $1,000 (it works both ways of course).

Tick size

Tick size is 0.05 VIX points = $50. In some cases (spreads, block trades) it is 0.01 points ($10).

Trading hours

VIX futures trade almost round the clock during the work week.

The main trading session ("regular" hours) is from 8:30 to 15:15 Chicago time = 9:30 to 16:15 New York time = when US equity and option markets are trading).

VIX futures also trade during "extended" hours from 17:00 Chicago time on Sunday until the 15:15 Friday close, with just 15 minutes breaks every day from 15:15 to 15:30. Liquidity is low outside the regular hours, although it can be slightly higher when the European markets open.

Contract months available

Traditionally the cycle on VIX futures has been monthly. There are up to nine serial contract months available at a time.

Additionally, weekly futures have been introduced in August 2015. Normally up to six weekly expirations are available at a time.

Mini VIX Futures

There is a mini version of VIX futures, with contract multiplier of 100 (1/10 of the regular VIX futures), trading under the symbol VXM on CFE. Mini VIX futures under the old symbol VM had been delisted in January 2014 and reintroduced in August 2020 as VXM.

ETFs and ETNs Based on VIX Futures

There are numerous VIX ETNs and ETFs (exchange traded notes and exchange traded funds), which can be used for setting up a long or short exposure to VIX futures without trading the futures directly. They vary in direction and leverage (long, short, 2x long) and maturity (most focus on near term futures, but there are also a few focusing on the middle or long end of the VIX futures curve). Some of the ETNs have options available on them.

Trading VIX Futures

While very popular, VIX futures, as well as VIX options, ETNs and ETFs, are quite complex products and trading them is not recommended without good understanding of how they work and how their prices relate to the spot VIX index (it is not uncommon for the VIX index to go up and VIX futures go down at the same time). For more details about the specifics of VIX products, practical tips and strategies, see Trading the VIX.