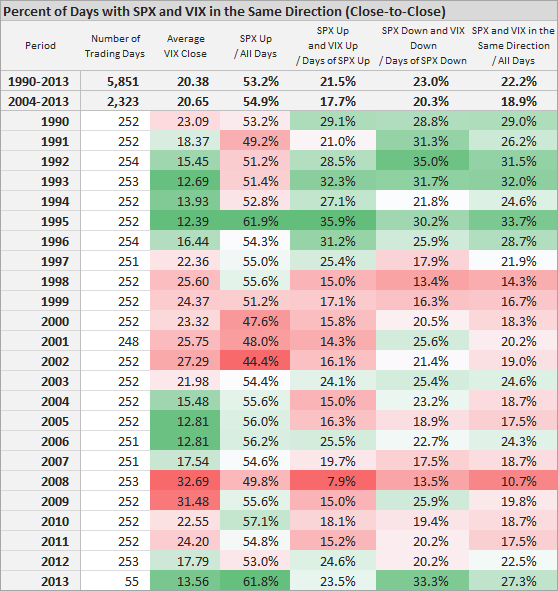

While negatively correlated, VIX and S&P500 still move in the same direction approximately 20% of time. This page provides some details.

VIX-S&P500 Same Direction Statistics

The common rule of thumb is that VIX and S&P500 tend to move in opposite directions: VIX rises when equities decline and vice versa.

However, VIX and S&P500 moving in the same direction is far from uncommon. In fact, the two indices move in the same direction once in every 5 trading days on average (20% of days). The exact figure is 22.2% when looking at the whole history of VIX data (1990-2013). In the last years, the number of days with VIX and S&P500 in the same direction has been a bit lower: 18.9% (2004-2013).

You can see in the table above that the percentage of same direction moves is slightly higher for SPX down + VIX down than for SPX up + VIX up, although the difference is very small (it can get bigger and even inverse when looking only at individual years).

Another obvious observation when looking at the statistics is that the same direction days were more common in the 1990's than in the last decade – except for this year (so far – the data used for this analysis ends on 21 March 2013). The percentage of days with VIX going down when S&P500 goes down has been particularly high in 2013 – exactly 1 in 3 trading days when S&P500 declines. This is in line with the general downtrend in VIX that we have observed in the first three months of 2013.

VIX-S&P500 Correlation

Correlation of VIX and S&P500 is of course highly negative, but it is not perfect -1 (this is also quite obvious from the statistics above). Over time it fluctuates between -0.40 and -0.90. It has stayed between -0.70 and -0.90 for most of the last 10 years. Here you can find charts and detailed statistics on VIX-SPX correlation (all-time and in individual years).

VIX Going Up When S&P500 Goes Up

Of course, many of the 20% trading days with the same direction in SPX and VIX are days when the market moves sideways and the moves are close to zero. However, there are also days when stocks make a bigger move up or down and the VIX still goes in the same direction.

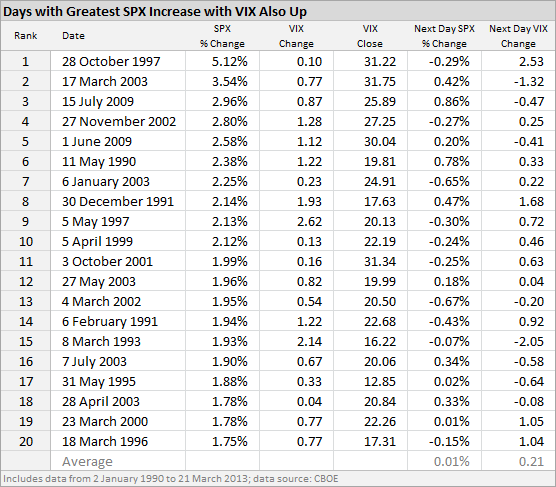

The table below shows 20 days with the greatest positive change in S&P500 when the VIX index also increased. In general, you can find two categories of days here:

- Days with very small VIX change (something like +0.10). These days could easily have been left out of the table if the VIX change was only a little lower and fell into the negative territory.

- Days with big VIX change (often +1 VIX point or more). These are days when volatility goes up on positive price move in equities. Although it is not talked about very much, volatility is non-directional and high volatility can also mean big up moves, not just market crashes to the downside.

The last two columns in the table show S&P500 and VIX moves on the day following the day in the table. There is no directional edge in the S&P500 move, but there is slightly positive bias in the next day VIX move, although not statistically significant. The average next day moves are 0.01% for S&P500 and +0.21 points for VIX. These figures are -0.07% and +0.17 when looking at the top 100 days (not shown on this page).

You might have also noticed that VIX closing values on the days in the table are quite high (definitely above the long-term average VIX close of 20-21 – there are 4 days with VIX above 30 and only one with VIX below 15). Trading days were selected and ranked based on percentage size of S&P500 up move. Bigger moves are of course much more common during times when the markets are volatile and VIX is high.

VIX Going Down When S&P500 Goes Down

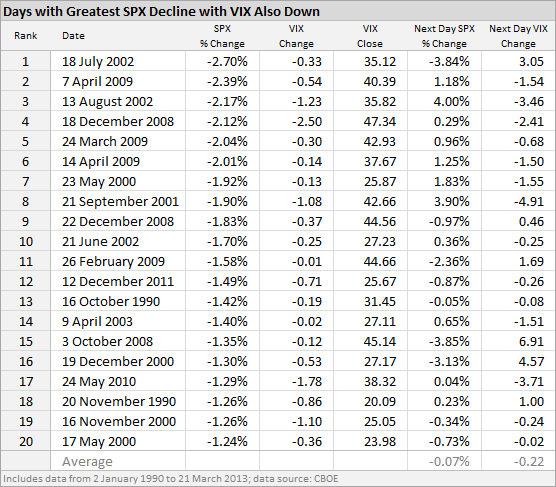

Below you can see a similar table for days with the greatest decline in S&P500 when VIX also declined:

Notice the VIX closing values. There is no day with VIX close below 20, but there are 7 days with VIX above 40 (and that is after the decline on the particular day).

Next day S&P500 and VIX moves again don't show any statistically significant edge, although average next day VIX move is -0.22. The figures are -0.15% for SPX and +0.30 for VIX when looking at top 100 days.