If you are not familiar with the basics, see VIX Futures and VIX Futures Curve.

Spot VIX Value and VIX Futures Curve Relationship

It is widely known that VIX futures curve tends to generally be in contango when spot VIX is low and in backwardation when spot VIX is high. This is in line with the mean reverting nature of VIX (and any index measuring volatility). Spot VIX and the short end of VIX futures curve tend to be more volatile than more distant futures months.

The Effect of Time to Expiration on VIX Futures Curve

The sharp VIX contango has been getting a lot of attention recently and I have seen several blog posts and pieces of analysis comparing the difference between the first and second VIX futures month, or between futures and spot VIX, to history (and I did one of my own).

There is one more factor that needs to be addressed in this kind of analysis: the time left to expiration. For example, front month VIX futures being 2.5 or more VIX points higher than the spot 4 weeks before expiration has been quite common in history, but seeing such difference one week before expiration (as we saw yesterday) is very rare.

In the analysis and charts below I focus on 3 spreads:

- The difference between the first VIX futures month and spot VIX

- The difference between the second VIX futures month and spot VIX

- The difference between the second and the first VIX futures month

I focus on the short end of the futures curve because:

- That's where the attention of most has been in the recent weeks.

- As you would expect, the effect of time to expiration is strongest on the short end of the curve.

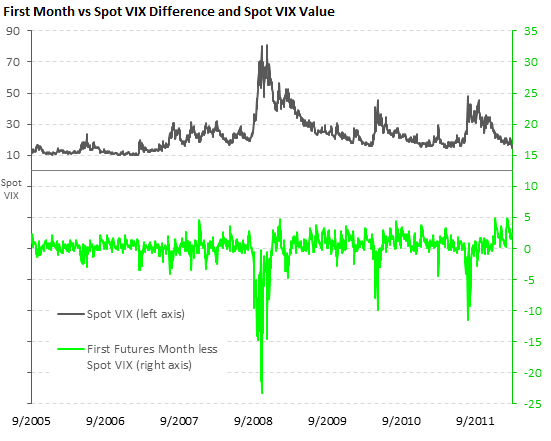

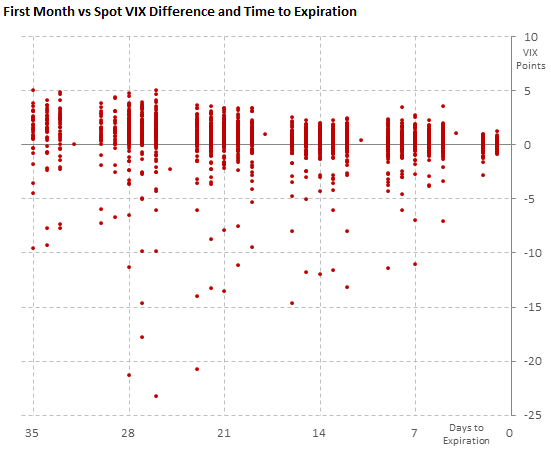

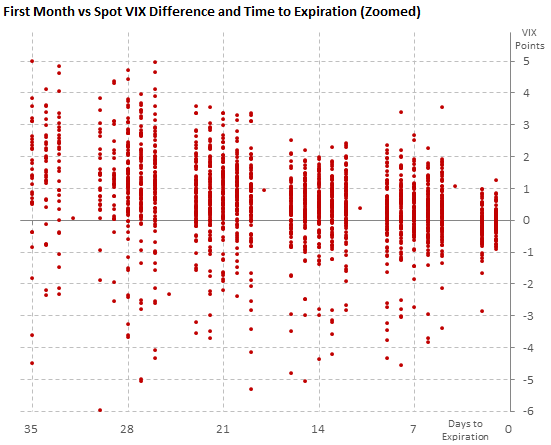

First Month vs Spot VIX Difference

As you can see, the difference between the front futures month and spot VIX has been in low positive numbers for most of the time. Negative (even large negative) values are not totally uncommon and typically occur when spot VIX spikes (and here not only the absolute spot VIX value is important, but also the value relative to the developments before). The lowest was -23.31 on 24 October 2008 (spot VIX 79.13). The two highest were 4.98 on 14 July 2004 (spot VIX 13.76) and 4.97 on 23.12.2011 (spot VIX 20.73).

Note that this and similar charts on this page only show time post September 2005 – since the cycle on VIX futures became pure monthly with all 12 months every year.

To complete the picture, there is another chart, showing the difference between the front futures month and spot VIX as it relates to time left to expiration:

Obviously a difference further from zero (to either side) is much more likely with more time left to expiration. On the positive difference side (relevant to the current market situation), all of the 23 largest positive differences (+3.58 to +4.98) occurred with 26 or more calendar days left to expiration.

Extremely large positive differences close to expiration occurred on 13 January 2009 (diff +3.40, spot VIX 43.27, 8 days to expiration), 14 January 2009 (diff +2.65, spot VIX 49.14, 7 days to expiration), and 16 January 2009 (diff +3.54, spot VIX 46.11, 5 days to expiration). These are the 3 biggest differences if we only take instances with 18 or fewer days to expiration.

Number 4 in this ranking is yesterday, 14 March 2012 (diff +2.49, spot VIX 15.31, 7 days left to expiration). Not regarding time to expiration and including all days in VIX futures history, it would only be rank 130.

As you can remember (or see from the spot VIX values), the current situation in the markets is very different from January 2009, making any effort to drive conclusions regarding future direction of equities or volatility based solely on the record difference tricky at least.

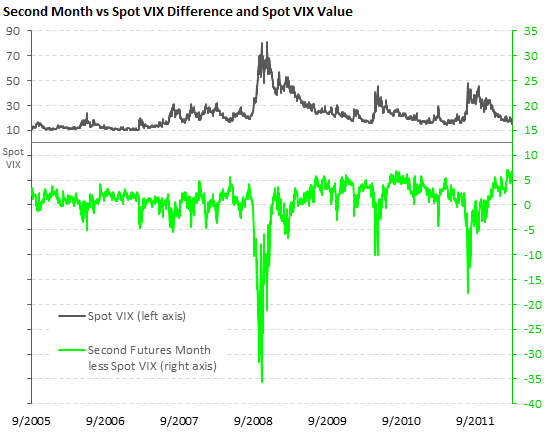

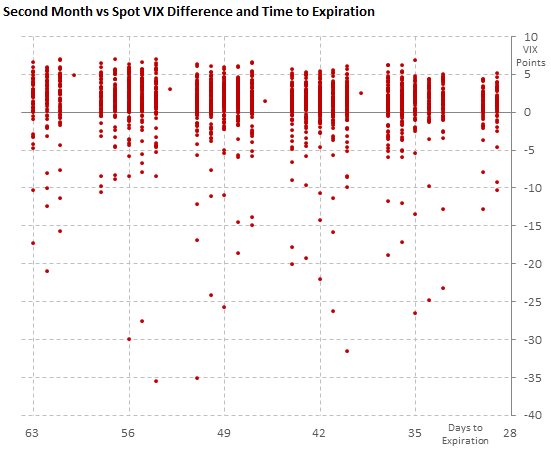

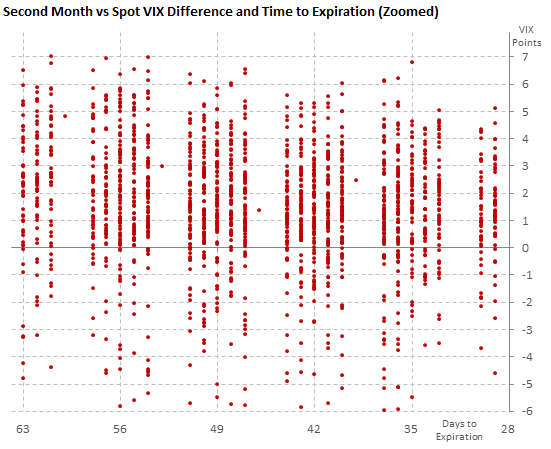

Second Month vs Spot VIX Difference

Here are the same charts for the difference between the second futures month and spot VIX. This is the difference I was looking at in the 27 February post: VIX Contango Record Steep.

As a short update to that post, the 4 greatest positive differences occurred in 2012: +7.02 on 17 Feb, +6.99 on 24 Feb, +6.96 on 21 Feb, and yesterday ranks 4th: +6.79 on 14 March. The greatest non-2012 positive difference was +6.76 on 20 August 2010 (spot VIX 25.49).

Time to expiration has an effect on this difference too, but (as expected) far less pronounced than on the first month vs spot. It is better visible on the positive side, because all the record negative differences occurred in the 2008 post-Lehman Armageddon, when any calendar effects were overridden by the extreme swings and broken structure of the markets (of the 17 instances when the difference was below -18, 16 occurred in October 2008 and 1 in November 2008).

So let's look at the positive differences (the zoomed chart below is better). You can see some convergence to zero here (as with the first month vs spot difference), but it's quite subtle. Anyway, yesterday's +6.79 is clearly the record high for instances with fewer days to expiration.

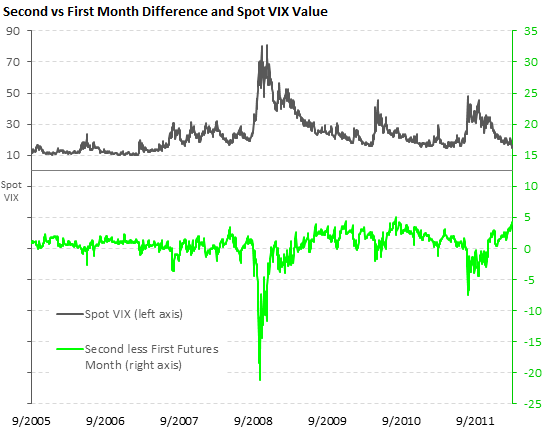

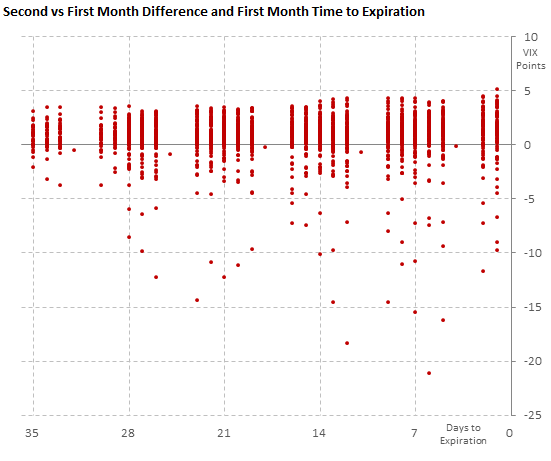

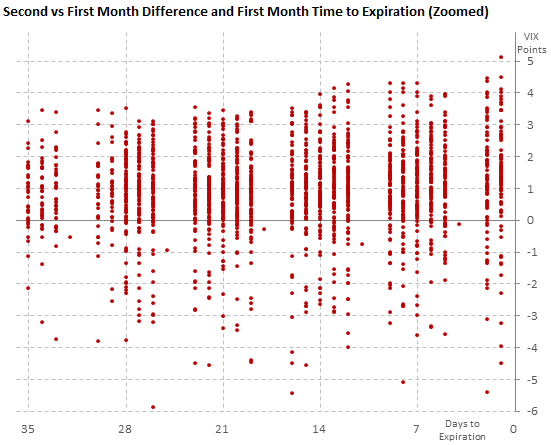

Second vs First Month Difference

Probably the most interesting difference to look at is the difference between the first and the second futures month, because (unlike spot VIX) both are directly tradable.

The historical range here has been -21 to +5. Again, all 25 greatest negative differences (below -7.5) occurred in October and November 2008. We will again look at positive differences, which are more relevant to current market situation.

Historically, there has been only one day when the difference between the second and the first VIX futures month was greater than positive 5 VIX points. And no, it wasn't in 2012. It was on 17 August 2010, when the front month (August 2010) was 24.35, the second month (September 2010) was 29.45, and the difference was 5.10 points. Spot VIX was 24.33. It was the last trading day of the front month contract.

As you can see from the charts below, the effect of time to expiration is inverse here. The difference between the second and the first VIX futures month is more likely to be greater (to either side) with less time to expiration. It is actually not that surprising when we look at the number of days left on a relative basis. The difference in days left to first and second expiration is 28 or 35 (4 or 5 weeks). And of course 1 day and 29 days (right side of the charts) is a more significant difference than e.g. 28 and 56 days (left side of the charts).

Conclusion

- When looking at the short end of VIX futures curve and comparing it to historical statistics, time left to VIX expiration should also be considered before driving any conclusions. The position of a particular day in the expiration cycle does matter (the closer to the short end of the futures curve you're looking, the more it matters).

- The difference between VIX futures and spot VIX is more likely to be greater (more positive or more negative) with more time left to expiration. As expiration nears, futures converge to spot.

- The (now widely followed) first-second VIX futures month spread is more likely to be greater (more positive or more negative) close to the first month expiration.