- Instantly calculate aggregate Greeks and break-even points

- Manage your risk, simulate scenarios and what-ifs quickly and easily in Excel

- Condors, straddles, spreads, covered calls, or any combination of up to 5 legs

- Not only at expiration, but at any time, including intraday

- Set different volatility for each leg, or flat volatility to keep it simple

- Works with both European and American options, also commodity/FX options

- Works in all versions of Excel from Excel 97 to the latest, including Excel for Mac

- Simple navigation, easy to use even with limited Excel or finance skills

- Detailed user guide if you need to know more

$59 one-time payment

Instant download

How It Works & Screenshots

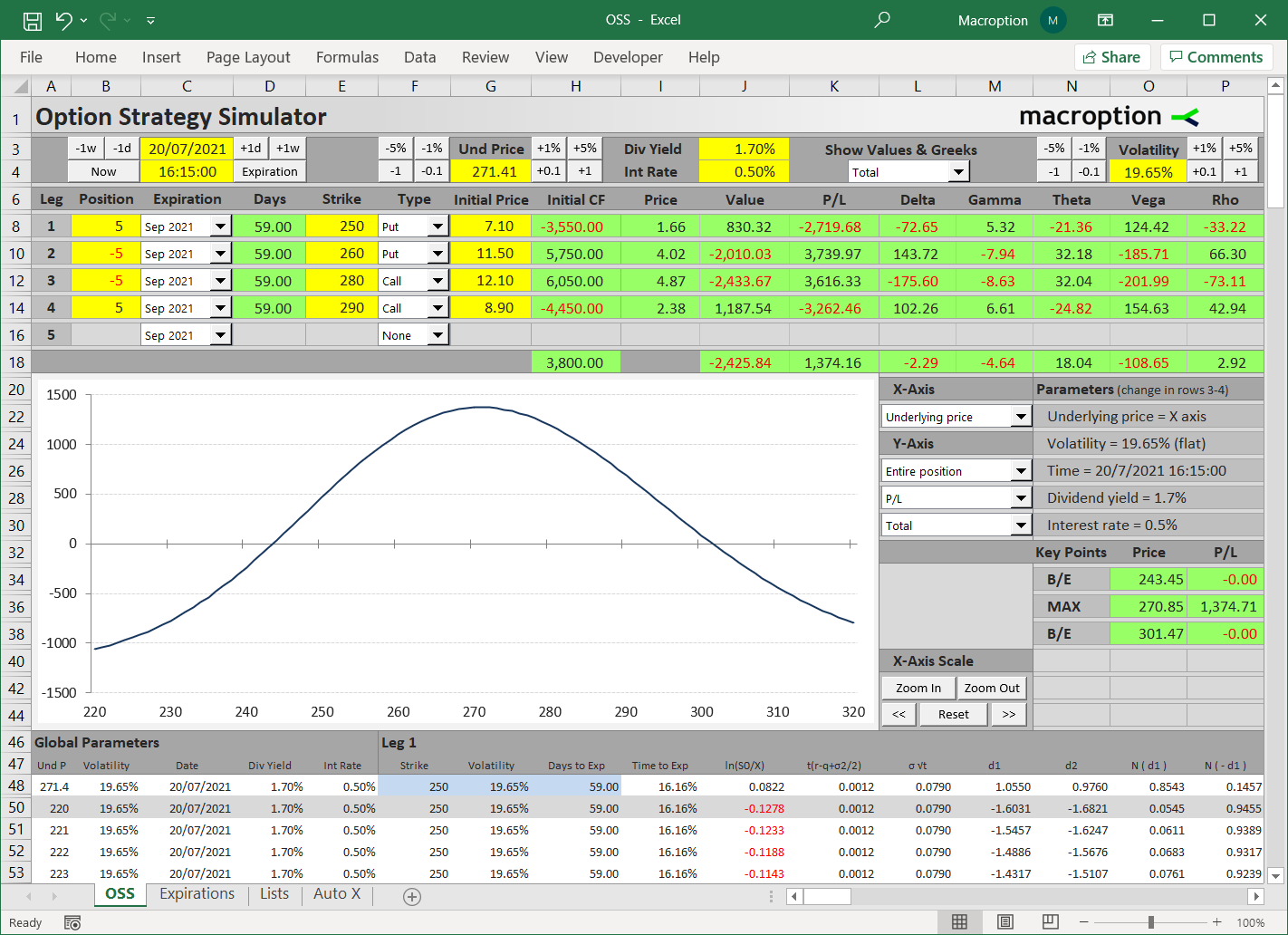

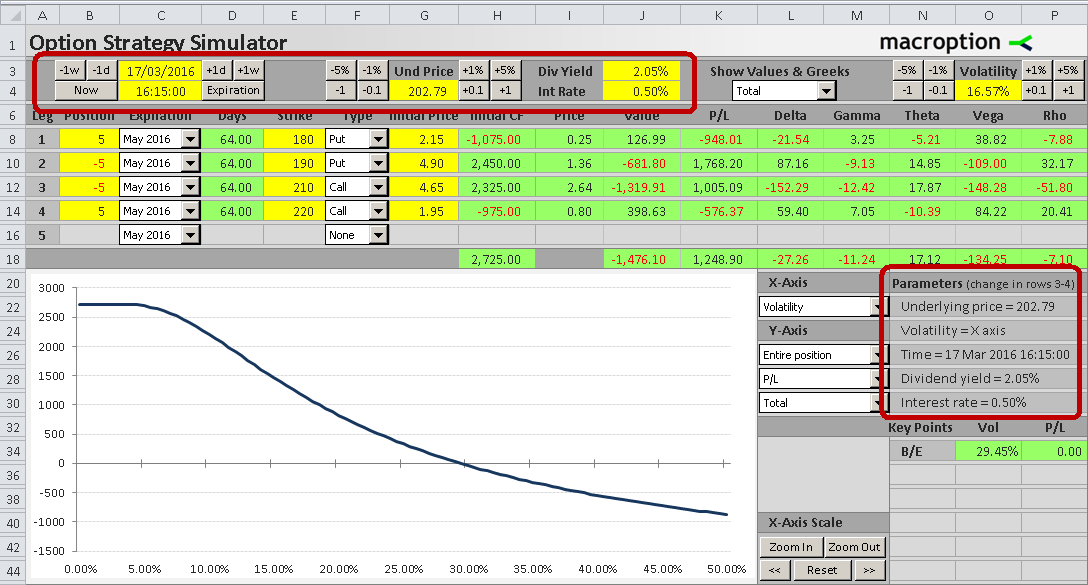

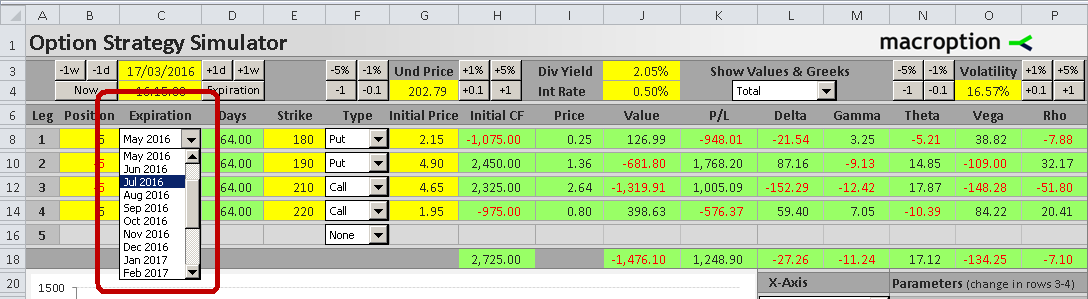

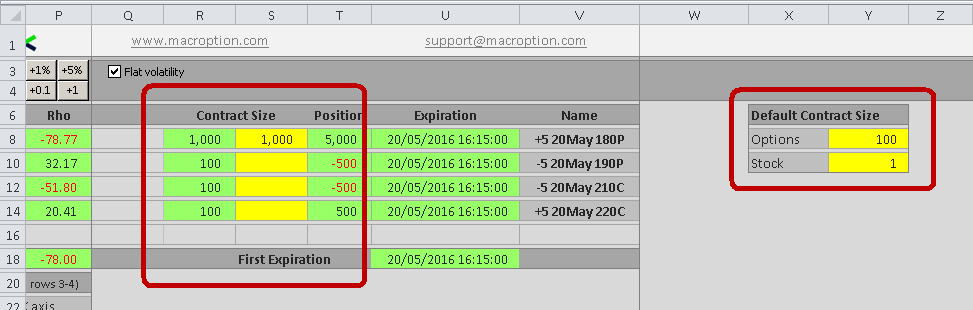

Enter position details. Use up to 5 legs and set each to Call / Put / Stock / None. Set number of contracts or shares for each, expiration, strike and initial price.

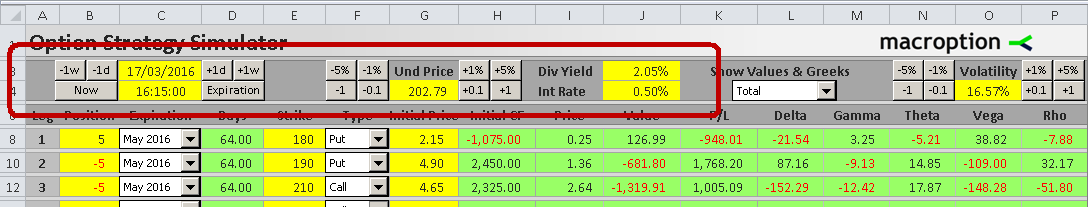

Set parameters – valuation date and time, current underlying price, dividend yield and interest rate. The buttons allow you to change the key parameters quickly and easily.

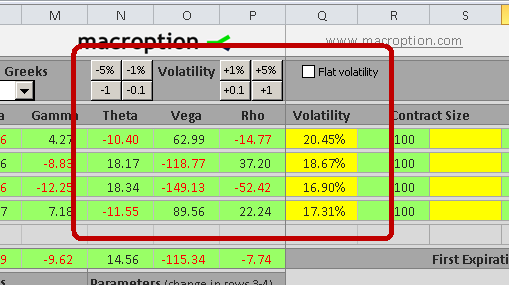

You can work with flat volatility (same for all legs), which is simpler but can be inaccurate at times. Alternatively you can set different volatility for each leg and model changes in volatility skew or surface.

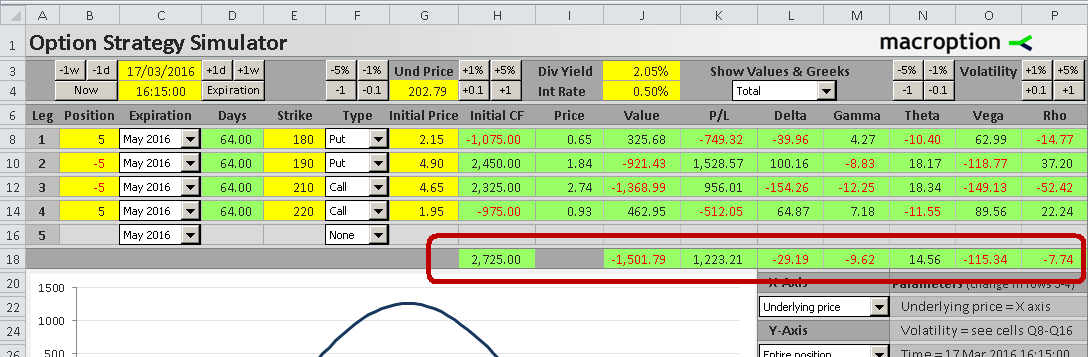

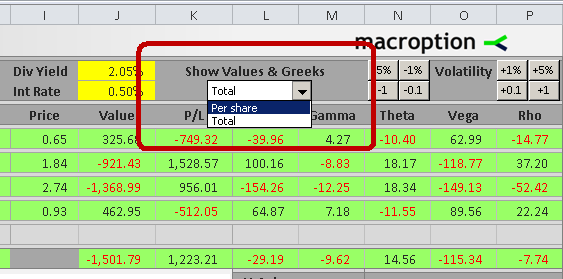

The simulator instantly shows option prices, dollar value, profit or loss and Greeks for individual legs and for the entire position.

You can choose to view the values, P/L and Greeks either per share or as total dollar values for your position size.

Chart & Simulations

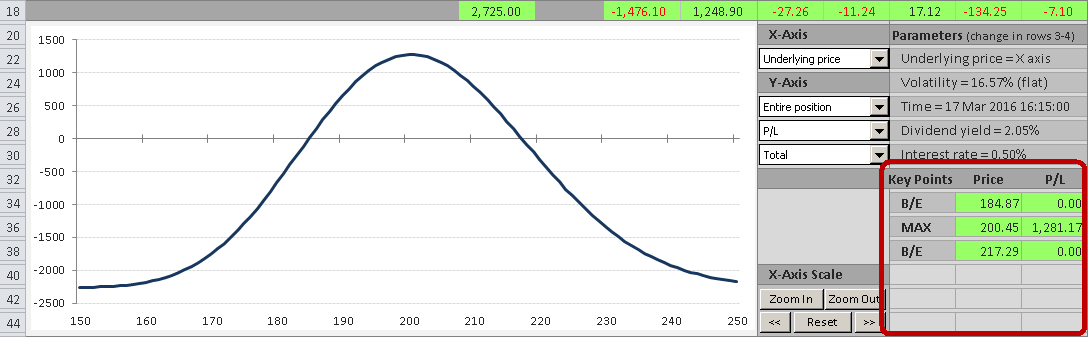

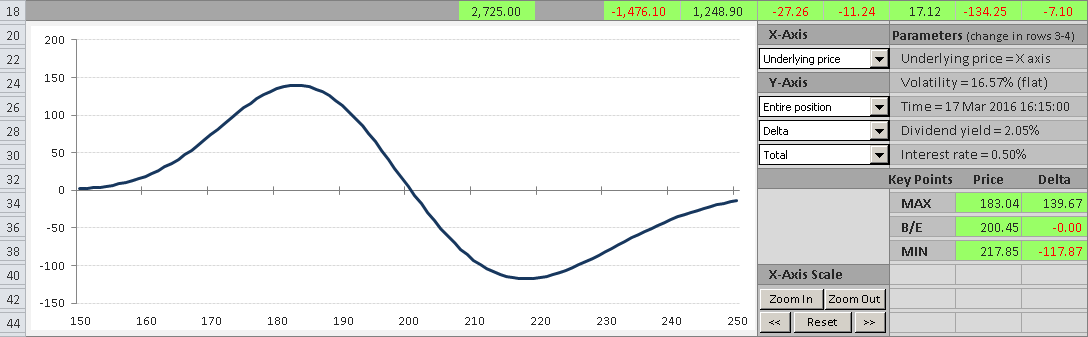

The chart shows effects of individual parameters on P/L or any of the individual Greeks. The one below shows how your profit or loss changes with underlying price. In the bottom right corner you can see exact values for the important points, such as break-evens, minimums and maximums.

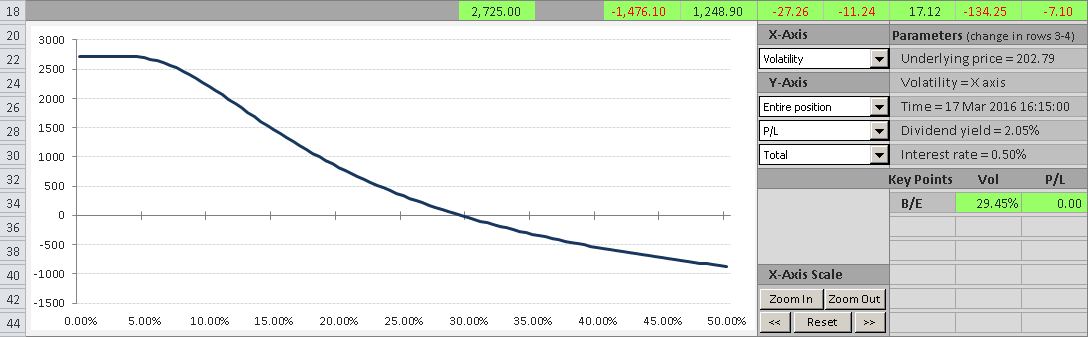

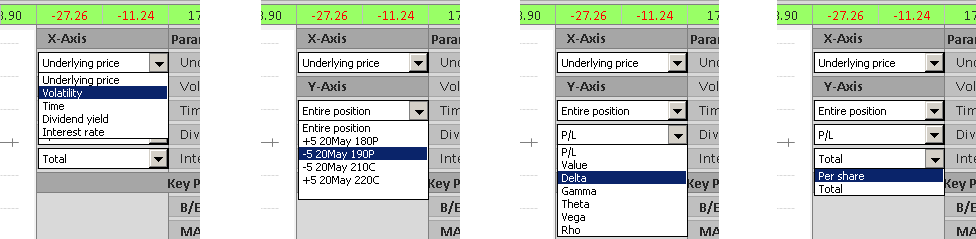

You can also display the effect of volatility on P/L, for example.

In this particular example, the position breaks even at implied volatility of 29.45% – under current conditions (underlying price 202.79 and valuation at 17 March close). You can see summary of the parameters on the right. If you change any of the parameters (in rows 3-4), the chart is updated automatically. This allows you to quickly simulate various scenarios and visualize the effects.

Besides the behaviour of P/L under different scenarios, you can also model the effects of individual parameters on any of the Greeks. The example below shows how the aggregate delta changes with underlying price (180/190/210/220 iron condor). In the corner you can again see the exact price where the delta crosses zero (200.45), where it is highest (183.04) and lowest (217.85).

Besides entire position you can also analyze individual legs, so you can better identify the main sources of particular risk exposures.

You can see a summary of all chart options below. Any combination of these will work.

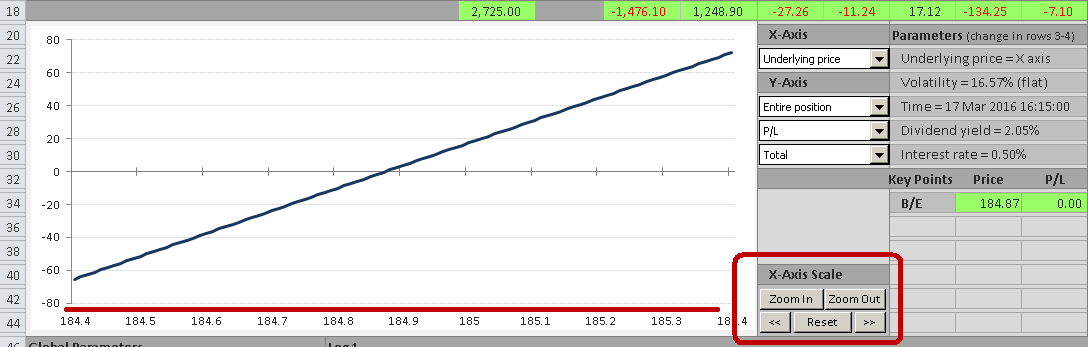

If you want to explore a particular area in greater detail, you can quickly zoom in and move along the X-axis, using the buttons. No need to change Excel chart settings manually.

The simulator helps you stay in control, understand the risks and behaviour of a position under any possible situation, and make faster and better decisions.

$59 one-time payment

Instant download

It's Easy to Customize

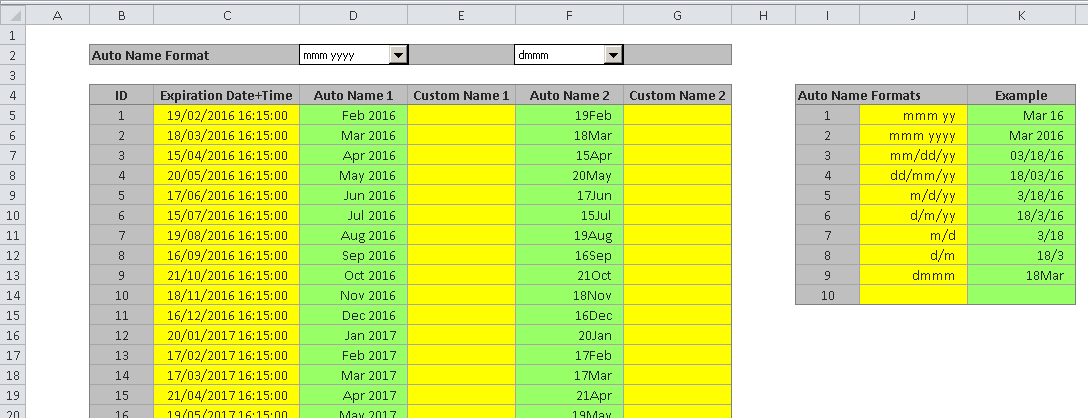

When entering position details, expirations are selected from drop-down boxes, which is much faster than typing them in repeatedly.

The preset expirations are for the standard US options monthly cycle. If you work with weeklies or some other options, you can easily change the expirations or the date formats in a designated sheet.

You can also customize the number of shares per option contract (which is 100 by default) either by setting it globally or by setting a different multiplier for each leg.

The latter can be useful for positions containing different types of options on the same underlying.

$59 one-time payment

Instant download

Frequently Asked Questions

Is it a one-time payment or monthly/recurring?

One-time payment, yours forever.

Does it work in my version of Excel?

The simulator works in all versions of Excel from Excel 97 to the latest, also including Office 365 and Excel for Mac. For older versions you may need to use a different version of the simulator, which is also included.

Does it work in OpenOffice / LibreOffice / Apple Numbers / other spreadsheet software?

It may work in some, but unfortunately I can't guarantee it and can't provide support for software other than Microsoft Excel. Generally you need your software to support Excel formulas and macros.

Does it work for options in my country?

Yes. The simulator does not depend on a particular country or currency – you just need to set the correct contract multiplier in a designated cell. Since 2016, the simulator has been used by customers all over the world, including the US, Europe, Australia, India, China, Japan, Russia, Brazil, and many other countries.

How do I pay? Is it secure?

You can pay by credit/debit card or PayPal. All payments are processed by PayPal, but you don't need a PayPal account to check out when paying with a card. Contact me for alternative ways to pay (wire transfer, bitcoin).

I have other questions / need more information.

Please contact me.

$59 one-time payment

Instant download

Related Calculators – Often Bought Together

Option Strategy Payoff Calculator – Good to learn about individual option strategies and their payoffs at expiration.

Implied Volatility Calculator – Calculates IV from option prices and helps you understand the essential volatility input.