The answer is yes, volatility does revert to its mean. This is true for both realized and implied volatility, which are of course closely related.

Nevertheless, volatility is not necessarily mean reverting on all time horizons. I will illustrate it on the VIX index, which is the best known volatility index. Its official name is CBOE Volatility Index and it measures 30-day implied volatility of S&P500 options. The behavior of volatility of other assets on particular time horizons can be slightly different, although the differences are not that big for most risk assets (especially stocks and most commodities).

Volatility Trending / Mean Reverting Over Various Time Horizons

In general, volatility (in this case the VIX index) is:

- Trending (and often quite well) intraday

- Mean reverting day-to-day or week-to-week

- Making big and fast spikes on market crashes, followed by gradual decline back down

- Staying in the same range in the very long term (multiple years)

Below I will demonstrate typical behavior of volatility over different time horizons on charts of the VIX.

Intraday: Trending

Volatility is usually trending quite well intraday, at least on some days. Above you can see a chart of the VIX (CBOE Volatility Index) over 4 days (7-10 January 2013). Each bar represents 5 minutes.

Medium Term: Mean Reverting

In the medium term volatility is usually mean reverting. Sometimes the mean reversion happens from day to day, with one day up move in volatility being offset by a down move the next day. Sometimes the waves take much longer, with the VIX trending in one direction for a week or two and then back. The chart above is the VIX in the second half of 2012 (daily bars).

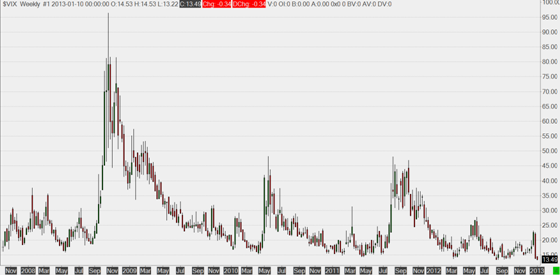

Long Term: Mean Reverting, But Quite Specific

In the very long term (5 and more years), the VIX stays in the same area, with long-term minimum just below 10 and most of the time spent between 10 and 30. A characteristic feature of volatility in the long term is that it sometimes spikes up very fast (when the stock market crashes) and then returns back down gradually. On the VIX chart above (2008-2012, weekly bars) you can see such spikes in September-October 2008 (after Lehman), May 2010 (Flash Crash), and August 2011 (European sovereign debt crisis).

Here you can find an overview of VIX all-time highs and notable spikes.